FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

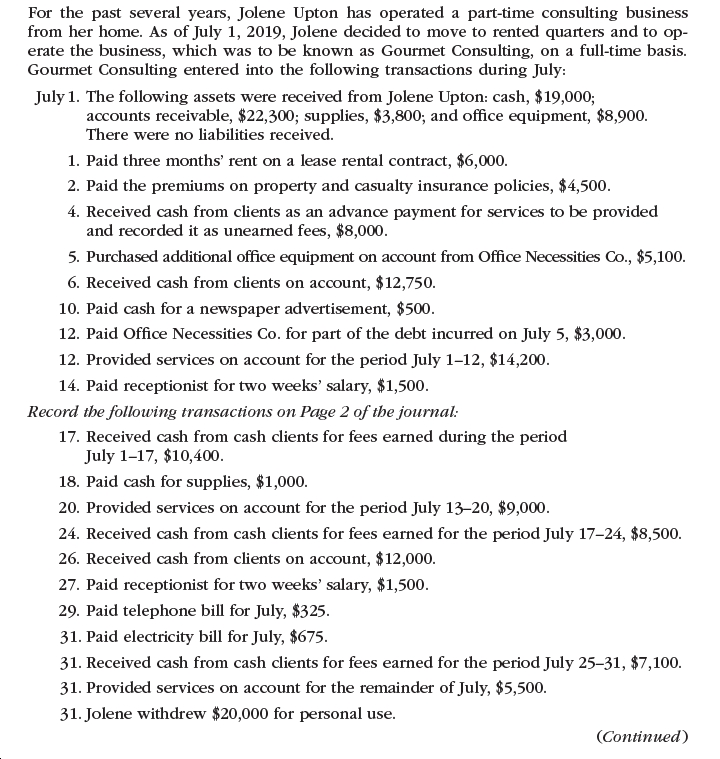

Transcribed Image Text:For the past several years, Jolene Upton has operated a part-time consulting business

from her home. As of July 1, 2019, Jolene decided to move to rented quarters and to op-

erate the business, which was to be known as Gourmet Consulting, on a full-time basis.

Gourmet Consulting entered into the following transactions during July:

July 1. The following assets were received from Jolene Upton: cash, $19,000;

accounts receivable, $22,300; supplies, $3,800; and office equipment, $8,900.

There were no liabilities received.

1. Paid three months' rent on a lease rental contract, $6,000.

2. Paid the premiums on property and casualty insurance policies, $4,500.

4. Received cash from clients as an advance payment for services to be provided

and recorded it as unearned fees, $8,000.

5. Purchased additional office equipment on account from Office Necessities Co., $5,100.

6. Received cash from clients on account, $12,750.

10. Paid cash for a newspaper advertisement, $500.

12. Paid Office Necessities Co. for part of the debt incurred on July 5, $3,000.

12. Provided services on account for the period July 1-12, $14,200.

14. Paid receptionist for two weeks' salary, $1,500.

Record the following transactions on Page 2 of the journal:

17. Received cash from cash clients for fees earned during the period

July 1-17, $10,400.

18. Paid cash for supplies, $1,000.

20. Provided services on account for the period July 13–20, $9,000.

24. Received cash from cash clients for fees earned for the period July 17-24, $8,500.

26. Received cash from clients on account, $12,000.

27. Paid receptionist for two weeks' salary, $1,500.

29. Paid telephone bill for July, $325.

31. Paid electricity bill for July, $675.

31. Received cash from cash clients for fees earned for the period July 25-31, $7,100.

31. Provided services on account for the remainder of July, $5,500.

31. Jolene withdrew $20,000 for personal use.

(Continued)

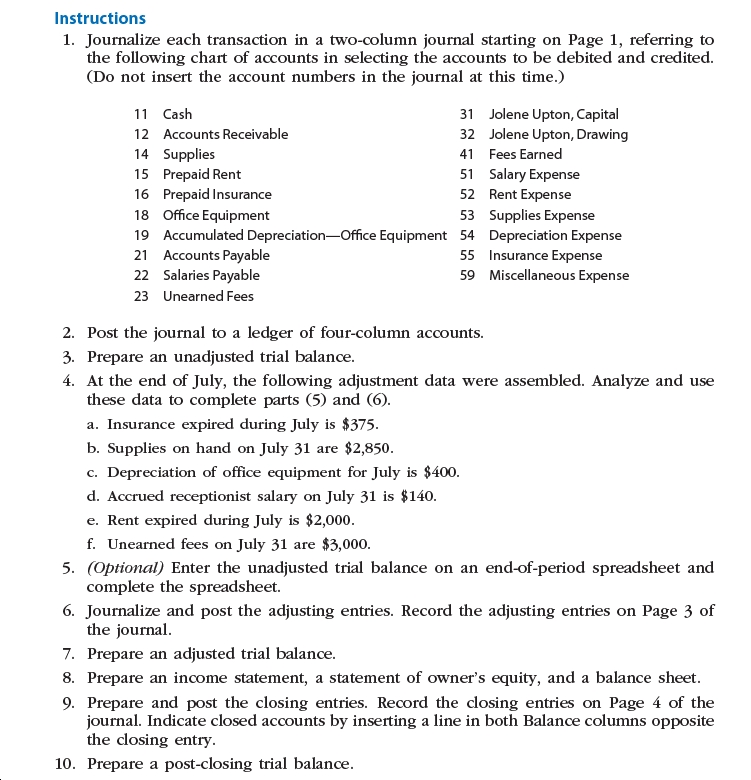

Transcribed Image Text:Instructions

1. Journalize each transaction in a two-column journal starting on Page 1, referring to

the following chart of accounts in selecting the accounts to be debited and credited.

(Do not insert the account numbers in the journal at this time.)

Jolene Upton, Capital

Jolene Upton, Drawing

11 Cash

31

12 Accounts Receivable

32

14 Supplies

15 Prepaid Rent

16 Prepaid Insurance

18 Office Equipment

19 Accumulated Depreciation-Office Equipment 54 Depreciation Expense

21 Accounts Payable

22 Salaries Payable

41 Fees Earned

51 Salary Expense

52 Rent Expense

53 Supplies Expense

55 Insurance Expense

59 Miscellaneous Expense

23 Unearned Fees

2. Post the journal to a ledger of four-column accounts.

3. Prepare an unadjusted trial balance.

4. At the end of July, the following adjustment data were assembled. Analyze and use

these data to complete parts (5) and (6).

a. Insurance expired during July is $375.

b. Supplies on hand on July 31 are $2,850.

c. Depreciation of office equipment for July is $400.

d. Accrued receptionist salary on July 31 is $140o.

e. Rent expired during July is $2,000.

f. Unearned fees on July 31 are $3,000.

5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and

complete the spreadsheet.

6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of

the journal.

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a statement of owner's equity, and a balance sheet.

9. Prepare and post the closing entries. Record the closing entries on Page 4 of the

journal. Indicate closed accounts by inserting a line in both Balance columns opposite

the closing entry.

10. Prepare a post-closing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 10 steps with 8 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

question 5

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

question 5

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- How do I record the current transaction?arrow_forwardPlease do not give solution in image format thankuarrow_forwardPrepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); ACcounts Payable (201); D. Brooks, Capital (301); D. Brooks, Withdrawals (302); Services Revenue (403); and Utilities Expense (690). View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 12 > Brooks invested $200,000 cash along with $28,000 in office equipment in the company. Note: Enter debits before credits. Date General Journal Debit Credit Mar 01arrow_forward

- 4arrow_forwardABC Company has the following T Account at the end of the year: Post to T-Acct (aka Ledger) Asset Cash Liability + C/ stock - Dividend + Acct Payable Commonstah Dividend Revenue 30,000 1,000 500 Common stah Dividend Service Revenue 30,000 480 Expense Rent expense 41000 500 15,000 4,000 5,000 15,000 480 Travel expense 1,000 Insurance expense 5,000arrow_forwardHow do I record the current transaction?arrow_forward

- A. March 1, paid interest due on note, $2,900 B. December 31, interest accrued on note payable, $4,350 Prepare journal entries to record the above transactions. If an amount box does not require an entry, leave it blank. Mar.1 Dec. 31 Create a T-account for Interest Payable, post any entries that affect the account, and tally the ending balance for the account (assume Interest Payable beginning balance of $2,900). Interest Payable Beginning Balance Balancearrow_forwardTransactions Aug. 1 Billed customers for fees earned, $72,120. 4 Purchased supplies on account, $1,960. 8 Received cash from customers on account, $62,770. 11 Paid creditors on account, $880. Required: A. Journalize these transactions in a two-column journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. B. Post the entries prepared in (A) to the following T accounts: Cash, Supplies, Accounts Receivable, Accounts Payable, Fees Earned. To the left of each amount posted in the accounts, select the appropriate date. C. Assume that the unadjusted trial balance on August 31 shows a credit balance for Accounts Receivable. Does this credit balance mean that an error has occurred?arrow_forwardPlease do not give image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education