Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

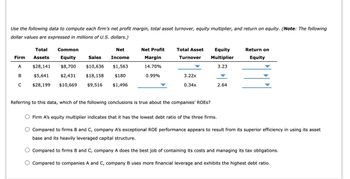

Transcribed Image Text:Use the following data to compute each firm's net profit margin, total asset turnover, equity multiplier, and return on equity. (Note: The following

dollar values are expressed in millions of U.S. dollars.)

Common

Equity

$8,700 $10,636 $1,563

$28,141

B

$5,641

$2,431 $18,158 $180

C $28,199 $10,669 $9,516 $1,496

Firm

A

Total

Assets

Net

Sales Income

Net Profit

Margin

14.70%

0.99%

Total Asset

Turnover

3.22x

0.34x

Referring to this data, which of the following conclusions is true about the companies' ROES?

Equity

Multiplier

3.23

2.64

Return on

Equity

Firm A's equity multiplier indicates that it has the lowest debt ratio of the three firms.

Compared to firms B and C, company A's exceptional ROE performance appears to result from its superior efficiency in using its asset

base and its heavily leveraged capital structure.

Compared to firms B and C, company A does the best job of containing its costs and managing its tax obligations.

Compared to companies A and C, company B uses more financial leverage and exhibits the highest debt ratio.

Expert Solution

arrow_forward

Step 1

A mathematical relationship between two variables is a ratio analysis. Investors use this analysis to gauge a company's financial performance.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Please helparrow_forwardCalculate the Weighted Average Cost of Capital (WACC) Cost of Equity = 11.02% Cost of Debt = 5.35% Debt-to-Equity Ratio = 15.52%arrow_forwardBased on the following information, what is the firm's weighted average cost of capital of the operating assets, WACCO? Cost of debt, RD: 7% Cost of equity, Rs: 20% Total market value of debt, D: 500 Total market value of equity, S: 1,500 Number of common shares outstanding: 100 Total market value of non-operating assets, N: 200 Cost of non-operating assets, RN: 9% Corporate tax rate, T: 40% O .143009 b. 168751 a. c. .188232 d. .127767arrow_forward

- If a bank has the following ratios, it can pay up to of its earnings as dividends. Tier 1 leverage = 4.7% Tier 1 common equity risk-based = 7.2% %3D Tier 1 risk-based 8.3% Total capital risk-based = 11%arrow_forwardLoreto Inc. has the following financial ratios: asset turnover = 2.40; net profit margin (i.e., net income/sales) = 5%; payout ratio = 30%; equity/assets = 0.40. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate?arrow_forwardBased on the following information, calculate the sustainable growth rate for Kaleb's Heavy Equipment: Profit margin Capital intensity ratio Debt-equity ratio Net income Dividends 8.1% .51 .67 $ 29,000 $19,720arrow_forward

- The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. Q1. ________is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Q2. Avery Co. has $3.9 million of debt, $2 million of preferred stock, and $2.2 million of common equity. What would be its weight on debt? a. 0.27 b. 0.25 c. 0.48 d. 0.20 Q1. Option 1 rS or Option 2 rD or Option 3 rP or Option 4 rE Please provide the correct answers. Thank you!arrow_forwardProblem solve this problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education