FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

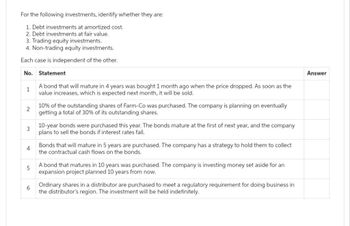

Transcribed Image Text:For the following investments, identify whether they are:

1. Debt investments at amortized cost.

2. Debt investments at fair value.

3. Trading equity investments.

4. Non-trading equity investments.

Each case is independent of the other.

No.

Statement

1

A bond that will mature in 4 years was bought 1 month ago when the price dropped. As soon as the

value increases, which is expected next month, it will be sold.

2

3

4

10% of the outstanding shares of Farm-Co was purchased. The company is planning on eventually

getting a total of 30% of its outstanding shares.

6

10-year bonds were purchased this year. The bonds mature at the first of next year, and the company

plans to sell the bonds if interest rates fall.

Bonds that will mature in 5 years are purchased. The company has a strategy to hold them to collect

the contractual cash flows on the bonds.

5

A bond that matures in 10 years was purchased. The company is investing money set aside for an

expansion project planned 10 years from now.

Ordinary shares in a distributor are purchased to meet a regulatory requirement for doing business in

the distributor's region. The investment will be held indefinitely.

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Review the Bond Table below; all bonds have semi-annual payments. Security. Coupon Rate Face Value 0.00% $1,000 4.50% 5.00% 1-yr Treasury 5-yr Treasury 10-yr Treasury 5-yr Corporate (rated A) 10-year Corporate 8.40% (rated BBB) Multiple Choice O 4.80% O If a company wanted to issue a new Corporate Bond (10 years, A rating) for full price, what coupon rate would it have to offer? 6.90% 6.50% 7.75% 7.50% $1,000 $1,000 $1,000 None of the above $1,000 Price $ 965.90 $991.18 $976.94 $912.46 $1,044.66arrow_forwardGive typing answer with explanation and conclusion O'Brien Ltd.'s outstanding bonds have a $1,000 par value, and they mature in 25 years. Their nominal annual, not semiannual yield to maturity is 9.25%, they pay interest semiannually, and they sell at a price of $700. What is the bond's nominal coupon interest rate? a.6.15% b.6.58% c.4.86% d.5.72% e.7.01%arrow_forwardSavitaarrow_forward

- MCQ: Legacy Inc. recently issued bonds that mature in 10 years. They have a par value of $1,000 and annual coupon of 6%. The current market interest rate is 8.5%. Assume that the bonds can be recalled at end of year 5 at $1,250. What will be the price of bonds? Select one: a. 833.82 b. 1067.75 c. 1130.95 d. 835.97 e. 582.73arrow_forwardWildhorse Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 9.875 percent and a yield to maturity of 6.0 percent. Assume face value is $1,000. Problem 8.30(a) Your answer is incorrect. Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Current price $ EAarrow_forwardPlease answer question 1 without excel usagearrow_forward

- solve this 2 questionarrow_forwardQ1. A company issued 20-year bonds with par value $1,000 two years ago at a coupon rate of 5 percent. The bonds make semiannual coupon payments. The yield to maturity on this bond is 4 percent. Calculate the current yield of the bond. Q2. A company has an odd dividend policy. The company will pay a dividend of $3 per share next year and has announced that it will increase the dividend by $5 per share for each of the subsequent four years and then maintains a constant 2% growth rate. If you require a return of 8 percent on the company’s stock. A. How much will you pay for a share today?B. At the price you are willing to pay for, what is the dividend yield in the first year? Q3. A project has the following cash flow with a discount rate of 12%: Annual cash flows: Year 0 Year 1 Year 2 Year 3 Year 4 $ -520,000 $ 170,000 $ 210,000 $ 225,000 $ 195,000 $520,000 is used in purchasing an equipment for the project only. Compute the following: Payback period; Discounted Payback…arrow_forwardWhich of the following is most likely classified as a Held-to-Maturity (HTM) debt investment? Which of the following is most likely classified as a Held-to-Maturity (HTM) debt investment? 30% ownership of Yves St. Laurent stock 10-year bond that will be held for 10 years 100% ownership of a supplier's voting stock a 5-year bond that will be sold tomorrowarrow_forward

- Schallheim Corporation’s outstanding bonds have a $1,000 par value, a 7 percent semiannual coupon, 16 years to maturity, and an 8.5 percent yield to maturity (YTM). What is the bond’s price? a. $870.11 b. $871.37 c. $1,000.00 d. $914.20 e. $455.00arrow_forwardANX Ltd just issued a 12-year 6% coupon bond. The face value of the bond is $1,000 and the bond makes semi-annual coupon payments. If the required return on the bond is 9%, what is the bond's price? Question 3Select one: A. $347.70 B. $782.57 C. None of these. D. $355.53 E. $785.18arrow_forwardThe following table lists several corporate bonds. Treat these as zero coupon bonds, as in Example 2. Company AT&T LA Time to Maturity (years) 10 Annual Compound 2.97 Interest Rate (%) Bank of General Goldman America Electric Sachs 10 3.42 2 6.12 3 5.81 Verizon 8 5.41 Wells Fargo 7 4.18 If you bought AT&T bonds with a maturity value of $12,000, how much did you originally pay? (Round your answer to the nearest $1.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education