FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

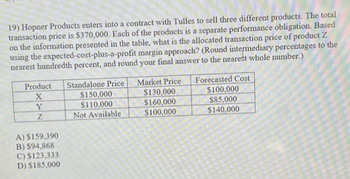

Transcribed Image Text:19) Hopner Products enters into a contract with Tulles to sell three different products. The total

transaction price is $370,000. Each of the products is a separate performance obligation. Based

on the information presented in the table, what is the allocated transaction price of product Z

using the expected-cost-plus-a-profit margin approach? (Round intermediary percentages to the

nearest hundredth percent, and round your final answer to the nearest whole number.)

Product

X

Y

Z

A) $159,390

B) $94,868

C) $123,333

D) $185,000

Standalone Price

$150,000

$110,000

Not Available

Market Price Forecasted Cost

$130,000

$100,000

$160,000

$85,000

$100,000

$140,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Trailblazer Company sells a product for $270 per unit. The variable cost is $150 per unit, and fixed costs are $576,000. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $224,640. a. Break-even point in sales units units b. Break-even point in sales units if the company desires a target profit of $224,640 unitsarrow_forwardcompany 1 sells a product for $24.30 with trade discount rates of 7% and 3%. company 2 sells the same product for $22.30 with two trade discount rates of 7% and 5%. a. Which company is offering it for a cheaper price? The company 1 The company 2 b. What further trade discount rate must the company with the higher price provide to match the lower price?arrow_forwardUse the following information for the next two questions: Bass Co. appropriately uses the cost-to-cost method in measuring construction contract with a customer. its progress on Information on this contract, which was completed in 20x3, is a shown below: 20x1 20x2 20x3 20,000,000 20,000,000 20,000,000 Transaction price Profit each year Costs incurred each year (200,000) 8,200,000 400,000 1,400,000 3,600,000 (AICPA - Adapted) 1. 10. How much are the contract costs incurred in 20x2? a. 5,800,000 b. 6,200,000 c. 6,600,000 d. 10,200,000 11. How much are the estimated additional costs to complete as of December 31, 20x2? a. 5,400,000 b. 6,800,000 c. 7,200,000 d. 8,600,000arrow_forward

- Oriole Company sells 455 units for $290 each to Sheffield Inc. for cash. Oriole allows Sheffield to return any unused product within 30 days and receive a full refund. The cost of each product is $174. To determine the transaction price, Oriole decides that the approach that is most predictive of the amount of consideration to which it will be entitled is the most likely amount. Using the most likely amount, Oriole estimates that ten (10) units will be returned, the costs of recovering the units will be immaterial, and the returned units are expected to be resold at a profit. What amount of refund liability should Oriole record at the time of sale? $1740 O $2900 $1160 O $0arrow_forwardABC Corporation manufactures a product that gives rise to a by-product called Z. The only costs associated with Z are selling costs of P1 for each unit sold. ABC accounts for Z sales first b deducting its separable costs from such sales and then by deducting this net amount from cost of sales of the major product. This year, 1,000 units of Z were sold at P4 each. If ABC changes its method of accounting for Z sales by showing the net amount as additional sales revenue, ABC's gross margin would*a. decrease by P3,000b. increase by P4,000c. increase by P3,000d. be unaffectedarrow_forwardCarla Vista Company sells product 1976NLC for $20 per unit. The cost of one unit of 1976NLC is $21, and the replacement cost is $20. The estimated cost to dispose of a unit is $4, and the normal profit is 30% of selling price. At what amount per unit should product 1976NLC be reported, applying lower-of-cost-or-market?arrow_forward

- Urmila benarrow_forwardBlossom Company sells product 1976NLC for $15 per unit. The cost of one unit of 1976NLC is $17, and the replacement cost is $16. The estimated cost to dispose of a unit is $4, and the normal profit is 20% of selling price. At what amount per unit should product 1976NLC be reported, applying lower-of-cost-or-market? $17. $8. $16. $11.arrow_forwardats Assume a company has three products-A, B, and C-that emerge from a joint process. The joint processing costs that are incurred up to the split-off point equal $1,200,000. The selling prices and outputs for each product at the split-off point are as follows: Product A B С Selling Price $33 per pound $29 per pound $24 per pound Product A B C Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: Output 14,000 pounds 18,000 pounds 19,000 pounds Additional Processing Costs $65,000 $72,000 $88,000 Selling Price $37 per pound $34 per pound $30 per pound The company is trying to decide whether to retain or discontinue the entire joint manufacturing process. What is the financial advantage (disadvantage) of continuing to operate the entire joint manufacturing process?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education