FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

jitu

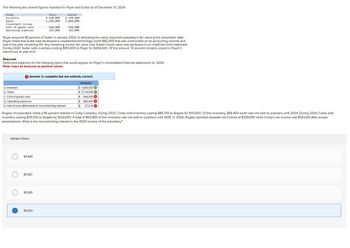

Transcribed Image Text:The following are several figures reported for Poyer and Sutter as of December 31, 2024:

Items

Inventory

Sales

Investment income

Cost of goods sold

Operating expenses

Poyer acquired 80 percent of Sutter in January 2023. In allocating the newly acquired subsidiary's fair value at the acquisition date,

Poyer noted that Sutter had developed a unpatented technology worth $82,000 that was unrecorded on its accounting records and

had a five-year remaining life. Any remaining excess fair value over Sutter's book value was attributed to an indefinite-lived trademark.

During 2024, Sutter sells inventory costing $143,000 to Poyer for $206,000. Of this amount, 15 percent remains unsold in Poyer's

warehouse at year-end.

Required:

Determine balances for the following items that would appear on Poyer's consolidated financial statements for 2024:

Note: Input all amounts as positive values.

Multiple Choice

O

Poyer

$ 630,000

1,260,000

a. Inventory

b. Sales

c. Cost of goods sold

d. Operating expenses

e. Net income attributable to non controlling interest

630,000

295,000

Answer is complete but not entirely correct.

Amounts

$ 1,050,550✔

$ 2,114,000✔

$ 944,550 X

680,500 X

27,010 X

$11,840

Sutter

$ 430,000

1,060,000

$11,627

Angela, Incorporated, holds a 90 percent interest in Corby Company. During 2023, Corby sold inventory costing $84,750 to Angela for $113,000. Of this inventory, $56,400 worth was not sold to outsiders until 2024. During 2024, Corby sold

inventory costing $79,300 to Angela for $122,000. A total of $53,800 of this inventory was not sold to outsiders until 2025. In 2024, Angela reported separate net income of $239,000 while Corby's net income was $121,000 after excess

amortizations. What is the noncontrolling interest in the 2024 income of the subsidiary?

$12,165

530,000

365,000

$12,100

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education