FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

part one: Prepare a columnar flexible budget for Flaming Foliage Sky Tours’ expenses, using air miles as the cost driver at the following activity levels: 21,000 air miles, 25,000 air miles, and 28,000 air miles.

part two: Prepare a revised expense variance report for September, which is based on the flexible budget prepared in part 1. (format for table in part two is attached below)

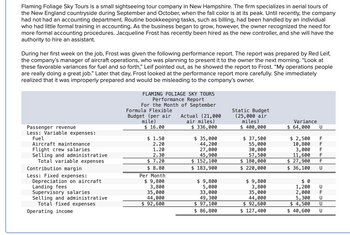

Transcribed Image Text:Flaming Foliage Sky Tours is a small sightseeing tour company in New Hampshire. The firm specializes in aerial tours of

the New England countryside during September and October, when the fall color is at its peak. Until recently, the company

had not had an accounting department. Routine bookkeeping tasks, such as billing, had been handled by an individual

who had little formal training in accounting. As the business began to grow, however, the owner recognized the need for

more formal accounting procedures. Jacqueline Frost has recently been hired as the new controller, and she will have the

authority to hire an assistant.

During her first week on the job, Frost was given the following performance report. The report was prepared by Red Leif,

the company's manager of aircraft operations, who was planning to present it to the owner the next morning. "Look at

these favorable variances for fuel and so forth," Leif pointed out, as he showed the report to Frost. "My operations people

are really doing a great job." Later that day, Frost looked at the performance report more carefully. She immediately

realized that it was improperly prepared and would be misleading to the company's owner.

Passenger revenue

Less: Variable expenses:

Fuel

Aircraft maintenance

Flight crew salaries

Selling and administrative

Total variable expenses

Contribution margin

Less: Fixed expenses:

Depreciation on aircraft

Landing fees

Supervisory salaries

Selling and administrative

Total fixed expenses

Operating income

FLAMING FOLIAGE SKY TOURS

Performance Report

For the Month of September

Formula Flexible

Budget (per air

mile)

$ 16.00

$ 1.50

2.20

1.20

2.30

$7.20

$ 8.80

Per Month

$ 9,800

3,800

35,000

44,000

$ 92,600

Actual (21,000

air miles)

$336,000

$ 35,000

44,200

27,000

45,900

$ 152,100

$ 183,900

$ 9,800

5,000

33,000

49,300

$ 97,100

$ 86,800

Static Budget

(25,000 air

miles)

$ 400,000

$ 37,500

55,000

30,000

57,500

$ 180,000

$ 220,000

$ 9,800

3,800

35,000

44,000

$ 92,600

$ 127,400

Variance

$ 64,000 U

$ 2,500

10,800

3,000

11,600

$ 27,900 F

$ 36,100

U

FFFFF

$0

1,200

2,000

5,300

$ 4,500

$ 40,600

UFUN

U

U

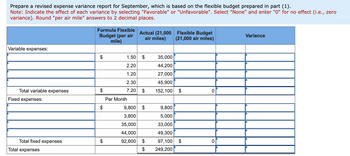

Transcribed Image Text:Prepare a revised expense variance report for September, which is based on the flexible budget prepared in part (1).

Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero

variance). Round "per air mile" answers to 2 decimal places.

Variable expenses:

Total variable expenses

Fixed expenses:

Total fixed expenses

Total expenses

Formula Flexible

Budget (per air

mile)

$

$

Actual (21,000

air miles)

1.50

2.20

1.20

2.30

7.20 $

Per Month

9,800 $

3,800

35,000

44,000

92,600

$

35,000

44,200

27,000

45,900

152,100

9,800

5,000

33,000

49,300

97,100

249,200

Flexible Budget

(21,000 air miles)

$

$

0

0

Variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Symphony Electronics produces wireless speakers for outdoor use on patios, decks, etc. Their most popular model is the All Weather and requires four separate XL12 components per unit. The company is now planning raw material needs for the second quarter. Sales of the All Weather are the highest in the second quarter of each year as customers prepare for the summer season. The company has the following inventory requirements: a. The finished goods inventory on hand at the end of each month must be equal to 16,400 units plus 10% of the next month's sales. The finished goods inventory on March 31 is budgeted to be 28,700 units. b. The raw materials inventory on hand at the end of each month must be equal to 20% of the following month's production needs for raw materials. The raw materials inventory on March 31 for XL 12 is budgeted to be 98,800 components. c. The company maintains no work in process inventories. A sales budget for the All Weather speaker is as follows: April May June July…arrow_forwardShawke Company's partially completed flexible overhead budget for the current period follows. This budget is based on its predicted activity of 50% of productive capacity. Complete its flexible overhead budgets for the current period using 1,950, 3,900, and 5,850 units of productive capacity. For Year Ended December 31 Production (in units) Overhead costs Total variable overhead Total fixed overhead Total overhead costs Flexible Overhead Budgets Total Fixed Cost Variable Amount per Unit $ 12 $ 17,900 Flexible Budget at Capacity Level of 25% 50% 75% 1,950 3,900 5,850arrow_forwardYou are given the following budgeted and actual data for the Grey Company for each of the months January through June of the current year. In December of the prior year, sales were forecasted as follows: January, 100 units February, 95 units March, 102 units April, 107 units May, 114 units June, 122 units. In January of the current year, sales for the months February through June were reforecasted as follows: February, 90 units March, 102 units April, 102 units May, 104 units June, 117 units. In February of the current year, sales for the months March through June were reforecasted as follows: March, 97 units April, 102 units May, 99 units June, 117 units In March of the current year, sales for the months April through June were reforecasted as follows: April, 102 units May, 94 units June, 107 units In April of the current year, sales for the months May and June were reforecasted as follows: May, 84 units June, 102 units In May of the current year, sales for June were…arrow_forward

- Please add detail explanation for all calculation. Built-Tight is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for product costs for the quarter follow. **attached image chart -Budgeted Sales on July $64,000 / August $80,000 / September $48,000 -Budgeted Cash Payments for Direct Materials on July $16,160 / August $13,440 / September $13,760 Direct Labor on July $4,040 / August $3,360 / September $3,440 Factory Overhead on July $20,200 / August $16,800 / September $17,200 Sales are 20% cash and 80% on credit. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $15,000 in cash; $45,000 in accounts receivable; $4,500 in accounts payable; and a $5,000 balance in loans payable. A minimum cash balance of $15,000 is required. Loans are obtained at the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid…arrow_forwardPlease provide answer in text (Without image)arrow_forwardHelp fill out . The ones I filled out aren’t all correct. I need some help pleasearrow_forward

- Prepare a flexible budget for May. (Round your answers to the nearest whole number.)arrow_forwardThe Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 4,640 kayaks during 2022. Each kayak will require 56 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). The polyethylene powder used in these kayaks costs $1.20 per pound, and the finishing kits cost $210 each. Each kayak will use two kinds of labor-2 hours of type I labor from people who run the oven and trim the plastic, and 3 hours of work from type II workers who attach the hatches and seat and other hardware. The type I employees are paid $17 per hour, and the type II are paid $14 per hour. Manufacturing overhead is budgeted at $414,840 for 2022, broken down as follows. Variable costs Indirect materials $46,400 Manufacturing supplies 64,960 Maintenance and utilities 102,080 213,440 Fixed costs Supervision 78,000 Insurance 13,200 Depreciation 110,200 201,400 Total $414,840 During the first quarter, ended March 31,…arrow_forwardAnswer both the requirements, answer in text form please (without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education