FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

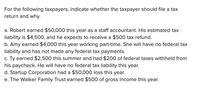

Transcribed Image Text:For the following taxpayers, indicate whether the taxpayer should file a tax

return and why.

a. Robert earned $50,000 this year as a staff accountant. His estimated tax

liability is $4,500, and he expects to receive a $500 tax refund.

b. Amy earned $4,000 this year working part-time. She will have no federal tax

liability and has not made any federal tax payments.

c. Ty earned $2,500 this summer and had $200 of federal taxes withheld from

his paycheck. He will have no federal tax liability this year.

d. Startup Corporation had a $50,000 loss this year.

e. The Walker Family Trust earned $500 of gross income this year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Carmen Reyes worked part -time last year while attending college and earned $4,288. The total withholding taxes she paid were $450. Carmen also earned $78 in interest and $16 in dividends. How much tax refund should she receivearrow_forwardPlease fast answer.arrow_forwardMary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information: She received $100,000 in salary. She received $20,000 of dividend income. She received $4,100 of interest income on Home Depot bonds. She received $24,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,900. She received $15,000 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $7,700. Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. a) What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round…arrow_forward

- Karen Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal exemptions and had a take-home pay of $499.00 this week, how much would her employer take from her to satisfy part of the tax levy?arrow_forwardFlingen Inc. reveals the following information in their annual report for FY 2021 Selected Income Statement Items: Sales $10,500,000 Cost of goods sold $5,500,000 Pretax earnings $650,000 Selected Balance Sheet Items: Merchandise inventory $800,000 Total assets $2,500,000 Upper management plans to cut cost of goods sold by 4.5% for the coming year but retain the same sales and weeks of inventory. What is the return on assets estimated to be for 2022? Group of answer choices 33.7% 32.1% 36.8% 34.1%arrow_forwardMalcolm Moore, single, had medical expenses of $5,000 last year and was able to deduct $3,000 of them. He was reimbursed $4,500 of these expenses this year by his insurance company. His total itemized deductions last year were $19,000. What amount must he include in this year's tax return as gross income?arrow_forward

- What is the taxpayer's gross income in each of the following situations? Do not type a dollar sign. Use commas when appropriate as in 3,500. If the answer is zero, type a 0. a. Myra received a salary of $80,000 from her employer, Green Construction. b. In July, Green Construction gave Myra an all-expense-paid trip to Las Vegas (value of $3,200) for exceeding her sales goals. c. Darrin received $9,000 from his employer to help him pay his medical expenses not covered by insurance, this payment is not available to all employees. d. Blake received $5,000 from his deceased wife's employer to help him in his time of greatest need." e. Austin collected $50,000 as the beneficiary of a group term life insurance policy when his wife died. The premiums on the policy were paid by his deceased wife's employer.arrow_forwardReese, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late December, she received a $11,000 bill from her accountant for consulting services related to her small business. Reese can pay the $11,000 bill anytime before January 30 of next year without penalty. Assume Reese’s marginal tax rate is 32 percent this year and will be 37 percent next year, and that she can earn an after-tax rate of return of 5 percent on her investments. Required: What is the after-tax cost if she pays the $11,000 bill in December? What is the after-tax cost if she pays the $11,000 bill in January? Use Exhibit 3.1. Note: Round your answer to the nearest whole dollar amount. 3. Based on requirements a and b, should Reese pay the $11,000 bill in December or January? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardRequired information [The following information applies to the questions displayed below.] Christopher is a self-employed cash-method, calendar-year taxpayer, and he made the following cash payments related to his business this year. Calculate the after-tax cost of each payment assuming Christopher has a 37 percent marginal tax rate. c. $600 for office supplies in May of this year. He used half of the supplies this year and he will use the remaining half by February of next year. After-tax costarrow_forward

- Subject -account Please help me. Thankyou.arrow_forwardsabel, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late December she received a $41,000 bill from her accountant for consulting services related to her small business. Isabel can pay the $41,000 bill anytime before January 30 of next year without penalty. Assume her marginal tax rate is 37 percent this year and next year, and that she can earn an after-tax rate of return of 6 percent on her investments. Required: What is the after-tax cost if Isabel pays the $41,000 bill in December? What is the after-tax cost if Isabel pays the $41,000 bill in January? Use Exhibit 3.1. Note: Round your answer to the nearest whole dollar amount. Based on requirements a and b, should Isabel pay the $41,000 bill in December or January?arrow_forwardn each of the following cases, discuss how the taxpayers might respond to a tax rate increase in a manner consistent with the income effect. a. Mr. Edwards earns $32,000 a year as an employee, and Mrs. Edwards doesn’t work.b. Mr. Frank earns $22,000 a year as an employee, and Mrs. Frank earns $10,000 a year as a self-employed worker.c. Mr. George earns $22,000 a year as an employee, and Mrs. George earns $10,000 a year as an employee.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education