FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

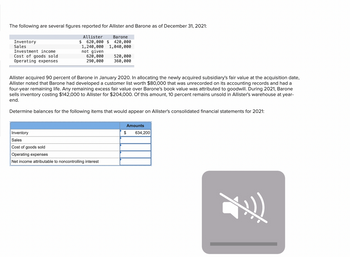

Transcribed Image Text:The following are several figures reported for Allister and Barone as of December 31, 2021:

Allister

Inventory

Sales

Investment income

Cost of goods sold

Operating expenses

$ 620,000 $

Barone

420,000

1,240,000 1,040,000

not given

620,000

290,000

520,000

360,000

Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date,

Allister noted that Barone had developed a customer list worth $80,000 that was unrecorded on its accounting records and had a

four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone

sells inventory costing $142,000 to Allister for $204,000. Of this amount, 10 percent remains unsold in Allister's warehouse at year-

end.

Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:

Inventory

Sales

Cost of goods sold

Operating expenses

Net income attributable to noncontrolling interest

Amounts

$

634,200

N

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 1, Freeman Company agreed to sell the assets of its Footwear Division to Albanese Incorporated for $97 million. The sale was completed on December 31, 2024. The following additional facts pertain to the transaction: • The Footwear Division qualifies as a component of the entity according to GAAP regarding discontinued operations. • The book value of Footwear's assets totaled $65 million on the date of the sale. • Footwear's operating income was a pre-tax loss of $14 million in 2024. . Freeman's income tax rate is 25%. In the income statement for the year ended December 31, 2024, Freeman Company would report income from discontinued operations of:arrow_forwardManama Co owns 75% of the outstanding common stock of Muscat Co. The book values and fair values of Muscat's assets and liabilities were equal. The cost of Manama's investment was equal to 75% of the book value of Muscat's net assets. Separate company income statements for Manama and Muscat for the year ended December 31, 2020 are summarized as follows Sales Revenue Investment income from Muscat Cost of Goods Sold Manama $2,400,000 142,000 Muscat S800,000 Expenses Net Income (1,600,000) (450 000) $492.000 (400,000) (200,000) $200.000 Manama agreed to purchases its inventory from Muscat at a markup of 10% of cost. Durıng 2020, Muscat sold 198,000 of inventory to Manama Manama's beginning and ending inventories for 2020 were S110,000 and $88,000, respectively Half of this merchandise remained in company's inventory at January and December 31, 2020, respectively Required: Prepare a consolidated income statement for Manama Co and Subsidiary for 2020. windnwearrow_forwardIn May 2020, a parent sold inventories to a subsidiary entity for $60 000. The inventories had previously cost the parent entity $48 000. The entire inventory is still held by the subsidiary at reporting date, 30 June 2020. Ignoring tax effects, which of the following is the adjustment entry in the consolidation worksheet at reporting date? a. Cash Dr 48 000 Sales revenue Cr 48 000 Cost of sales Dr 48 000 Inventories Cr 48 000 b. Sales revenue Dr 48 000 Cash Cr 48 000 Inventories Dr 48 000 Cost of sales Cr 48 000 c. Cost of sales Dr 60 000 Sales revenue Cr 12 000 Inventories Cr 48 000 d. Sales revenue Dr 60 000 Cost of sales Cr 48 000 Inventories Cr 12 000 Answer (write…arrow_forward

- The following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone $ 410,000 $ 210,000 820,000 620,000 not given Inventory Sales Investment income Cost of goods sold Operating expenses 410,000 185,000 310,000 255,000 Allister acquired 80 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $60,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $121,000 to Allister for $162,000. Of this amount, 10 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Inventory Sales Cost of goods sold Operating expenses Net income attributable to…arrow_forwardOn January 1, 2020, Allan Company bought a 15 percent interest in Sysinger Company. The acquisition price of $184,500 reflected an assessment that all of Sysinger’s accounts were fairly valued within the company’s accounting records. During 2020, Sysinger reported net income of $100,000 and declared cash dividends of $30,000. Allan possessed the ability to significantly influence Sysinger’s operations and, therefore, accounted for this investment using the equity method. On January 1, 2021, Allan acquired an additional 80 percent interest in Sysinger and provided the following fair-value assessments of Sysinger’s ownership components: Consideration transferred by Allan for 80% interest $ 1,400,000 Fair value of Allan's 15% previous ownership 262,500 Noncontrolling interest's 5% fair value 87,500 Total acquisition-date fair value for Sysinger Company $ 1,750,000 Also, as of January 1, 2021, Allan assessed a $400,000 value to an unrecorded…arrow_forwardOn May 1, 2021, Jazzie Co. agreed to sell the assets of its Mister Division to Shawna Inc. for $80 million. The sale was completed on December 31, 2021. Jazzie’s year ends on December 31st. The following additional facts pertain to the transaction: The Mister Division qualifies as a component of an entity as defined by GAAP. Mister's net assets totaled $48 million on Jazzie's books at the time of the sale. Mister incurred a pre-tax operating loss of $10 million in 2021. Jazzie’s income tax rate is 40%. Suppose that the Mister Division's assets had not been sold by December 31, 2021, but were considered held for sale. Assume that the fair value of these assets at December 31 was $40 million. In their 2021 income statement, Jazzie Co. would report for discontinued operations: Group of answer choices a $6 million after tax loss. a $10 million after tax loss. a $10.8 million after tax loss. an $18 million after tax loss.arrow_forward

- On September 17, 2024, Ziltech, Incorporated, entered into an agreement to sell one of its divisions that qualifies as a component of the entity according to generally accepted accounting principles. By December 31, 2024, the company's fiscal year-end, the division had not yet been sold, but was considered held for sale. The net fair value (fair value minus costs to sell) of the division's assets at the end of the year was $11 million. The pretax income from operations of the division during 2024 was $4 million. Pretax income from continuing operations for the year totaled $14 million. The income tax rate is 25%. Ziltech reported net income for the year of $7.2 million. Required: Determine the book value of the division's assets on December 31, 2024. Note: Enter your answer in whole dollars and not in millions. For example, $4,000,000 rather than $4.arrow_forwardFollowing are several figures reported for Allister and Barone as of December 31, 2018: Allister Barone Inventory $ 410,000 $ 210,000 Sales 820,000 620,000 Investment income not given Cost of goods sold 410,000 310,000 Operating expenses 185,000 255,000 Allister acquired 80 percent of Barone in January 2017. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $60,000 that was unrecorded on its accounting records and had a 4-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2018, Barone sells inventory costing $121,000 to Allister for $162,000. Of this amount, 10 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2018:arrow_forwardPlease Assist in this question (a) During the current period SP Ltd sold inventory to its wholly owned subsidiary, Jaza Ltd, for $15 000. These items previously cost Sp Ltd $12 000. JazaLtd subsequently sold half the items to Nanjing Ltd for $8000. The tax rate is 30%. The group accountant for SP Ltd, Steve yu, maintains that the appropriate consolidation adjustment entries are as follows: Required (i) Discuss whether the entries suggested Steve Yu are correct, explaining on a line-by-line basis the correct adjustment entry. (ii)Determine the consolidation worksheet entries in the following year, assuming the inventory has been –sold, and explain the adjustments on a line-by-line basis. (b) On 1 July 2016 Henna Ltd sold an item of plant to Jordy Ltd for $450000 when its’ carrying value in Henna Ltd book was $600000 (costs $900000, accumulated depreciation $300000). This plant has a remaining useful life of five (5) years form the date of sale. The group measures its property plants and…arrow_forward

- Allison Corporation acquired 90 percent of Bretton on January 1, 2022. Of Bretton's total acquisition-date fair value, $65,100 was allocated to undervalued equipment (with a 10-year remaining life) and $86,800 was attributed to franchises (to be written off over a 20-year period). Since the takeover, Bretton has transferred inventory to its parent as follows: Remaining at Year- Year Cost Transfer Price End (at transfer 2022 2023 $50,100 53,100 75,375 price) $33,400 2024 $100,200 88,500 100,500 39,165 51,700 On January 1, 2023, Allison sold Bretton a building for $67,000 that had originally cost $93,800 but had only a $40,200 book value at the date of transfer. The building is estimated to have a five-year remaining life (straight-line depreciation is used with no salvage value). Selected figures from the December 31, 2024, trial balance of these two companies are as follows: Sales Allison $729,750 Bretton $417,000 Cost of Goods Sold 458,700 229,350 Operating Expenses 125,100 83,400…arrow_forwardThe following are several figures reported for Poyer and Sutter as of December 31, 2024: Sutter $ 250,000 700,000 Items Inventory Sales Investment income Cost of goods sold Operating expenses Poyer $ 450,000 900,000 450,000 205,000 350,000 275,000 Poyer acquired 90 percent of Sutter in January 2023. In allocating the newly acquired subsidiary's fair value at the acquisition date, Poyer noted that Sutter had developed a unpatented technology worth $68,000 that was unrecorded on its accounting records and had a five-year remaining life. Any remaining excess fair value over Sutter's book value was attributed to an indefinite-lived trademark. During 2024, Sutter sells inventory costing $125,000 to Poyer for $170,000. Of this amount, 15 percent remains unsold in Poyer's warehouse at year-end. Required: Determine balances for the following items that would appear on Poyer's consolidated financial statements for 2024: Note: Input all amounts as positive values. a. Inventory b. Sales c. Cost…arrow_forwardStamp Holding Company has several operating divisions. On October 1, 2021, management decided to sell one of its division that qualifies as a separate component according to IFRS. The division was sold on December 18, 2021, for a net selling price of P14,000,000. On that date, the net assets of the division has a book value of P12,000,000. For the period January 1, 2020 to the date of disposal, the division reported a pretax loss from operations of P4,200,000. The company’s income tax rate is 30% on all items of income or loss. Stamp Holding Company disclose separately involving its discontinued operations in the December 31, 2020 statement of comprehensive income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education