FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Flounder Company sells tablet PCs combined with Internet service, which permits the tablet to connect to the Internet anywhere and set up a Wi-Fi hot spot. It offers two bundles with the following terms.

| 1. | Flounder Bundle A sells a tablet with 3 years of Internet service. The price for the tablet and a 3-year Internet connection service contract is $469. The standalone selling price of the tablet is $230 (the cost to Flounder Company is $157). Flounder Company sells the Internet access service independently for an upfront payment of $292. On January 2, 2020, Flounder Company signed 100 contracts, receiving a total of $46,900 in cash. | |

| 2. | Flounder Bundle B includes the tablet and Internet service plus a service plan for the tablet PC (for any repairs or upgrades to the tablet or the Internet connections) during the 3-year contract period. That product bundle sells for $574. Flounder Company provides the 3-year tablet service plan as a separate product with a standalone selling price of $145. Flounder Company signed 220 contracts for Flounder Bundle B on July 1, 2020, receiving a total of $126,280 in cash. |

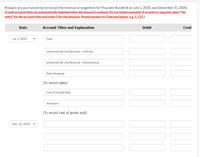

Transcribed Image Text:Prepare any journal entries to record the revenue arrangement for Flounder Bundle B on July 1, 2020, and December 31, 2020.

(Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No

entry" for the account titles and enter O for the amounts. Round answers to O decimal places, eg. 5,125.)

Date

Account Titles and Explanation

Debit

Credi

Jul. 1, 2020

Cash

Unearned Service Revenue - Internet

Unearned Service Revenue - Maintenance

Sales Revenue

(To record sales)

Cost of Goods Sold

Inventory

(To record cost of goods sold)

Dec. 31, 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Garden Shoppe buys hedge trimmers from a wholesaler and sells them to customers at a retail price of $417.96 each. The Garden Shoppe earns a 37% markup on its cost for this hedge trimmer. Calculate The Garden Shoppe's cost for one hedge trimmer. (Rounding: penny.)arrow_forward19) Hopner Products enters into a contract with Tulles to sell three different products. The total transaction price is $370,000. Each of the products is a separate performance obligation. Based on the information presented in the table, what is the allocated transaction price of product Z using the expected-cost-plus-a-profit margin approach? (Round intermediary percentages to the nearest hundredth percent, and round your final answer to the nearest whole number.) Product X Y Z A) $159,390 B) $94,868 C) $123,333 D) $185,000 Standalone Price $150,000 $110,000 Not Available Market Price Forecasted Cost $130,000 $100,000 $160,000 $85,000 $100,000 $140,000arrow_forwardPark-n-Shop is promoting a deal. For a single purchase of $500, the customer can choose to get a $50 voucher for next purchase as long as the customer posts an advertisement on the Facebook. Under this deal, the customer needs to pay $520 for the current purchase (i.e., if the customer takes the deal, she or he pays $20 more). The fair value of Facebook advertisement is $20 for each post. Required: Prepare journal entries for Park-n-Shop when a customer purchased $500 goods and chose to take this deal. You don’t need to record the inventory-related journal entryarrow_forward

- BigBoy Equipment Inc. sells heavy-duty forklift trucks. Model 217A has a stand-alone price of $154,000. BigBoy offers to sell the 217A inclusive of a three-year service contract for $198,200. Required: Prepare a journal entry to record the sale of one Model 217A forklift truck plus service contract for $198,200 assuming: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. A comparable service contract is sold separately for $66,000. BigBoy uses the relative stand-alone value method for multiple deliverables. 2. The service contract has a variable stand-alone value ranging from $38,400 to $66,000 and BigBoy uses the residual value method. Viow transaction list 1 Record the sale of Model 217A assuming comparable service contract Is sold separately and using relative falr value method. Is sold 2 Record the sale of Model 217A assuming the service contract has a varlable stand-alone value ranging from $30,000 to $70,000 and…arrow_forwardanswer must be in table format or i will give down votearrow_forwardAdiwele Ltd has a financial year end of 31 March. The entity manufactures Compact Discs for resale. The manufacturing cost per compact disc is R2 per unit. Finished units of the compact disc are sold at R2.5 per unit. On 31 March 2021, Adiwele Ltd had 100 500 units of compact discs in stock. To sell this products Adiwele Ltd will incur the following costs: Sales commission of 20 cents per unit, Additional designing costs of 25 cents per unit, Advertising and packaging costs of 23 cents per unit, Salaries for administrative staff of R6 000 per month. Adiwele Ltd measures inventory at lower of cost and net realisable value as per IAS 2, Inventories according to IFRS at year end. What is the value of the closing inventory on 31 March 2021 as per IAS 2? 1.251 250 2. 201 000 3. 208 035 4. 136 035 5. 244 215arrow_forward

- Bonita Company sells tablet PCs combined with Internet service, which permits the tablet to connect to the Internet anywhere and set up a Wi-Fi hot spot. It offers two bundles with the following terms. 1. Bonita Bundle A sells a tablet with 3 years of Internet service. The price for the tablet and a 3-year Internet connection service contract is $506. The standalone selling price of the tablet is $234 (the cost to Bonita Company is $167). Bonita Company sells the Internet access service independently for an upfront payment of $324. On January 2, 2020, Bonita Company signed 90 contracts, receiving a total of $45,540 in cash. 2. Bonita Bundle B includes the tablet and Internet service plus a service plan for the tablet PC (for any repairs or upgrades to the tablet or the Internet connections) during the 3-year contract period. That product bundle sells for $612. Bonita Company provides the 3-year tablet service plan as a separate product with a standalone selling price of $155.…arrow_forwardIvanhoe Tailors sells tablet PCs combined with Internet service, which permits the tablet to connect to the Internet anywhere and set up a Wi-Fi hot spot. It offers two bundles with the following terms. 1. 2. (a) Ivanhoe Bundle A sells a tablet with 3 years of Internet service. The price for the tablet and a 3-year Internet connection service contract is $520. The standalone selling price of the tablet is $238 (the cost to Ivanhoe Tailors is $170). Ivanhoe Tailors sells the Internet access service independently for an upfront payment of $328. On January 2, 2025, Ivanhoe Tailors signed 90 contracts, receiving a total of $46,800 in cash. Ivanhoe Bundle B includes the tablet and Internet service plus a service plan for the tablet PC (for any repairs or upgrades to the tablet or the Internet connections) during the 3-year contract period. That product bundle sells for $624. Ivanhoe Tailors provides the 3-year tablet service plan as a separate product with a standalone selling price of…arrow_forwardPlease make sure that the answers are visible.arrow_forward

- SoccerHawk Merchandise Inc. enters into a 6-month contract to sell soccer balls to City Soccer. The contract contains the following price scale: Sales Volume Price per Soccer Ball First 300 soccer balls sold $22 Next 200 soccer balls sold 19 Next 250 soccer balls sold 17 Additional soccer balls sold 15 On the date the contract is signed, SoccerHawk estimates based on past experience that there is a 20% chance it will sell 450 soccer balls, a 45% chance it will sell 600 soccer balls, and a 35% chance it will sell 800 soccer balls. The company sells the following soccer balls during the 6-month contract: Number of Soccer Balls Month 1 155 Month 2 60 Month 3 125 Month 4 75 Month 5 85 Month 6 60 Total sales 560 balls Required: 1. 2. 3. Prepare the journal entries for SoccerHawk assuming that City Soccer pays the amount due at the end of each month based on the sales to date. ***** The transaction price is…arrow_forwardPlease help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education