FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

For 20Y3, Greyhound Technology Company reported its most significant decline in net income in years. At the end of the year, Duane Vogel, the president, is presented with the following condensed comparative income statement:

| GREYHOUND TECHNOLOGY COMPANY Comparative Income Statement For the Years Ended December 31, 20Y3 and 20Y2 |

|||

| 20Y3 | 20Y2 | ||

| Sales | $ 586,521 | $ 513,000 | |

| Cost of goods sold | (416,000) | (320,000) | |

| Gross profit | $ 170,521 | $ 193,000 | |

| Selling expenses | $ (59,130) | $ (43,000) | |

| Administrative expenses | (34,290) | (27,000) | |

| Total operating expenses | $ (93,420) | $ (70,000) | |

| Income from operations | $ 77,101 | $ 123,000 | |

| Other income | 2,809 | 2,200 | |

| Income before income tax | $ 79,910 | $ 125,200 | |

| Income tax expense | (22,400) | (37,600) | |

| Net income | $ 57,510 | $ 87,600 |

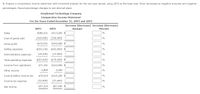

Transcribed Image Text:1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y2 as the base year. Enter decreases as negative amounts and negative

percentages. Round percentage changes to one decimal place.

Greyhound Technology Company

Comparative Income Statement

For the Years Ended December 31, 20Y3 and 20Y2

Increase (Decrease) Increase (Decrease)

20Υ3

20Υ2

Amount

Percent

Sales

$586,521

$513,000 $

%

Cost of goods sold

(416,000)

(320,000)

%

Gross profit

$170,521

$193,000 $

%

Selling expenses

$(59,130)

$(43,000) $

%

Administrative expenses

(34,290)

(27,000)

Total operating expenses

$(93,420) $(70,000) $

%

Income from operations

$77,101

$123,000 $

%

Other income

2,809

2,200

%

Income before income tax

$79,910

$125,200 $

Income tax expense

(22,400)

(37,600)

%

Net income

$57,510

$87,600 $

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous YearSales $4,000,000 $3,600,000Cost of goods sold 2,280,000 1,872,000Selling expenses 600,000 648,000Administrative expenses 520,000 360,000Income tax expense 240,000 216,000a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round to the nearest whole percentage.b. Comment on the significant changes disclosed by the comparative income statement.arrow_forwardPlease answer all 3 parts accordingly: Joyner Company’s income statement for Year 2 follows: Sales $ 709,000 Cost of goods sold 76,000 Gross margin 633,000 Selling and administrative expenses 150,800 Net operating income 482,200 Nonoperating items: Gain on sale of equipment 5,000 Income before taxes 487,200 Income taxes 146,160 Net income $ 341,040 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Year 1 Assets Cash $ 313,940 $ 57,200 Accounts receivable 222,000 143,000 Inventory 319,000 279,000 Prepaid expenses 11,000 22,000 Total current assets 865,940 501,200 Property, plant, and equipment 640,000 508,000 Less accumulated depreciation 165,400 130,900 Net property, plant, and equipment 474,600 377,100 Loan to Hymans Company 48,000 0 Total assets $ 1,388,540 $ 878,300 Liabilities and Stockholders' Equity Accounts payable $ 315,000 $ 254,000 Accrued liabilities 43,000 51,000 Income…arrow_forwardThe balance sheet of ATLF, Inc. reports total assets of $950,000 and $1,050,000 at the beginning and end of the year, respectively. Net income and sales for the year are $100,000 and $800,000, respectively. What is ATLF's profit margin? Select one: a. 8% b. 15% c. 10% d. 80% e. 12.5%arrow_forward

- Common-Sized Income Statement Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill's data are expressed in dollars. The electronics industry averages are expressed in percentages. Electronics Tannenhill Industry Company Average Sales $1,540,000 100 % Cost of goods sold 1,016,400 72 Gross profit $523,600 28 % Selling expenses $308,000 15 % Administrative expenses 123,200 7 Total operating expenses $431,200 22 % Operating income $92,400 6 % Other revenue 30,800 2 $123,200 8 % Other expense 15,400 1 Income before income tax $107,800 7 % Income tax expense 46,200 4 Net income $61,600 3 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Tannenhill Company Common-Sized Income Statement For the Year Ended December 31 Tannenhill Tannenhill…arrow_forwardPlease help mearrow_forwardBC Training reports sales revenue of $2,800,000. Average inventory during the year was $130,000. The inventory turnover ratio for the year is 8.0.What amount of gross profit would the company report in its income statement? Gross profitarrow_forward

- Horizontal analysis of the income statement income statement data for Winthrop company for two recent years ended December 31st are as follows. Sales Cost of goods Gross profit Selling expenses Administrative expenses Total operating expense Income before income tax expense Income tax expense Net income Current year 2,240,000 sales (1,925,000) no cost of goods $315,000 gross profit $ (152,500) selling expenses 118,000 administrative expenses $(270,500) total operating expense $44,500 income before tax expense (17,800) income tax expense $26,700 net income Previous year $2,000,000 sales (1,750,000) cost of goods $250,000 gross profit ($125,000) selling expenses (100,000) administrative expenses ($225,000) total operating expense $25,000 income before income tax expense ( 10,000) income tax expense $15,000 A. Prepare a comparative income statement with horizontal analysis Tama indicated the increase and decrease for the current year when compared with the…arrow_forwardBellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forwardHorizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31 are as follows: Current Year Previous Year Sales $536,800 $440,000 Cost of merchandise sold 444,000 370,000 Gross profit $92,800 $70,000 Selling expenses $25,760 $23,000 Administrative expenses 22,800 19,000 Total operating expenses $48,560 $42,000 Income before income tax expense $44,240 $28,000 Income tax expenses 17,700 11,200 Net income $26,540 S16,800 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Increase Increase (Decrease) Previous year year (Decrease)arrow_forward

- Income statement data for Winthrop Company for two recent years ended December 31 are as follows: 1 Current Year Previous Year 2 Sales $1,596,000.00 $1,400,000.00 3 Cost of goods sold 1,316,700.00 1,197,000.00 4 Gross profit $279,300.00 $203,000.00 5 Selling expenses $76,950.00 $67,500.00 6 Administrative expenses 55,000.00 50,000.00 7 Total operating expenses $131,950.00 $117,500.00 8 Income before income tax $147,350.00 $85,500.00 9 Income tax expense 11,060.00 7,000.00 10 Net income $136,290.00 $78,500.00 A. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. Round percentages to one decimal place. B. What conclusions can be drawn from the horizontal analysis? Round the answers to one decimal place.arrow_forwardThe Intramural Sports Club reports sales revenue of $602,000. Inventory at both the beginning and end of the year totals $110,000. The inventory turnover ratio for the year is 4.1. What amount of gross profit does the company report in its income statement? THE INTRAMURAL SPORTS CLUB Income Statement (partial)arrow_forwardBellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education