FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

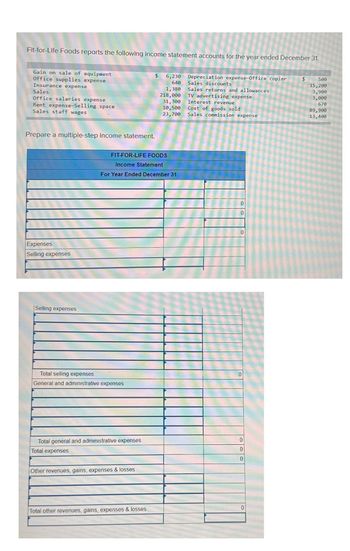

Transcribed Image Text:Fit-for-Life Foods reports the following income statement accounts for the year ended December 31.

Gain on sale of equipment

Office supplies expense

Insurance expense

Sales

Office salaries expense

Rent expense-Selling space

Sales staff wages

Prepare a multiple-step income statement.

Expenses

Selling expenses

Selling expenses

Total selling expenses

General and administrative expenses

FIT-FOR-LIFE FOODS

Income Statement

For Year Ended December 31

Total general and administrative expenses

Total expenses

Other revenues, gains, expenses & losses

$

Total other revenues, gains, expenses & losses

6,230

640

1,380

218,000

31,300

10,500

23,700

Depreciation expense-Office copier

Sales discounts

Sales returns and allowances

TV advertising expense

Interest revenue

Cost of goods sold

Sales commission expense

0

0

0

0

0

0

0

0

$

500

15,200

3,900

3,000

670

89,900

13,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reports the following sales-related information. $ 220,000 Sales returns and allowances 4,400 Sales salaries expense Prepare the net sales portion only of this company's multiple-step income statement. Sales, gross Sales discounts Net sales Multiple-Step Income Statement (Partial) $ 15,000 10,400arrow_forwardProvide full journal entryarrow_forwardushaarrow_forward

- Given the information below find net profit/loss in dollars for the month of June Guest Hotel Inc. Income Statement for the period ending June 30, 2021 Sales Food 179,178 79,882 Beverage Total Sales Cost of Sales Food Beverage Total cost of goods sold- Gross Profit Controllable Expenses Salaries & Wages Occupancy Office & General Utilities 77,074 26,752 100,578 27,123 11,364 9.144 Transportation Kitchen supplies Professional fees Advertising Social Media Expenses 10,750 Vehicle Total Controllable Expenses Net Profit / Loss 5.908 8,035 7.000 7,788 4.907arrow_forwardPlease create an income statement and include gross profit percentage.arrow_forwardThe following transactions pertain to Year 1, the first-year operations of Rooney Company. All inventory was started and completed during Year 1. Assume that all transactions are cash transactions. 1. Acquired $4,900 cash by issuing common stock. 2. Paid $660 for materials used to produce inventory. 3. Paid $1,900 to production workers. 4. Paid $1,078 rental fee for production equipment. 5. Paid $90 to administrative employees. 6. Paid $106 rental fee for administrative office equipment. 7. Produced 340 units of inventory of which 190 units were sold at a price of $13 each. Required Prepare an income statement and a balance sheet in accordance with GAAP.arrow_forward

- PR 21-6A Contribution margin, break-even sales, cost-volume-profit chart, OBJ. 2, 3, 4, 5 margin of safety, and operating leverage Wolsey Industries Inc. expects to maintain the same inventories at the end of 2016 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials.... $ 46 Direct labor .... 40 Factory overhead. Selling expenses: $200,000 20 Sales salaries and commissions... 110,000 8 Advertising... Travel .... Miscellaneous selling expense 40,000 12,000 7,600 1 Administrative expenses: Office and officers' salaries . 132,000 Supplies... Miscellaneous administrative expense. Total ... 10,000 4 1 13,400 $525,000 $120 It is…arrow_forwardContinued from previous questionarrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue Cost of Goods Manufactured Beginning Finished Goods Inventory Ending Finished Goods Inventory Selling Expenses Administrative Expenses What is the cost of goods available for sale? O A. $5,700 OB. $29,300 OC. $26,700 O D. $24,300 $51,000 28,000 1,300 2,600 15,100 3,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education