Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

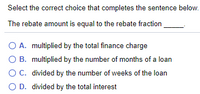

Transcribed Image Text:Select the correct choice that completes the sentence below.

The rebate amount is equal to the rebate fraction

O A. multiplied by the total finance charge

O B. multiplied by the number of months of a loan

OC. divided by the number of weeks of the loan

O D. divided by the total interest

Expert Solution

arrow_forward

Introduction

Rebate is a term used in short-selling, which is selling securities that a trader does not own. In order to sell a stock that isn't owned, the trader must borrow the stock in order to deliver it to the buyer. When an investor places a short sale trade, that individual must deliver the stock to the buyer on the trade settlement date.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute the principal (in $) for the loan. Use ordinary interest when time is stated in days. Principal Rate (%) Time Interest $ 11 1 1//2 years $495arrow_forwardWhat is the total amount you will pay if you do not pay the loan within the term and meet all the conditions of the loan? Assume that the loan is compounding monthly. First you need to calculate the payment; so what is TVM variable: the number of periods N?arrow_forwardUse the exact interest method (365 days) and the ordinary interest method (360 days) to compare the amount (in $) of interest for the loan. (Round your answers to two decimal places.) Principal Rate (%) Time (days) Exact Interest Ordinary Interest $7,290 7 17 $ $arrow_forward

- Use the ordinary interest method to compute the time (in days) for the loan. Round your answer up to the next highest day when necessary. Principal Rate (%) $7,700 10.4 Time days Interest $226arrow_forward1. Consider a loan at 4.125% APR on 6 years for a $23,000 car a. Estimate the monthly payment (using the average balance method). b. How much would you pay in total for interest?arrow_forwardPlease include the excel formula If the following is a loan, identify a) the principal amount, b) the monthly interest rate, and c) the length of the loan in months. Determine if the following situation is an investment or a loan. If the following is an investment, identify a) if it is a one-time or recurring investment, b) the number of compounding periods per year and c) the total number of compounding periods. If the following is a loan, identify a) the principal amount, b) the monthly interest rate, and c) the length of the loan in months. Ashtyn purchased new appliances for her house for a total of $5,744. The store she buys the appliances from offers an annual simple interest rate of 8.5% with no down payment and monthly payments for 3 years. This situation represents a(n) . a) b) c) What will be your monthly payments? Use Excel to calculate the value.arrow_forward

- The principal P is borrowed and the loan's future value A at timet is given. Determine the loan's simple interest rate r to the nearest tenth of a percent. P = $3400.00, A = $3446.75, t = 3 months % (Round to the nearest tenth of a percent.)arrow_forwardCalculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) AmountFinanced Number ofPayments APR TableFactor FinanceCharge MonthlyPayment $700 18 17% $arrow_forwarda) Based on your prepared amortization schedule for Concert Time Again, Inc term loan, what is the remaining loan balance after the 4th payment AND which financial statement would that amount appear on? Type the financial statement in the text box below and write the Dollar Amount on your PDF upload Financial Statement b) Based on your prepared amortization schedule, what is the interest expense for this loan after the 4th payment AND which financial statement would this appear on? Assume the first 4 payments are in the same accounting period that is presented on the financial statement. Type the financial statement in the text box below and write the Dollar Amount on your PDF upload Financial Statement c) What will the loan balance be after the 60th payment? $arrow_forward

- Suppose you earn a gross income of $2,920.00 per month and apply for a mortgage with a monthly PITI of $908.12. You have other financial obligations totaling $169.36 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% A. FHA only B. Conventional only C. FHA and Conventional D. None of the abovearrow_forwardwhats the answer for number 6arrow_forwardUse the exact interest method (365 days) and the ordinary interest method (360 days) to compare the amount of interest for the following loan. Round your answers to the nearest cent. Principal Rate (%) Time (days) Exact Interest Ordinary Interest $ $136,000 7.30 64 1,741 1,765arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education