Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

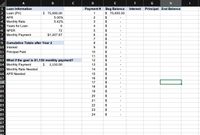

1) Use the Loan worksheet to complete the loan amortization table.

In cell F2, insert the IPMT function to calculate the interest for the first payment. Copy the function to the range F3:F25. (The results will update after you complete the other functions and formulas.)

2) In cell G2, insert the PPMT function to calculate the principal paid for the first payment. Copy the function to the range G3:G25.

3) In cell H2, insert a formula to calculate the ending principal balance. Copy the formula to the range H3:H25.

4) Now you want to determine how much interest was paid during the first two years.

In cell B10, insert the CUMIPMT function to calculate the cumulative interest after the first two years. Make sure the result is positive.

5) In cell B11, insert the CUMPRINC function to calculate the cumulative principal paid at the end of the first two years. Make sure the result is positive.

6) You want to perform a what-if analysis to determine the rate if the monthly payment is $1,150 instead of $1,207.87.

In cell B15, insert the RATE function to calculate the necessary monthly rate given the NPER, proposed monthly payment, and loan. Make sure the result is positive.

7) Finally, you want to convert the monthly rate to an APR.

In cell B16, insert a formula to calculate the APR for the monthly rate in cell B15.

Transcribed Image Text:B

G

Loan Information

Beg Balance

$ 75,000.00

1

Payment #

Interest

Principal End Balance

$ 75,000.00

2 Loan (PV)

3 APR

4 Monthly Rate

5 Years for Loan

6 NPER

7 Monthly Payment

5.00%

2

2$

0.42%

3

4

24

72

24

$1,207.87

6

2$

8

7

9 Cumulative Totals after Year 2

10 Interest

11 Principal Paid

8

10

$

12

11

13 What if the goal is $1,150 monthly payment?

14 Monthly Payment

15 Monthly Rate Needed

16 APR Needed

12

24

1,150.00

13

24

14

24

15

$

24

24

17

16

18

17

19

18

20

19

2$

21

20

$

22

21

24

23

22

24

23

2$

25

24

%24

26

27

28

29

20

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 4arrow_forwardYour company has loaned money to an outside entity. You earned the monthly interest on the loan but did not receive the payment yet. The payment is expected to be received next month. To capture the interest expected to be received in the future you have created account #901 , Interest Receivable in your chart of accounts and booked the journal entry to DR: Interest Receivable and CR: Interest Income. While the basic journal entry was correct, your manager is questioning how you setup this new account. Based on this image of the chart of accounts below what needs to be corrected and how would you correct this?arrow_forwardI just asked this question and it was wrong. Here is what the expert said. Please help with the red fields.arrow_forward

- Calculate the missing information for the installment loan that is being paid off early. Number ofPayments PaymentsMade PaymentsRemaining Sum-of-the-Digits PaymentsRemaining Sum-of-the-Digits Numberof Payments RebateFraction 18 7arrow_forwardNonearrow_forwardif u don’t answer this i will report you.arrow_forward

- Go to the Loan Calculator The cells in the range B6:B8 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula.Update the defined names in the worksheet as follows: a)Delete the Loan_Calculator defined name. b)For cell B8, edit the defined name to use Loan_Amount as the name. 2. In cell B8, calculate the loan amount by entering a formula without using a function that subtracts the Down_Payment from the Price. 3.Liam also wants to use defined names in other calculations to help him interpret the formulas.a) In the range D4:D8, create defined names based on the values in the range C4:C8.arrow_forwardCalculate the missing information for the installment loan that is being paid off early. Number ofPayments PaymentsMade PaymentsRemaining Sum-of-the-Digits PaymentsRemaining Sum-of-the-Digits Numberof Payments RebateFraction 18 4arrow_forwardRank the following car loan descriptions from highest payment ot lowest payment. The loan amount is the same for all. 5-year loan 3% interest rate 5-year loan 4% interest rate 6-year loan 3% interest rate 6-year loan 4% interest ratearrow_forward

- Describe 2 accrual transactions and 2 deferral transactions. For the accrual transactions, please use credit or debit sales and credit purchase. For the deferral transactions, please use prepaid insurance and prepaid telephone charges. Note: This can be made up amounts, just as long as they make sense. This is for an Electrotechnology Sales and Repairs business. Please include the dates that the transactions occurred. Please see below, as I have included an example of what the end product should look like. Please include an explanation as to what was done. Accruals: 1. On March 30, 2021 Ortiz LLC provided accounting reservices for Beker Law firm and sent them a bill for $5,000. Payment has not been received to this day. 2. Store supplies of $200 are on hand. The supplies account shows a $1,900 balance. Deferrals: 1. On April 1, 2021. ORTIZ LLC paid $12,000 for a one-year insurance Policy. 2. On February 1, 2021 . ORTIZ LLC received $20,000 for accounting services for 1 year.arrow_forwardThe interest / paid on an amortization of a loan of PV dollars where N payments of PMT dollars have been made is given by the formula:arrow_forwardComplete the table for the last three payments. (Do not round until the final answer. Then round to the nearest cent as needed.) Payment Number Amount Paid Interest Paid Principal Repaid Outstanding Principal Balance 30 31 32 $0 Total Paid = $ (Do not round until the final answer. Then round to the nearest cent as needed.) Interest Paid = S (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education