ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

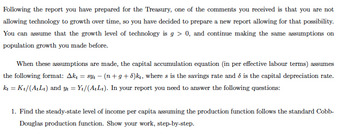

Transcribed Image Text:Following the report you have prepared for the Treasury, one of the comments you received is that you are not

allowing technology to growth over time, so you have decided to prepare a new report allowing for that possibility.

You can assume that the growth level of technology is g> 0, and continue making the same assumptions on

population growth you made before.

When these assumptions are made, the capital accumulation equation (in per effective labour terms) assumes

the following format: Ak₁ = syt −(n+g+d)kt, where s is the savings rate and is the capital depreciation rate.

kt = Kt/(AtLt) and yt = Y₁/(A+Lt). In your report you need to answer the following questions:

1. Find the steady-state level of income per capita assuming the production function follows the standard Cobb-

Douglas production function. Show your work, step-by-step.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The production function used by the Australian Bureau of Statistics is written Y = AK L rY where Y is aggregate output, A is total-factor productivity, K is aggregate capital, L is the size of the labor force, I is aggregate intermediate input (e.g., energy, material), and the exponents are constants. Given this production function, which of the following expressions correctly represents the growth rate of per-capita income, 9Y? = gA + agK + BgL + Y9I = gA + agk + (1 – B) gL +ygı = 9A + agk + (B– 1) gL +Yg1 O None of the choices given is correct.arrow_forwardA common Wall Street rule of thumb is that the growth rate ought to be roughly equal to the: Group of answer choicesarrow_forwardConsider an economy described by the textbook Solow model with the following Cobb-Douglas production function: Y = ÅK°L*. %3D where a The economy is producing 100 units of output and the productivity parameter is equal to 1. the depreciation rate is 6%, the investment rate is 24%, and there are 64 workers, the growth rate of total output Y, is positive and the economy is converging to to its steady-state output per capita of 100 units. Question 6 total depreciation exceeds gross investment, the economy is below its steady state and outout per person is growing at a positve rate Question 7 Starting from steady state a permanent decrease in the rate of depreciation in the Solow model causes output per capita to Select) in the short nun in the long run the growth rate of the economy Sekectarrow_forward

- 1. Consider Avataria, which can be described by the Solow model with the population growth. Its production function Y(K,L) = 2K¹2 L¹/2 Its investment rate is 40%, its depreciation rate is 10%, and its population growth rate is 10%. Calculate the capital-labor ratio, output per worker, and consumption per worker in the steady state. Assume that now the population growth slows down to 4%. What happens with the output per worker and consumption per worker in the new steady state? Calculate the exact values. (a) (b)arrow_forward9 Based on the production function Y = AKaG1-a (with G representing public expenditure, and the remaining variables and parameters representing usual values), show, using the necessary assumptions the value of the tax amount that maximizes the economic growth rate. Then, represent graphically the situation.arrow_forwardSuppose that the populist leader of our imaginary country increases the savings rate from 13% to 15%, i.e., (s = 0.15), what is the new steady state level of capital per worker? [Note: Assume that the other parameters n and d remain unchanged.]arrow_forward

- A population grows according to an exponential growth model. The initial population is P₀=15, and the growth rate is r=0.35. Then: P₁= P₂= Find an explicit formula for Pₙ. Your formula should involve n. Pₙ= Use your formula to find P₁₂ P₁₂= Give all answers accurate to at least one decimal placearrow_forwardNeed urgent plzarrow_forwardA CES production function with physical and human capital Consider the CES production function in terms of physical capital, K, and human capital, H: where 0 a. Set up the Hamiltonian and find the first-order conditions. b. What is the optimal relation between K and H? Substitute this relation into the given production function to get a relation between Y and K. What does this “reduced-form” production function look like? c. What is the steady-state value of the ratio of physical to human capital, (K/H)∗? d. Describe the behavior of the economy over time if the initial condition is such that K(0)/H(0)? e. Suppose that the inequality restrictions IK ≥ 0 and IH ≥ 0 apply. How do these constraints affect the dynamics if the economy begins with K(0)/H(0)∗?arrow_forward

- Consider an economy with fixed land T that is constant over time. Production is given by: AKTBL1-a-ß Y = Population grows at a rate n and productivity A grows at a rate equal to g. That is, Ĺ = nL and À = gA. Capital accumulates as Ø = I – SK with I = yY. These are assumptions typical of the K Solow model.arrow_forwardPlease don't copyarrow_forwardConsider an economy that exhibits both population growth (L grows at rate n) and technological progress (A grows at rate a) described by the production function, Y = F(K,AL) = Kª(AL)¹-α| Here K is capital and Y is output. (a) Show that this production function exhibits constant returns to scale. What is the per-effective-worker production function? (c) Find expressions for the steady-state capital-output ratio, capital stock per effective worker, and output per effective worker, as a function of the saving rate (s), the depreciation rate (8), the population growth rate (n), the rate of technological progress (a), and the coefficient a. (You may assume the condition that capital per effective worker evolves according to Ak = sf (k) − (a +n+8)k.) (d) Show that at the Golden Rule steady state the saving rate for this economy is equal to the parameter a.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education