FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

![!

Required information

[The following information applies to the questions displayed below.]

AirPro Corporation reports the following for this period.

Actual total overhead

Standard overhead applied

Budgeted (flexible) variable overhead rate

Budgeted fixed overhead

Predicted activity level

Actual activity level

Enter your answers in the tabs below.

Required A Required B

Total Overhead Variance

Actual total overhead

Standard overhead applied

Total overhead variance

$ 28,425

$ 32,860

< Required A

Compute the total overhead variance and identify it as favorable or unfavorable.

$ 2.10 per unit

$ 12,600

Check my work

12,600 units

10,600 units

Required B

>](https://content.bartleby.com/qna-images/question/b5ae4578-9d0d-4369-b6dd-45d14c4c9e30/558b1f35-7c00-45f2-844b-467f3414ac17/tgn15z_thumbnail.png)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

AirPro Corporation reports the following for this period.

Actual total overhead

Standard overhead applied

Budgeted (flexible) variable overhead rate

Budgeted fixed overhead

Predicted activity level

Actual activity level

Enter your answers in the tabs below.

Required A Required B

Total Overhead Variance

Actual total overhead

Standard overhead applied

Total overhead variance

$ 28,425

$ 32,860

< Required A

Compute the total overhead variance and identify it as favorable or unfavorable.

$ 2.10 per unit

$ 12,600

Check my work

12,600 units

10,600 units

Required B

>

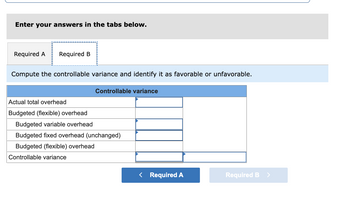

Transcribed Image Text:Enter your answers in the tabs below.

Required A Required B

Compute the controllable variance and identify it as favorable or unfavorable.

Controllable variance

Actual total overhead

Budgeted (flexible) overhead

Budgeted variable overhead

Budgeted fixed overhead (unchanged)

Budgeted (flexible) overhead

Controllable variance

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following information: Budgeted overhead Actual overhead $ 250,000 $ 240,000 Budgeted machine hours 8,000 Actual machine hours 7,800 Net income before overhead adjustment $ 75,000 Compute the ADJUSTED Net Incomearrow_forwardThe Illustrative Corporation recorded the following budgeted and actual information relating to fixed overhead costs for its Z-Line of products Standard fixed overhead per direct labor hour Standard direct labor hours per unit Budgeted production Budgeted fixed overhead costs $3 0.75 3,400 $7.650.00 Actual production in units Actual fixed overhead costs incurred What is Illustrative's fixed manufacturing overhead volume variance? A. $2.025.00 favorable OB. $4.950.00 favorable OC. $2,025.00 unfavorable D. $4.950.00 unfavorable 4,300 $2.700.00arrow_forwardABC Company listed the following data for the current year: Budgeted factory overhead $1,134,000 Budgeted direct labor hours 70,000 Budgeted machine hours 25,000 Actual factory overhead 1,100,900 Actual labor hours 71,100 Actual machine hours 24,000 If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:arrow_forward

- Do not give image formatarrow_forwardMountain tops applies overhead on the basis of direct labor hours and reports the following information: Budget Actual Overhead $450,000 $452, 000 Direct Labor Hours 75,000 77,000 Direct Materials $195,000 Direct Labor 333,000 A. What is the predetermined overhead rate? B. How much overhead was applied during the year? C. Was overhead over applied, or under applied and by how much?arrow_forward5) Hakan&Ahmet Manufacturing Company uses applied overhead rate for allocating its manufacturing overhead to its products. The following information is estimated for the upcoming year of 2024: BUDGETED COSTS AND ESTIMATED ACTIVITY LEVELS Budgeted MOH Budgeted Direct Materals Cost Budgeted Direct Labor Cost Estimated Direct Labor Hours Estimated Machine Hours AMOUNTS and HOURS $ 720,000 $ 600,000 $ 480,000 72,000 dlh 120,000 mh At the end of the first week of January 2024, the company completed only one job order. Actual costs and actual usage of dlh and mh for this unit were as follows: Job Order Direct Material Cost ($) 100 GRS-34 Direct Labor Direct Labor Cost ($) 150 Hours 15 Machine Hours 30 Q1) Calculate a predetermined manufacturing overhead rate (applied overhead rate) by using each of the cost drivers of "direct materials cost", "direct labor hours", "direct labor costs" and "machine hours". Q2) By using each of these rates, calculate the unit cost of this job order.arrow_forward

- A summary of Coastal Equipment's flexible budget for manufacturing overhead follows: Cost Formula Direct Labour - Hours (DLHS) Overhead Costs (per direct labour-hour) 4,400 4,900 5,400 Variable cost $2.20 $9,680 $ 10,780 $11,880 Fixed cost 54,560 54,560 54,560 Total overhead cost $ 64,240 $ 65,340 $ 66,440 The following information is available for a recent period: The denominator activity of 4,400 DLHS was chosen to compute the predetermined overhead rate. At the 4,400 standard DLH level of activity, the company should produce 2,200 units of product. The company's actual operating results were as follows: Number of units produced 2,350 Actual DLHS 4,400 Actual variable overhead costs $9,890 Actual fixed overhead costs $ 54,900 Required: Compute the predetermined overhead rate and break it down into variable and fixed cost elements. Note: Round your answers to 2 decimal places. What were the standard hours allowed for the year's actual output? Note: Do not round intermediate…arrow_forwardanswer must be in table format or i will give down votearrow_forwardces. Required information Use the following information for the Quick Studies below. (Algo) Rafner Manufacturing has the following budgeted data for its two production departments.. Budgeted Data Overhead cost Direct labor hours Machine hours Assembly $1,437,500 12,500 direct labor hours 5,500 machine hours Finishing $914,500 19,500 direct labor hours 15,500 machine hours QS 17-8 (Algo) Allocating overhead with departmental rates LO P2 Allocate overhead to a job that uses 75 direct labor hours in the Assembly department and uses 60 machine hours in the Finishing department Department Departmental Overhead Rate Hours Used Overhead Allocated Assembly S 1,437 000 per direct labor hour 12.500 DLHS $ 17.962.500,000 Finishing $ 914,500 per direct labor hour i 19.500 OLHS 17,832,750,000 Total $ 35.795.250.000arrow_forward

- Wilco Inc. allocates overhead on the basis of direct labor hours. They report the following budgeted and actual data: Budgeted MOH Actual MOH Budgeted Direct Labor Hours Budgeted Machine Hours Actual Direct Labor Hours Actual Machine Hours How much is MOH Over/Under allocated for the period? O Underallocated by $4000 O Underallocated by $2000 Overallocated by $2000 O Overallocated by $4000 $80,000 $82,000 80,000 40,000 78,000 43,000arrow_forwardThe following information is available for the Danske Company: Denominator hours for May Actual hours worked during May Standard hours allowed for May Flexible budget fixed overhead cost Actual fixed overhead costs for May Danske Company had total underapplied overhead of $20,000. Additional information is as follows: Variable Overhead: Applied based on standard direct labor-hours allowed Budgeted based on standard direct labor-hours Fixed Overhead: Applied based on standard direct labor-hours allowed Budgeted based on standard dinect labon-hours $ 52,000 43,000 $ 40,000 32,000 What is the fixed overhead price (spending) variance for May? Multiple Choice $4,000 unfavorable 94.100 unfavorablearrow_forwardAnswer question Darrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education