FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Mary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information:

- She received $100,000 in salary.

- She received $20,000 of dividend income.

- She received $4,100 of interest income on Home Depot bonds.

- She received $24,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,900.

- She received $15,000 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $7,700.

- Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income.

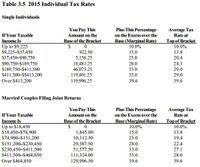

Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

a) What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermediate calculations.

c) What is her average tax rate? Round your answer to 2 decimal places.

Transcribed Image Text:**Table 3.5: 2015 Individual Tax Rates**

### Single Individuals

| If Your Taxable Income Is | You Pay This Amount on the Base of the Bracket | Plus This Percentage on the Excess over the Base (Marginal Rate) | Average Tax Rate at Top of Bracket |

|---------------------------|----------------------------------------------|---------------------------------------------------------------|-----------------------------------|

| Up to $9,225 | $0 | 10.0% | 10.0% |

| $9,225–$37,450 | $922.50 | 15.0% | 13.8% |

| $37,450–$90,750 | $5,156.25 | 25.0% | 18.8% |

| $90,750–$189,750 | $18,481.25 | 28.0% | 23.4% |

| $189,750–$411,500 | $46,075.25 | 33.0% | 28.1% |

| $411,500–$413,200 | $119,401.25 | 35.0% | 29.0% |

| Over $413,200 | $119,996.25 | 39.6% | 39.6% |

### Married Couples Filing Joint Returns

| If Your Taxable Income Is | You Pay This Amount on the Base of the Bracket | Plus This Percentage on the Excess over the Base (Marginal Rate) | Average Tax Rate at Top of Bracket |

|---------------------------|----------------------------------------------|---------------------------------------------------------------|-----------------------------------|

| Up to $18,450 | $0 | 10.0% | 10.0% |

| $18,450–$74,900 | $1,845.00 | 15.0% | 13.8% |

| $74,900–$151,200 | $10,312.50 | 25.0% | 18.7% |

| $151,200–$230,450 | $29,387.50 | 28.0% | 23.2% |

| $230,450–$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer all parts! William and Annette Johnson (both age 45) are married taxpayers who file a joint return. They have a son, Sean, age 7. During the tax year, they had the following receipts: 1 Salary ($75,000 for William, $62,000 for Annette) $137,000 2. Interest Income · City of Normal school bonds $1,000 · Ford Motor Company bonds 1,200 · PNC Bank certificate of deposit 600 2,800 3. Annual gift from parents 26,000 4. Lottery winnings 1,000 5. Short-term capital loss (from stock investment) ( 5,000) 6. Federal income tax refund from last year return 2,400 7. Child support from Annette's ex-husband 8,000 8. State income tax refund from the prior year (they used standard deduction in the prior year) 700 They also have the following facts related to their…arrow_forwardSamuel Jenkins made two investments; the first was 13 months ago and the second was two months ago. He just sold both investments and has a capital gain of $5,000 on each. If Samuel is single and has taxable income of $40,000, what will be the amount of capital gains tax on each investment? See Capital Gains table and Taxable income rate table. Investment 1 (held 13 months) Investment 2 (held 2 months) Capital Gains Taxarrow_forwardJeremy earned $100,000 in salary and $6,000 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,000 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules.) b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000. What is Jeremy’s tax refund or tax due including the tax on the capital gain?arrow_forward

- Ms. Zhao has $200,000 private activity municipal bond interest income from The City of Indianapolis. Ms. Zhao's only other income for the year is her $600,000 salary and Mr. Zhao has a $400,000 salary. Furthermore, both Ms. and Mr. Zhao, married, are 50 years old, file a joint return, have no dependents, and have $27,000 itemized deductions. Compute the Zhao's tentative minimum tax for the current year.arrow_forwardAiden is married and has salary income of $80,000 and total itemized deductions is $30,000. During the year, he sold two investments resulting in a $5,000 long-term capital gain and a $15,000 short-term capital loss. He calculated his AGI to be $70,000 (80,000 -10,000) and his taxable income to be $40,000 (70,000-30,000). Based on the tax formula and the net capital loss rules, comment on whether or not the adjusted gross income and taxable income are correct. Explain and provide support for your position.arrow_forwardSamuel Jenkins made two investments; the first was 13 months ago and the second was 2 months ago. He just sold both investments and has a capital gain of $10,000 on each. If Samuel is single and has taxable income of $41,250, what will be the amount of capital gains tax on each investment? See Capital Gains table and Taxable income rate table. Investment 1 (held 13 months) Investment 2 (held 2 months) Capital Gains Taxarrow_forward

- Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Troy receives a salary of $60,000 per year. He also receives a bonus equal to 10% of all collections from clients he serviced during the year (which he receives in January of the following year). Determine the tax consequences of the following events to the corporation and to Troy: a. On December 31, 2023, Troy was visiting a customer. The customer gave Troy a $10,000 check payable to the corporation for appraisal services Troy performed during 2023. Troy did not deliver the check to the corporation until January 2024. The corporation recognizes the income in: Troy recognizes the bonus related to this collection in: Question Content Area b. Assume Eagle Corporation is an accrual basis taxpayer. On December 31, 2023, Troy was visiting a customer. The customer gave Troy a $10,000 check payable to the corporation for appraisal services Troy performed during 2023. Troy deposited the…arrow_forwardDuring the current year, Kristina, a single taxpayer with no dependents, has a salary of $130,000. She has the following income and (losses) from passive activities in 2021: Rental House ($28,850) Restaurant ( 3,900) Golf Course 7,800 Kristina has suspended loss carryforwards into 2021 of ($2,500) on the rental house and ($11,400) on the restaurant. She has a gain of $6,700 from selling the restaurant in 2021. She actively manages the rental house and is the sole owner. 1. What is Kristina's AGI in 2021? 2. What, if any, are Kristina's suspended loss carryforwards by activity? If she does not have any, explain why. 3. Assume Kristina has no deductions For AGI, no qualified business income, and takes the standard deduction; what is her federal income tax liability for 2021?arrow_forwardAllie received a $50,000 distribution from her 401(k) account this year that she established while working for Big Stories, Incorporated. Assume that her marginal ordinary tax rate is 24 percent. a. Allie is 45 and still employed with Big Stories, Incorporated. How much tax and penalty will Allie pay on the distribution? b. Allie is 56 and was terminated from Big Stories, Incorporated this year. How much tax and penalty will Allie pay on the distribution? c. Allie is 67 and retired. How much tax and penalty will Allie pay on the distribution?arrow_forward

- Ms. Zhao has $200,000 private activity municipal bond interest income from The City of Indianapolis. Ms. Zhao's only other income for the year is her $600,000 salary and Mr. Zhao has a $400,000 salary. Furthermore, both Ms. and Mr. Zhao, married, are 50 years old, file a joint return, have no dependents, and have $27,000 itemized deductions. Compute the Zhao's tentative minimum tax for the current year.arrow_forwardLast year, lana purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected. a.$7,000 gain b.$3,000 loss c.$13,000 loss d.$2,000 gainarrow_forwardYou are the tax supervisor at a local tax return preparation firm. Suzanne and her husband Steve have been working with the local fire department for 8 years. They have a total income after adjustments (reported on line 11 of the form 1040) of $160,000. After reviewing the preparation of the return, you notice there are a few things not taken into consideration for her tax return preparation. For each of the following questions, provide where the change on the tax return would occur and how much would it effect their taxable income, if they had an effective tax rate of 21% and a marginal tax rate of 24%, prior to the change. The ROTH IRA contribution of $7000 for each of Suzanne and Steve. (5PTS) Fertility treatment for Suzanne, so she should conceive a child. The process is still going on, but in 2020, they spent $15,000 on treatments and racked up 300 miles going back and forth to hospitals. (5PTS) They made a charitable contribution for the Fireman’s Fund,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education