FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

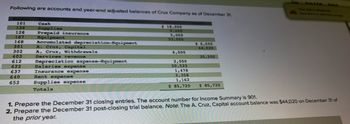

Transcribed Image Text:Following are accounts and year-end adjusted balances of Cruz Company as of December 31.

101

126

128

167

168

301

302

403

612

622

637

640

652

Cash

Supplies

Prepaid insurance

Equipment

Accumulated depreciation Equipment

A. Cruz, Capital

A. Cruz, Withdrawals

Services revenue

Depreciation expense-Equipment

Salaries expense

Insurance expense

Rent expense

Supplies expense

Totals

$ 18,000

9,200

2,000

23,000

6,000

2,000

20,522

1,478

2,358

1,162

$ 85,720

$ 6,500

44,020

35,200

$ 85,720

1. Prepare the December 31 closing entries. The account number for Income Summary is 901.

2. Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $44,020 on December 31 of

the prior year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income Statement FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: Depreciation Expense $ 3,095 Fuel Expense 3,374 Maintenance and Repairs Expense 2,622 Other Expense 10,337 Provision for Income Taxes (Benefit) (219) Purchased Transportation 15,101 Rentals and Landing Fees 3,361 Revenues 65,450 Salaries and Employee Benefits 23,207 Prepare an income statement. FedEx CorporationIncome StatementFor the Year Ended May 31 (in millions) $Revenues Expenses: $Salaries and employee benefits Purchased transportation Rentals and landing fees Depreciation expense Fuel expense Maintenance and repairs expense Provision for income taxes (benefit) Other expense Total expenses fill in the blank 19 $Net incomearrow_forwardPlease help me with show all calculation thankuarrow_forwardFollowing are accounts and year-end adjusted balances of Cruz Company as of December 31. Number Account Title Debit Credit 101 126 $ 18,000 14,500 Cash Supplies Prepaid insurance Equipment Accumulated depreciation-Equipment A. Cruz, Capital A. Cruz, Withdrawals Services revenue 2,000 23,000 128 167 $ 6,500 45,800 168 301 302 6,000 403 48,000 612 Depreciation expense-Equipment Salaries expense 2,000 27,984 2,016 3,216 1,584 622 637 Insurance expense Rent expense 640 652 Supplies expense Totals $ 100,300 $ 100,300 1. Prepare the December 31 closing entries. The account number for Income Summary is 901. 2. Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $45,800 on December 31 of the prior year. Complete this questions by entering your an below. Required 1 Required 2 Prepare the December 31 post-closing trial balanc Capital account balance was $45,800 on Decembe CRUZ COMPANY Post-Closing Trial Balance December 31 Debit Credit Totalsarrow_forward

- Fountain Office Supply's March 31, 2018, balance sheet follows: Fountain Office Supply Balance Sheet March 31, 2018 Assets Current Assets: Cash $34,000 Accounts Receivable 22,000 Merchandise Inventory 21,500 Prepaid Insurance 2,500 Total Current Assets $80,000 Property, Plant, and Equipment: Equipment and Fixtures 55,000 Less: Accumulated Depreciation (30,000) 25,000 Total Assets $105,000 Liabilities Current Liabilities: Accounts Payable $15,000 Salaries and Commissions Payable 6,450 Total Liabilities $21,450 Stockholders' Equity Common Stock, no par 14,000 Retained Earnings 69,550 Total Stockholders' Equity 83,550 Total Liabilities and Stockholders' Equity $105,000 The budget committee of Fountain Office Supply has assembled the following data: a. Sales in April…arrow_forwardQuestion Content Area Balances of the current asset and current liability accounts at the end and beginning of the year are as follows: End Beginning Cash $62,000 $73,000 Accounts Receivable (net) 75,000 60,000 Inventories 54,000 47,000 Accounts Payable (merchandise creditors) 43,000 37,000 Salaries Payable 2,800 3,800 Sales (on account) 210,000 Cost of Merchandise Sold 70,000 Operating Expenses Other Than Depreciation 67,000 Use the direct method to prepare the operating activities section of a statement of cash flows. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. blankCash Flows From The Operating Activities Section Cash flows from (used for) operating activities: $- Select - $- Select - - Select - $- Select -arrow_forwardDo not give answer in imagearrow_forward

- For the year just completed, Hanna Company had net income of $37,500. Balances in the company’s current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of Year Beginning of Year Current assets: Cash and cash equivalents $ 56,000 $ 83,000 Accounts receivable $ 164,000 $ 200,000 Inventory $ 436,000 $ 364,000 Prepaid expenses $ 11,000 $ 13,000 Current liabilities: Accounts payable $ 354,000 $ 384,000 Accrued liabilities $ 9,000 $ 12,000 Income taxes payable $ 34,000 $ 26,000 The Accumulated Depreciation account had total credits of $58,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash outflows as negative amounts.)arrow_forwardThe following items are taken from the financial statements of the Riverbed Service for the year ending December 31, 2020: Accounts payable $ 18400 Accounts receivable 11000 Accumulated depreciation – equipment 27800 Advertising expense 20900 Cash 15000 Owner’s capital (1/1/20) 100600 Owner's drawings 13800 Depreciation expense 12300 Insurance expense 3100 Note payable, due 6/30/21 69200 Prepaid insurance (12-month policy) 6200 Rent expense 16900 Salaries and wages expense 31800 Service revenue 132300 Supplies 4100 Supplies expense 5900 Equipment 207300 What is the balance that would be reported for owner’s equity at December 31, 2020?arrow_forwardWell Company paid Being Company for merchandise with a $4,500, 90-day, 10% note dated December 11. What is the financial statement effect to Being Company at the end of the accounting period on December 31? Select one: a. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash InterestReceivable Retained Earnings InterestIncome A) +25 +25 +25 b. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense B) +25 -25 c. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense C) -25 -25 -25 d. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY…arrow_forward

- Complete a general ledger based on the belowarrow_forwardPrepare the retained earnings statement Prepare the balance sheet (Classified Format)arrow_forwardSelected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company’s income tax rate is 40% for all items. Debit Credit a. Interest revenue $ 14,400 b. Depreciation expense—Equipment $ 34,400 c. Loss on sale of equipment 26,250 d. Accounts payable 44,400 e. Other operating expenses 106,800 f. Accumulated depreciation—Equipment 72,000 g. Gain from settlement of lawsuit 44,400 h. Accumulated depreciation—Buildings 175,300 i. Loss from operating a discontinued segment (pretax) 18,650 j. Gain on insurance recovery of tornado damage 29,520 k. Net sales 1,002,500 l. Depreciation expense—Buildings 52,400 m. Correction of overstatement of prior year’s sales (pretax) 16,400 n. Gain on sale of discontinued segment’s assets (pretax) 36,000 o. Loss from settlement of lawsuit 24,150 p. Income tax expense ? q. Cost of goods sold 486,500…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education