FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

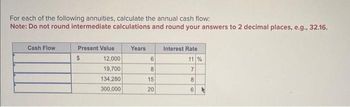

Transcribed Image Text:For each of the following annuities, calculate the annual cash flow:

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.

Cash Flow

Present Value

$

12,000

19,700

134,280

300,000

Years

6

8

15

20

Interest Rate

11 %

7

8

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vijayarrow_forwardConsider the following cash flows: Year 0 Cash Flow -$ 5,100 es 01234 1,500 2,600 1,300 1,000 Check my work 4 What is the payback period for the cash flows? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Payback period -32.16 yearsarrow_forwardFor what value of X would the cash flow have a present value of -$4,900 assuming the money was invested in an account earning 4% interest compounded annually? $2,200 O tA $ i = 4% 1 $2,500 2 Click here to access the TVM Factor Table calculator. $3,500arrow_forward

- 9farrow_forwardFor each of the following, compute the present value: (Do not round Intermediate calculations and round your final answers to 2 decimal places.) 16 Present Value Years 3 Interest Rate 10 Future Value $ 14,451 41,557 876,073 540,164arrow_forwardWhat is the future value at the end of year 3 of the following set of cash flows if the interest rate is 8%? (the cash flows occur at the end of each period) (round answer to nearest penny and enter in the following format 12345.67) Year 0 cash flow = 2000 Year 1 cash flow = 1700 Year 2 cash flow = 700 Year 3 cash flow = 900 Answer: کےarrow_forward

- For each of the following annuities, calculate the present value. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Annuity Payment $ 2,000 $ 1,280 $ 11,580 30,150 69 $ Years 7 17 25 Interest Rate 9 % 8 10 12arrow_forwardQ. 4arrow_forwardYear Cash Flow 0 -$ 17,400 1 9,700 8,600 5,100 2 3 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a. Profitability index b. Profitability index c. Profitability indexarrow_forward

- Uneven Cash Flow Stream Year Cash Stream A Cash Stream B 1 $100 $300 2 400 400 3 400 400 4 400 400 5 300 100 What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest cent.Stream A $ _______Stream B $ _______arrow_forwardFor each of the following annuities, calculate the present value. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present Value Annuity Payment $ $ $ $ 1,950 1,265 11,455 29,900 Years 7 9 16 24 Interest Rate 8% 7 9 11arrow_forwardWhat is the discount rate at which the following cash flows have a NPV of $0? Answer in %, rounding to 2 decimals.Year 0 cash flow = -116,000Year 1 cash flow = 28,000Year 2 cash flow = 43,000Year 3 cash flow = 38,000Year 4 cash flow = 41,000Year 5 cash flow = 40,000Year 6 cash flow = 37,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education