FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

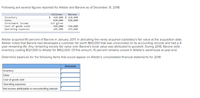

Transcribed Image Text:Following are several figures reported for Allister and Barone as of December 31, 2018:

Allister

Barone

$ 410,000 $ 210,000

620,000

Inventory

Sales

Investment income

Cost of goods sold

Operating expenses

820,000

not given

410,000

185,000

310,000

255,000

Allister acquired 80 percent of Barone in January 2017. In allocating the newly acquired subsidiary's fair value at the acquisition date,

Allister noted that Barone had developed a customer list worth $60,000 that was unrecorded on its accounting records and had a 4-

year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2018, Barone sells

inventory costing $121,000 to Allister for $162,000. Of this amount, 10 percent remains unsold in Allister's warehouse at year-end.

Determine balances for the following items that would appear on Allister's consolidated financial statements for 2018:

Amounts

Inventory

Sales

Cost of goods sold

Operating expenses

Net income attributable to noncontrolling interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 2, 2014, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $180,700 cash. Just before the acquisition, the balance sheets of the two companies were as follows: Prunce Sun Cash $282,130 $ 59,040 Accounts receivable (net) 142,020 24,810 Inventory 118,670 53,230 Plant and equipment (net) 395,640 92,960 Land 62,550 29,220 Total asset $1,001,010 $259,260 Accounts payable $106,440 $ 50,420 Mortgage payable 67,320 37,660 Common stock, $2 par value 421,400 76,960 Other contributed capital 217,440 21,970 Retained earnings 188,410 72,250 Total equities $1,001,010 $259,260 The fair values of Sun Company’s assets and liabilities are equal to their book values with the exception of land. (a) Your answer is correct. Prepare a journal entry to record the purchase of Sun Company’s common stock.…arrow_forwardFollowing are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone Inventory $ 500,000 $300,000 Sales 1,000,000 800,000 Investment income not given Cost of goods sold 500,000 400,000 Operating expenses 230,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary’s fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a 4-year remaining life. Any remaining excess fair value over Barone’s book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,000. Of this amount, 10 percent remains unsold in Allister’s warehouse at year-end. Required: Determine balances for the following items that would appear on Allister’s consolidated financial statements for 2021: Inventory Sales…arrow_forwardThe following are several figures reported for Allister and Barone as of December 31, 2021: Allister Inventory Sales Investment income Cost of goods sold Operating expenses $ 620,000 $ Barone 420,000 1,240,000 1,040,000 not given 620,000 290,000 520,000 360,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $80,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $142,000 to Allister for $204,000. Of this amount, 10 percent remains unsold in Allister's warehouse at year- end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Inventory Sales Cost of goods sold Operating expenses Net income attributable to…arrow_forward

- The following are several figures reported for Allister and Barone as of December 31, 2021 Allister Barone $ 600,000 $ 400,000 1,200,000 1,000,000 not given 600,000 280,000 Inventory Sales Investment income Cost of goods sold Operating expenses 500,000 350,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date Allister noted that Barone had developed a customer list worth $76,000 that was unrecorded on its accounting records and had a five- year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $140,000 to Allister for $200,000. Of this amount, 15 percent remains unsold in Allister's warehouse at year-end Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021 4 Inventory Sales Cost of goods sold Operating expenses Net income attributable to…arrow_forwardPetunia Company acquired an 80% interest in Shaman Company in 2016. In 2017 and 2018, Shaman reported net income of $400,000 and $480,000, respectively. During 2017, Shaman sold $80,000 of merchandise $20,000 profit. Petunia sold the merchandise to outsiders during 2018 for $140,000. to Petunia For consolidation for a purposes, what is the noncontrolling interest's share of Shaman's 2017 and 2018 net income?arrow_forwardThe following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone $ 500,000 $ 300,000 1,000,000 not given 500,000 230,000 Inventory Sales 800,000 Investment income Cost of goods sold Operating expenses 400,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,00o. Of this amount, 10 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Amounts Inventory Sales Cost of goods sold Operating expenses Net income attributable…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education