Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please solve question 2, please do not use excel.

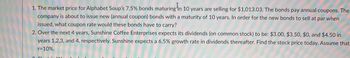

Transcribed Image Text:1. The market price for Alphabet Soup's 7.5% bonds maturing in 10 years are selling for $1,013.03. The bonds pay annual coupons. The

company is about to issue new (annual coupon) bonds with a maturity of 10 years. In order for the new bonds to sell at par when

issued, what coupon rate would these bonds have to carry?

2. Over the next 4 years, Sunshine Coffee Enterprises expects its dividends (on common stock) to be: $3.00, $3.50, $0, and $4.50 in

years 1,2,3, and 4, respectively. Sunshine expects a 6.5% growth rate in dividends thereafter. Find the stock price today. Assume that

r= 10%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- it is still incorrect, please find correct answerarrow_forwardI need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education