FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

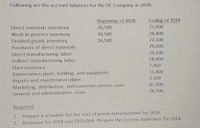

Transcribed Image Text:Following are the account balances for the DC Company in 2018:

Ending of 2018

27,000

Beginning of 2018

Direct materials inventory

26,500

28,400

Work-in-process inventory

Finished-goods inventory

30,500

22,100

79,000

16,500

Purchases of direct materials

24,500

Direct manufacturing labor

Indirect manufacturing labor

18,600

7,900

11,800

Plant insurance

Depreciation-plant, building, and equipment

Repairs and maintenance-plant

Marketing, distribution, and customer-service costs

General and administrative costs

3,500

87,900

26,500

Required:

1.

Prepare a schedule for the cost of goods manufactured for 2018.

2.

Revenues for 2018 was $425,000. Prepare the income statement for 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bubba Manufacturing Company provided the following information for the fiscal year to June 30, 2020: Inventories 01/07/2019 30/06/2020 Direct Materials $72,000 $65,000 Work-in-Process 107,000 128,000 Finished Goods 149,500 141,700 Other information: Office cleaner’s wages 4,500 Sales Revenue 1,031,000 Raw materials purchased 235,000 Factory wages 239,700 Indirect materials 23,500 Delivery truck driver’s wages 15,400 Indirect labor 9,500 Depreciation on factory plant & equipment 32,000 Insurance1 60,000 Depreciation on delivery truck 7,250 Utilities2 118,750 Administrative salaries 41,250 Special Design Costs 5,000 Selling expenses 9,000 Sales Comm ission 2% of gross profit 1 Of the total insurance, 66⅔% relates to the factory facilities & 33⅓% relates to general & administrative costs. 2 Of the total utilities, 80% relates to the…arrow_forwardPlease help mearrow_forwardThe cost of raw materials purchases for 2019 is?arrow_forward

- Please help mearrow_forwardThe following cost data pertains to DEF Inc. for December 31st, 2022: Ending Raw Materials Inventory: Beginning Work-in-Process: Ending Work-in-Process: Direct Materials Used: Direct Costs Incurred in Production: Indirect costs incurred in Production: Beginning Finished Goods Inventories: Ending Finished Goods Inventories: Sales: Selling and Administrative Expenses: Applied Overhead for the period: $50,000 $30,000 $15,000 $20,000 $40,000 $40,000 $40,000 $20,000 $190,000 $40,000 $40,000 The cost of goods sold for 2022 is $115,000 x. $137,000 $175,000 $135,000arrow_forwardThe following data were taken from the records of Blossom Manufacturing Company for the fiscal year ended December 31, 2022: Raw Materials Inventory (1/1/22) Raw Materials Inventory (12/31/22) Finished Goods Inventory (1/1/22) Finished Goods Inventory (12/31/22) Work in Process Inventory (1/1/22) Work in Process Inventory (12/31/22) Direct Labour Indirect Labour Accounts Receivable Factory Insurance $47,950 Factory Machinery Depreciation Factory Utilities Office Utilities Sales Sales Discounts Plant Manager's Salary Factory Property Taxes Factory Repairs Raw Materials Purchases Cash 44,350 85,700 77,600 9,850 6,550 145,100 18,200 27,250 7,600 $7,820 13,220 9,000 465,880 2,050 40,500 7,020 940 62,800 28,300arrow_forward

- Monty Corporation has the following cost records for June 2022. Indirect factory labor $4,500 Factory utilities $390 Direct materials used 19,600 Depreciation, factory equipment 1,370 Work in process, 6/1/22 2,940 Direct labor 39,200 Work in process, 6/30/22 3,720 Maintenance, factory equipment 1,760 Finished goods, 6/1/22 Finished goods, 6/30/22 4,900 Indirect materials 2,250 7,350 Factory manager's salary 2,940 (a) Prepare a cost of goods manufactured schedule for June 2022. MONTY CORPORATION Cost of Goods Manufactured Schedule For the Month Ended June 30, 2022 > > > $ $ $ $arrow_forwardThe selected amounts that follow were taken from Kandace Corporation's accounting records: Raw material used Direct labor Total manufacturing costs Work in process inventory (1/1) $27,000 $35,000 $104,000 $19,000 Cost of goods manufactured $100,000 Cost of goods available for sale $175,000 Finished goods inventory (12/31) $60,000 Sales revenue $300,000 Selling and administrative expenses $125,000 Income tax expense $18,000 Required: Compute the following: a. Manufacturing overhead. b. Work-in-process inventory, 12/31. c. Finished-goods inventory, 1/1. d. Cost of goods sold.arrow_forwardStatement of Cost of Goods Manufactured and Income StatementInformation from the records of the Bridgeview Manufacturing Company for August 2017 follows: Sales $313,000 Selling and administrative expenses 127,500 Purchases of raw materials 43,000 Direct labor 30,000 Manufacturing overhead 53,500 Inventories August 1 August 31 Raw materials $ 6,000 $ 5,000 Work-in-process 12,000 11,000 Finished goods 15,000 17,000 RequiredPrepare a statement of cost of goods manufactured and an income statement for August 2017.Do not use negative signs with any of your answers below. Bridgeview Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ending August 31, 2017 Current manufacturing costs: Cost of materials placed in production: Raw materials, 8/1/17 Answer Purchases Answer Total available Answer Raw materials, 8/31/17 Answer Answer Direct labor Answer…arrow_forward

- Calculate the cost of goods sold for the year.arrow_forwardThe following data refers to the most recent fiscal year for Sterritt Company. Amounts are in thousands of dollars. ($000) $ 4,800 5,250 3,170 225 233 585 510 334 700 7,050 71 Cost of goods manufactured for the year Cost of goods sold Direct labor Direct materials inventory, July 1 Direct materials inventory, June 30 Direct material purchases Finished goods inventory, July 1 Finished goods inventory, June 30 Manufacturing overhead Sales revenue Work-in-process inventory, June 30 Required: Find the following amounts. Note: Enter your answers in thousands. a. Direct materials used for the year b. Gross margin for the year c. Total manufacturing costs for the year d. Work-in-process inventory, July 1arrow_forwardAt May 31, 2020, the accounts of Sheffield Company show the following. 1. May 1 inventories—finished goods $ 14,800, work in process $ 17,600, and raw materials $ 8,600. 2. May 31 inventories—finished goods $ 9,600, work in process $ 17,000, and raw materials $ 8,000. 3. Increases to work in process were direct materials $ 64,300, direct labor $ 51,400, and manufacturing overhead applied $ 42,100. 4. Sales revenue totaled $ 217,000. (a) Prepare a condensed cost of goods manufactured schedule for May 2020. SHEFFIELD COMPANYCost of Goods Manufactured Schedulechoose the accounting periodchoose the accounting period select an opening section nameselect an opening section name $ enter a dollar amountenter a dollar amount select an account titleselect an account title $ enter a dollar amountenter a dollar amount select an account titleselect an account title enter a dollar amountenter a dollar amount…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education