FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

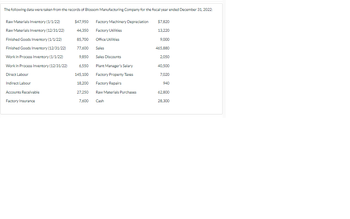

Transcribed Image Text:The following data were taken from the records of Blossom Manufacturing Company for the fiscal year ended December 31, 2022:

Raw Materials Inventory (1/1/22)

Raw Materials Inventory (12/31/22)

Finished Goods Inventory (1/1/22)

Finished Goods Inventory (12/31/22)

Work in Process Inventory (1/1/22)

Work in Process Inventory (12/31/22)

Direct Labour

Indirect Labour

Accounts Receivable

Factory Insurance

$47,950 Factory Machinery Depreciation

Factory Utilities

Office Utilities

Sales

Sales Discounts

Plant Manager's Salary

Factory Property Taxes

Factory Repairs

Raw Materials Purchases

Cash

44,350

85,700

77,600

9,850

6,550

145,100

18,200

27,250

7,600

$7,820

13,220

9,000

465,880

2,050

40,500

7,020

940

62,800

28,300

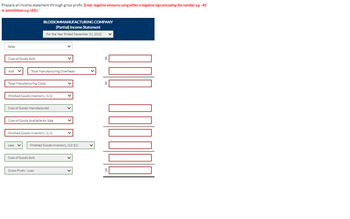

Transcribed Image Text:Prepare an income statement through gross profit. (Enter negative amounts using either a negative sign preceding the number e.g. -45

or parentheses e.g. (45).)

Sales

Cost of Goods Sold

Add

Total Manufacturing Overhead

BLOSSOMMANUFACTURING COMPANY

(Partial) Income Statement

For the Year Ended December 31, 2022

Total Manufacturing Costs

Finished Goods Inventory, (1/1)

Cost of Goods Manufactured

Cost of Goods Available for Sale

Finished Goods Inventory, (1/1)

Less ✓ Finished Goods Inventory, (12/31)

Cost of Goods Sold

Gross Profit/Loss

V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Garcon Pepper Company Company $ $ 13,200 18,550 Work in process inventory, beginning 17,700 22,500 Raw materials inventory, beginning 7,700 14,100 Rental cost on factory equipment 31,000 24,100 Direct labor 24,200 43,800 Finished goods inventory, 19,700 13,800 ending Work in process inventory, ending 24,400 21,000 Raw materials inventory, ending 6,700 7,600 Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net 12,300 17,000 34,000 53,500 13,000 14,000 6,500 3,550 36,000 68,000 50,400 56,800 297,600 379,360 27,000 24,200 15,000 20,950 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the…arrow_forwardThe balances in the perpetual inventory accounts of Anditon Manufacturing Corporation at the beginning and end of the current year are as follows: Inventory accounts: Materials Work in Process Finished Goods Inventory Account: Materials Inventory Direct Labor The total dollar amounts debited and credited during the year to the accounts used in recording manufacturing activities are as follows: Manufacturing Overhead Work in Process Inventory Finished Goods Inventory End of Year $ 126,000 109,000 325,000 Beginning of Year $ 222,000 75,000 238,000 Required A Required B Debit Entries $ 2,410,000 1,189,000 893,600 ? ? Credit Entries Required: a. Using these data, compute direct materials purchased, direct materials used, payments of direct labor payrolls, direct labor cost assigned to production, total manufacturing costs charged to the work in process inventory account during the year, the cost of finished goods manufactured, cost of goods sold, the total amount to be classified as…arrow_forwardAdelphia Manufacturing issued $70,000 of direct materials and $9,000 of indirect materials for production. Which of the following journal entries would correctly record the transaction? O A. Work-in- Process Inventory Raw Materials Inventory B. Manufacturing Overhead Raw Materials Inventory OC. Work-in - Process Inventory Manufacturing Overhead Raw Materials Inventory D. Raw Materials Inventory Finished Goods Inventory Work-in - Process Inventory 79,000 79,000 70,000 9,000 79,000 79,000 79,000 79,000 70,000 9,000arrow_forward

- Uramilabenarrow_forwardAt May 31, 2020, the accounts of Sheffield Company show the following. 1. May 1 inventories—finished goods $ 14,800, work in process $ 17,600, and raw materials $ 8,600. 2. May 31 inventories—finished goods $ 9,600, work in process $ 17,000, and raw materials $ 8,000. 3. Increases to work in process were direct materials $ 64,300, direct labor $ 51,400, and manufacturing overhead applied $ 42,100. 4. Sales revenue totaled $ 217,000. (a) Prepare a condensed cost of goods manufactured schedule for May 2020. SHEFFIELD COMPANYCost of Goods Manufactured Schedulechoose the accounting periodchoose the accounting period select an opening section nameselect an opening section name $ enter a dollar amountenter a dollar amount select an account titleselect an account title $ enter a dollar amountenter a dollar amount select an account titleselect an account title enter a dollar amountenter a dollar amount…arrow_forwardRequired information [The following information applies to the questions displayed below.] The following selected information was extracted from the 20x1 accounting records of Lone Oak Products: Raw material purchases Direct labor Indirect labor Selling and administrative salaries Building depreciation* Other selling and administrative expenses Other factory costs Sales revenue ($130 per unit) *Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions. Inventory data: January 1 $ 15,800 35,700 111,100 December 31 $ 18,200 62,100 97,900 Cost of goods sold 175,000 254,000 109,000 133,000 80,000 195,000 344,000 1,495,000 3. Compute the company's cost of goods sold. $ Raw material Work in process Finished goods* *The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education