Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

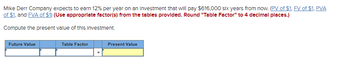

Transcribed Image Text:Mike Derr Company expects to earn 12% per year on an Investment that will pay $616,000 six years from now. (PV of $1, FV of $1, PVA

of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.)

Compute the present value of this Investment.

Future Value

Table Factor

Present Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The annual profit from an investment is $20,000 each year for 5 years and the cost of investment is $80,000 with a salvage value of $40,000. The discount rate (cost of capital) at this risk level is 14%. (round your response to the nearest Based on the given information, the net present value of the investment = $ whole number).arrow_forwardAn investment costs $4,000 today. This investment is expected to produce annual cash flows of $1,200, $1,400, $ 1,300 and $1,100, respectively, over the next four years. What is the internal rate of return (IRR) ( or geometric average) on this investment? Question 23 options: 2.43 % 6.25 % 9.72% 31.25%arrow_forwardFYT Inc estimates that a new project with conventional cash flows will generate an NPV of $500,000. What is the project's profitability index given that the required investment is $3.12 million? Enter index rounded to the nearest hundredth, as in "1.01"arrow_forward

- Robust Ventures is planning to expand its production operation. It has identified three different technologies for meeting the goal. The initial investment and annual revenues with respect to each of the technologies are summarized in table below. Suggest the best technology which is to be implemented based on the future worth method of comparison assuming 20% interest rate, compounded annually. Annual Revenue (Php) Initial Life Investment (years) (Php) Technology X 1,200,000 400,000 10 Technology Y 2,000,000 600,000 10 Technology Z 1,800,000 500,000 a. Technology X since it has the highest revenue. O b. Technology X since it is the least costly. c. Technology Z since it has the highest revenue. O d. Technology Y since it has the highest revenue. 10arrow_forwarda. Calculate the following Periodic Total Returns on a 5-year investment. To your calculations, assume that you have selling costs of 5% Year NCF (€) Market Value (€) Total Return 95,000 95,000 1. 10,000 98,000 5,000 100,000 8,000 101,000 4 12,000 103,000 135,000 117,000 b. If the quarterly Income Return is 2.2% and the Quarterly Capital Return is 0.4%, calculate the Annual Total Return of the investment 2. 3.arrow_forwardVishuarrow_forward

- Raysut cement has taken up a new project with an initial investment of 125000 OMR.The expected future cashflow from the project over the next three years will be 57000 OMR, 55000 OMR and 65000 OMR.What is the profitability index if the discount rate is 15 percent? Select one: O a. None of these O b. 1.07 О с. 1.23 O d. 1.12 О е. 1.04arrow_forwardPena company is considering an investment of $20,957 that provides net cash flows of $6900 annually for four years.arrow_forwardMike Derr Company expects to earn 8% per year on an investment that will pay $616,000 seven years from now. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Compute the present value of this investment. Future Value Table Factor Present Valuearrow_forward

- PRESENT AND FUTURE VALUES OF A CASH FLOW STREAM An investment will pay $150 at the end of each of the next 3 years, $250 at the end of Year 4, $350 at the end of Year 5, and $550 at the end of Year 6. a. If other investments of equal risk earn 10% annually, what is its present value? Round your answer to the nearest cent. $ b. If other investments of equal risk earn 10% annually, what is its future value? Round your answer to the nearest cent. $arrow_forwardBeene Distributing is considering a project that will return $230,000 annually at the end of each year for the next ten years. If Beene demands an annual return of 9% and pays for the project immediately, how much is it willing to pay for the project? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "PV of an Ordinary Annuity" to 4 decimal places and final answer to the nearest whole dollar.) Periodic Cash Flow x P (PV of an Ordinary Annuity) Present Value xarrow_forwardABM Enterprise would like to evaluate/analyze an investment proposal. Given the following: Investment amount - 450,000 (2022) Dividends / Revenue stream - 100,000 for the first year and an interval of 5,000 for the succeeding years Discount rate - 14% a. NPV for the perio 2023 through 2029; b. Total NPV using manual computation; c. Total NPV using the Excel function; and d. IRR rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education