FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

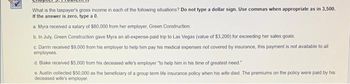

Transcribed Image Text:What is the taxpayer's gross income in each of the following situations? Do not type a dollar sign. Use commas when appropriate as in 3,500.

If the answer is zero, type a 0.

a. Myra received a salary of $80,000 from her employer, Green Construction.

b. In July, Green Construction gave Myra an all-expense-paid trip to Las Vegas (value of $3,200) for exceeding her sales goals.

c. Darrin received $9,000 from his employer to help him pay his medical expenses not covered by insurance, this payment is not available to all

employees.

d. Blake received $5,000 from his deceased wife's employer to help him in his time of greatest need."

e. Austin collected $50,000 as the beneficiary of a group term life insurance policy when his wife died. The premiums on the policy were paid by his

deceased wife's employer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Manuel pays insurance premiums for his employees. What type of insurance premium is not deductible as compensation paid to the employee?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Manuel pays insurance premiums for his employees. What type of insurance premium is not deductible as compensation paid to the employee?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $4,100 weekly. She is married, claims 4 deductions, and prior to this payroll check, has total earnings of $128,255. What are the correct deductions for Social Security, Medicare, and FIT? Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. (Use Table 9.1 and Table 9.2). (Round your answers to the nearest cent.) Social Security taxes Medicare taxes FIT Deductionsarrow_forwardThe following information applies to the questions displayed below.] Haru is a self-employed cash-method, calendar-year taxpayer, who made the following cash payments related to his business this year. Calculate the after-tax cost of each payment assuming Haru has a 37 percent marginal tax rate. a. $500 fine for speeding while traveling to a client meeting. b. $800 of interest on a short-term loan incurred in September and repaid in November. Half of the loan proceeds was used immediately to pay salaries and the other half was invested in municipal bonds until November. c. $600 for office supplies in May of this year. Haru used half of the supplies this year, and he will use the remaining half by February of next year. d. $450 for several pairs of work boots. Haru expects to use the boots about 80 percent of the time in his business and the remainder of the time for hiking. Consider the boots to be a form of clothing.arrow_forwardCompute the penalty described for the following taxpayers. If an amount is zero, enter "0". If required, round your answers to two decimal places. Question Content Area a. Wilson filed his individual tax return on the original due date, but failed to pay $2,310 in taxes that were due with the return. If Wilson pays the taxes exactly 3 months late (not over 60 days), calculate the amount of his failure-to-pay penalty.$fill in the blank b. Joan filed her individual income tax return 5 months after it was due. She did not request an extension of time for filing. Along with her return, Joan remitted a check for $725, which was the balance of the taxes she owed with her return. Disregarding interest, calculate the total penalties that Joan will be required to pay, assuming the failure to file was not fraudulent.$fill in the blankarrow_forward

- 1. Ms. Evelyn is tax compliance officer at the Bureau of internal revenue earning a monthly salary P35,196.00. How much is Ms. Evelyn's take home pay? 2. Allan S. Gala is a sales representative at a private pharmacy. He is given a monthly rice subsidy of P2,000.00. Over his monthly salary of P24,300.00. How much is his monthly net pay?arrow_forwardPlease answer with reason for all why the option is correct and why the other options are incorrectarrow_forwardWhich one of the following costs is most likely NOT fully deductible? Group of answer choices Jose, a local business owner, pays $30,000 in Self-Employment taxes. Sandra owns a mini golf course. She pays her employer portion of payroll taxes because of her employees, which totals to $12,000. Travis owns a CPA firm and pays his son Joe as an associate. Joe is a CPA and is paid the same salary as the other associates. X-Corp writes off a $12,000 business debt owed by Sam because he has not responded to their numerous requests for payment.arrow_forward

- Bill purchased a computer for his business. Bill paid $2,610 for the computer plus $196 for sales tax. He paid $300 for the computer to be set up in his office. When Bill filed his tax return, his tax preparer used Section 179 to expense the cost. What is Bill's adjusted basis in the computer? 1. $3,106 2. $2,806 3. $2,610 4. $0arrow_forwardLorna Hall’s real estate tax of $2,010.88 was due on December 14, 2019. Lorna lost her job and could not pay her tax bill until February 27, 2020. The penalty for late payment is 612%612% ordinary interest. (Use Days in a year table.)a. What is the penalty Lorna must pay? (Round your answer to the nearest cent.) Penalty Pay b. What is the total amount Lorna must pay on February 27? (Round your answer to the nearest cent.) Total Amountarrow_forwardA taxpayer would be required to pay Social Security and Medicare taxes for a domestic employee in all but one of the following situations. In which situation would this not be required? a.A cook who is paid $35,000 a year b.A nanny who earns $22,000 a year c.A baby-sitter who earns $1,300 a year d.A cleaning lady who is paid $8,000 a year e.The taxpayer would not have to pay Social Security and Medicare taxes in any of the above situations.arrow_forward

- Morgan is paid $2,849.50 per week. What is the amount of federal income tax withheld from Morgan's paycheck under the following conditions? Assume that Morgan has only one job or that step 2 of Form W-4 is not checked. Also, her employer uses the Percentage Method Tables for Automated Systems. Use percentage method tables for automated systems. Required: a. Morgan is single and no dependents b. Morgan is married (spouse does not work) and claims two dependents who are under the age of 17 c. Morgan is single, claims no dependents, but wants $70 in additional withholding Note: For all requirements, round your intermediate computations and final answers to 2 decimal places. Amount a. Federal income tax withholdings b. Federal income tax withholdings c Federal income tax withholdingsarrow_forwardClyde is a cash-method taxpayer who reports on a calendar-year basis. This year Paylate Corporation has decided to pay Clyde a year-end bonus of $1,450.Determine the amount Clyde should include in his gross income this year under the following circumstances. (Leave no answer blank. Enter zero if applicable.) Problem 5-53 Part-d (Algo) d. Clyde picked up the check in December, but the check could not be cashed immediately because it was postdated January 10. Amount to be included in gross income - ________arrow_forwardHow much should be the income tax withheld on compensation income? Mr. B, married, is a citizen and resident of the Philippines. He had the following data on income and expenses: Salaries, net of P7,000 SSS, Philhealth, Pagibig contributions, and labor union dues Thirteen month pay Allowances Gain on sale of asset P88,000 8,000 16,000 10,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education