Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

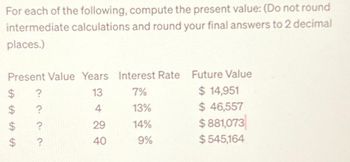

Transcribed Image Text:For each of the following, compute the present value: (Do not round

intermediate calculations and round your final answers to 2 decimal

places.)

Present Value Years Interest Rate Future Value

13

7%

$ 14,951

4

13%

$ 46,557

29

14%

40

9%

LA LA LA LA

$

?

$ ?

?

$ ?

$881,073

$545,164

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer me with clear format, weather hand-writing or typing Q2arrow_forward1. Using simple interest computations, find the future value of $3,620 at 2 38%/2 38%arrow_forwardComplete the following table. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present value $ $2,291.00 $33,250.00 $33,200.00 Years 8.50 years years 18.25 years 9.65 years Interest rate 11.00% 9.00% % 21.00% Future value $1,456.79 4,050.00 $250,100.55 $arrow_forward

- Compute the number of years (t) if future value (FV) = $10174, present value (FV) = $1498, and interest rate (r) = 14.7%,. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.):arrow_forwardWhere does the number 3 and number form highlighted on the picture comes from?arrow_forwardPlease show work. Thank youarrow_forward

- What is the future value?arrow_forwardSolve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value $ 750 940 18,500 73,800 Years 5 6 17 20 Interest Rate % % % % Future Value $ 1,451 1,788 145,332 319,815arrow_forwardNonearrow_forward

- Solve for the unknown number of years in each of the following: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years S 300 1,991 32,905 32,600 Interest Rate 10 % 8 13 20 Future Value $ 1,155 3,750 387,620 199,724arrow_forwardPresent value = $100; Interest rate = 5%; Number of years 11 (assume annual compounding). What is the future value? Group of answer choices 171.03 155.00 55.00 223.13 Answer with Explanation and with reason of answer is correct or incorrectarrow_forwardSolve for the unknown interest rate in each of the following: Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Present Value $ 755 945 19,000 74,300 Years 6 7 18 21 Interest Rate % % % % Future Value $ 1,461 1,798 145,832 320,815arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education