FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

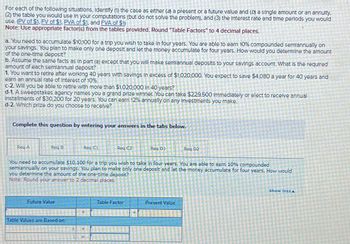

Transcribed Image Text:For each of the following situations, Identify (1) the case as either (a) a present or a future value and (b) a single amount or an annulty.

(2) the table you would use in your computations (but do not solve the problem), and (3) the Interest rate and time periods you would

use. (PV of $1, FV of $1, PVA of $1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided. Round "Table Factors" to 4 decimal places.

a. You need to accumulate $10,100 for a trip you wish to take in four years. You are able to earn 10% compounded semiannually on

your savings. You plan to make only one deposit and let the money accumulate for four years. How would you determine the amount

of the one-time deposit?

b. Assume the same facts as in part (a) except that you will make semiannual deposits to your savings account. What is the required

amount of each semiannual deposit?

1. You want to retire after working 40 years with savings in excess of $1,020,000. You expect to save $4,080 a year for 40 years and

earn an annual rate of Interest of 10%.

c-2. Will you be able to retire with more than $1,020,000 in 40 years?

d-1. A sweepstakes agency names you a grand prize winner. You can take $229,500 Immediately or elect to receive annual

Installments of $30,200 for 20 years. You can earn 12% annually on any Investments you make.

d-2. Which prize do you choose to receive?

Complete this question by entering your answers in the tabs below.

Req A

Req B

Req C1

Req C2

Req Di

Req D2

You need to accumulate $10,100 for a trip you wish to take in four years. You are able to earn 10% compounded

semiannually on your savings. You plan to make only one deposit and let the money accumulate for four years. How would

you determine the amount of the one-time deposit?

Note: Round your answer to 2 decimal places.

Future Value

Table Values are Based on:

Table Factor

Present Value

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define present and future value concepts.

VIEW Step 2: a. Determine the amount to be deposited to make $10,100 in 4 years.

VIEW Step 3: b. Determine the semi-annual deposit to be made to get $10,100 after 4 years.

VIEW Step 4: c. Determine the future annuity of $4080 for 40 years at 10%.

VIEW Step 5: d. Determine the prize to be selected.

VIEW Solution

VIEW Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For each case, provide the missing information. Assume payments occur at the end of each period. (Use the present value and future value tables, the formula method, financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places X.XXXXX. Round all final answers to the nearest cent, $X.XX, and round the loan maturity date to the nearest whole year.) (Click the icon to view the cases.) Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Cases Amount borrowed Interest rate Number of periodic payments per year Maturity (in years) Periodic payment (1) (a) 4% 4 10 $ 10,354.90 (2) $ 675,000 $ 4% 2 10 (b) S CO (3) 456,000 6 % 1 (c) 81.685.59 (4) $ 750.000 12 % T (d) I Xarrow_forwardAnswer the following compound interest problem using the provided formula ONLY. Show your complete solution.arrow_forwardPresent Value of an Annuity Find the present value of the following ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press PV, and find the PV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $800 per year for 10 years at 8%. $ $400 per year for 5 years at 4%. $ $800 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made at the beginning of each year; that is, they are annuities…arrow_forward

- Calculate the simple interest note proceeds. calulate the simple discount note proceeds.arrow_forwardP1 and P2 have a default setting of 1.00, meaning only the first payment is analyzed. Scroll down to the balance after the first payment, amount paid toward principal, and amount paid toward interest. BAL = $443,963.80 PRN = $56,036.20 INT = $40,000.00 To examine the last payment, change P1 and P2 to 7 and review the amortization output: What is the remaining balance? How much of the final payment goes toward repaying principal? How much of the final payment goes toward paying interest?arrow_forwardWhich of the following statements is true?a. When the interest rate increases, the present value of asingle amount decreases.b. When the number of interest periods increases, thepresent value of a single amount increases.c. When the interest rate increases, the present value of anannuity increases.d. None of the above are true.arrow_forward

- With loans, spreadsheets make it easy to _____. (can be more than 1 of the options listed below) a. Calculate the amortization schedule b. Determine the number of remaining loan payments c. Find the loan balance due at any time d. Demonstrate the split between the principal and interest amounts.arrow_forwardGive a numerical example of: Current liabilities. Long-term liabilitiesarrow_forwardGive typing answer with explanation and conclusionarrow_forward

- Which formula is correct for the compound interest calculation? Select one: a. P = F(1+i)^-n b. P = F/(1+in) c. P = F/(1+i/n)arrow_forwardWhich figure of merit provides an interest rate at which the present value of the future cash flows equals the amount invested? a) NPV b) IRR c) Cap Rate d) DCF Please ensure accuracy and explain your choicearrow_forwardProve the loan payment formula, shown below. PMT=Prn1−1+rn−nt Question content area bottom Part 1 Manipulate the formula shown below to prove the loan payment formula. The left side of the equation is the future value of the principal amount and the right side is the future value of the loan payments. First, solve the equation for PMT. P1+rnnt = PMT1+rnnt−1rnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education