Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

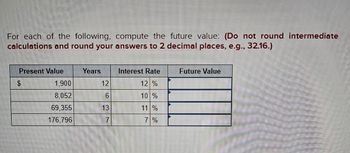

Transcribed Image Text:For each of the following, compute the future value: (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16.)

Present Value

$

1,900

8,052

69.355

176.796

Years

6

7

Interest Rate

12 %

10 %

11 %

Future Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Solve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value $ 750 940 18,500 73,800 Years 5 6 17 20 Interest Rate % % % % Future Value $ 1,451 1,788 145,332 319,815arrow_forwardNonearrow_forwardSolve for the unknown number of years in each of the following: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years S 300 1,991 32,905 32,600 Interest Rate 10 % 8 13 20 Future Value $ 1,155 3,750 387,620 199,724arrow_forward

- Present value = $100; Interest rate = 5%; Number of years 11 (assume annual compounding). What is the future value? Group of answer choices 171.03 155.00 55.00 223.13 Answer with Explanation and with reason of answer is correct or incorrectarrow_forwardFor each of the following, compute the future value: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present Value $ 2,350 10,053 105,305 243,382 Years Carne p 7 20 14 30 10 333 E MA Interest Rate 23232 HOS: ploping 201 18 % 10 % 11 % 3% Future Valuearrow_forwardUse the present value table to complete: (Round the "PV factor" answer to 4 decimal places.) Future Amount Desired Length of Time Rate Compounded Table Periods Rate Used P.V. Factor P.V. Amount $12,000 12 yrs 12% semiannually _______%arrow_forward

- Find the missing values assuming continuously compounded interest. (Round your answers to two decimal places.) InitialInvestment Annual% Rate Time toDouble Amount After10 Years $ % 15 yr $1600arrow_forwardSolve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value $ 755 945 19,000 74,300 Years 6 7 18 21 Interest Rate % % % % Future Value $ 1,461 1,798 145,832 320,815arrow_forwardHh3.arrow_forward

- For each of the following, compute the present value: (Do no calculations and round your answers to 2 decimal places, e.g., 32 Present Value Years 10 2 14 19 Interest Rate 6% 11 4.3 14 13 Future Value $ 18,728 42,917 804,382 661,816arrow_forwardCalculating Present Value For each of the following, compute the present value: Present Value Years Interest Rate Future Value ? 17.9% $16, 832 ? 9.7% $ 48,318? 23.13% $886, 073? 35 21% $550, 164arrow_forwardSolve for the unknown interest rate in each of the following (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.):arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education