ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

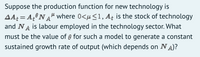

Transcribed Image Text:Suppose the production function for new technology is

AA: = A,°NA" where 0<u<1, Aț is the stock of technology

and NA is labour employed in the technology sector. What

must be the value of 9 for such a model to generate a constant

sustained growth rate of output (which depends on NA)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- I need help with parts (f) and (g) of question 2arrow_forwardSuppose the per-worker production function is: y = A(1-gA) Where ga is the fraction of all workers that produce technologies. Further, suppose the growth of technology is given by the following equation growth of A = (g//m)(L) Suppose L = 1 and m = 7, and that initially ga = 0.7. If ga fell to 0.8 the level of output per %3D worker would: fall Impossible to say rise stay the samearrow_forwardplease answer the following, I have attached an image of the question for better format. Thanks! 3. Suppose that the production function of a country is given by Y=KaL1-a, where 0<a<1, Y is output, L is labour, and K is capital, Derive the equation for steady state capital per worker, output per worker, and consumption per worker in terms of the saving rate (s) and depreciation rate (d).arrow_forward

- Assume positive population growth ( n > 0) and technological progress ( g > 0 ). Derive analytically the steady-state growth rates of output and capital, and the steady-state levels of output and capital per efficiency unit of labour. Illustrate your answer graphically and briefly discuss the economic intuition.arrow_forward= 2. Consider a Solow growth model in which the production function is Yt AK²N₁¹/2, where A = 1. Moreover, assume that the depreciation rate is d = 0.02, the rate of population growth is n = 0.02, and the saving rate is s = = 0.2. a. Compute the value of the capital stock per worker in steady state. b. Draw a graph that represents the steady-state equilibrium of the model. c. Suppose that the capital-labor ration in year t is 90. What will the level of the capital- labor ratio be in year t+1? Will it increase or decrease in future periods? Explain. d. Compute the rate of change of the capital labor ratio between time t and t + 1. How does it compare to the rate of growth of the capital-labor ratio in steady state?arrow_forwardQuestion 2Assume production function is given by:Y= K(1/2) L(1/2)a. Write the production function in per worker terms (y=f(k))b. Assume that the per worker level of capital in the steady state is 4, the depreciation rate is 5% per year, and population growth is 5% per year. Does this economy have “too much” or “too little” capital? How do you know? [Show your work].arrow_forward

- Please no written by hand and graph Consider a small world that consists of two different countries, a developed and a developing country. In both countries, assume that the production function takes the following form: Y = F (K, LE) = K¹/4 (LE) 3/4, where Y is output, K is capital stock, L is total employment and E is labour augmenting technology. (a) Does this production function exhibit constant returns to scale in K and L? Explain. (b) Express the above production function in its intensive form (i.e., output per-effective worker y as a function of capital per effective worker k). (c) Solve for the steady-state value of y as a function of saving rate s, population growth rate n, technological progress g, and capital depreciation rate 6. (d) The developed country has a savings rate of 30% and a population growth rate of 2% per year. Meanwhile, the developing country has a savings rate of 15% and population growth rate of 5% a year. Technology evolves at the rate of 8% and 2% in…arrow_forwardYou are given the production function Y= AK H14 N 2, where A = 4. The population growth rate n is 0.025, the depreciation rate d is 0.075 (both physical and human capital depreciate at the same rate), and the growth rate of autonomous factors is zero. Investment 1 is the sum of two components, investment in physical capital Ig and investment in human capital Iµ. The fraction of GDP that goes to physical capital investment is SK = 0.05 and the fraction of GDP that goes to human capital investment is SH = 0.05. (i) Convert the production function to a function relating Y/N to both K/N and H/N. (ii) Find the steady-state physical capital-labor ratio and the steady - state human capital - labor ratio. (iii) Find the steady – state per person output. 2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education