Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

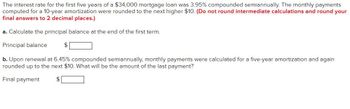

Transcribed Image Text:The interest rate for the first five years of a $34,000 mortgage loan was 3.95% compounded semiannually. The monthly payments

computed for a 10-year amortization were rounded to the next higher $10. (Do not round intermediate calculations and round your

final answers to 2 decimal places.)

a. Calculate the principal balance at the end of the first term.

Principal balance

$

b. Upon renewal at 6.45% compounded semiannually, monthly payments were calculated for a five-year amortization and again

rounded up to the next $10. What will be the amount of the last payment?

Final payment

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- A 54-unit apartment building in Canton, Ohio was financed with a $10,000,000 30-year fully amortizing fixed rate mortgage loan at an annual interest rate of 4.5% payable monthly and with no loan lockout or prepayment penalties. If the borrower wanted to pay the loan back after 8 years, what would be the payoff amount? a. $7,333,333 b. $8,008,942 c. $8,481,705 d. $8,913,848arrow_forward. When choosing between long and short term borrowing, which of the following is not usually a relevant consideration for a company? Any costs associated with refinancing, such as arrangement fees and penalties. Likely interest rate movements. Matching the term of the loan with the nature of the assets being financed. The principal agent problem.arrow_forwardCrane Ltd issued $1,200,000 of 10years, 5% bonds on January 1,2024,when the market interest rate was 6%. crane received $1,110,740 when it issued these bonds. Interest is payable semi-annually on July 1 and January 1. crane has a December 31 year end. Assume that Crane has a December 31 year end. Calculate how much of the bond discount was amortized in 2024arrow_forward

- What is the APR on a $700,000 fixed rate mortgage loan fully amortizing over 30 years if the stated annual interest rate is 5.5% and the lender charges 1.5% as an origination fee, $750 for an appraisal and $18 for a credit report? a.5.65% b.5.72% c.5.36% d. 5.5%arrow_forwardSonia wich to esatablish a trust fund from which her son can withdraw $6,000 every six months for 15 years, when he reach 16 years old. At the end of which time he wil recevie the remaining money in the trust, which you would like to be $25,000. The trust will be invested at 6% per annum componded semi-annually. How large should the trust be?arrow_forwardEducation and work help? 1.Write about how you believe this influence has affected your life. 2. Write about how this same influence has been impacted by your race. 3.Write about how this same influence has been impacted by your ethnicity.arrow_forward

- Find the accumulated amount A if the principal P is invested at the interest rate of r/year for t years. (Use a 365-day year. Round your answer to the nearest cent.) P = $180,000, r = 3%, t = 2 1/4, compounded monthly A = $arrow_forwarduestion The company's bank won't lend it any more money than it already has, and investment bankers have said that debentures are out of the question. The treasurer has asked you to do some research and suggest a few ways in which bonds might be made attractive enough to allow the company to borrow. Explain how to secure the bonds with owned assets in great detial. In what ways does it make the bonds more attractive to allow the company to borrow?arrow_forwardThe difference between expected payoff under certainty and expected payoff under risk is the expected: O A. value of perfect information OB. rate of return OC. monetary value D.net present value O E. profitarrow_forward

- An annuity pays $25,000 semiannually (every 6 months) for 12 years. An alternative investment’s APR is 10% with quarterly compounding. What is the value of this annuity?arrow_forward9.3 Consider another set of net cash flows: Year Cash Flow ($) 0 2,000 1 2,000 2 0 3 1,500 4 2,500 5 4,000 What is the net present value of the stream if the opportunity cost of capital is 10 percent? What is the value of the stream at the end of year 5 if the cash flows are invested in an account that pays 10 percent annually? What cash flow today (time 0), in lieu of the $2,000 cash flow, would be needed to accumulate $20,000 at the end of year 5? (Assume that the cash flows for years 1 through 5 remain the same.)arrow_forwardExplain in detail the similarities and differences between the following types of annuities: a.SPIA b.SPDA c.FPDA d.Why no FPIA?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON