FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

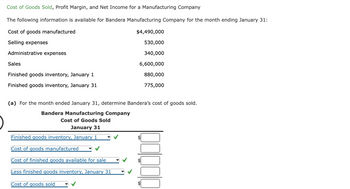

Transcribed Image Text:Cost of Goods Sold, Profit Margin, and Net Income for a Manufacturing Company

The following information is available for Bandera Manufacturing Company for the month ending January 31:

Cost of goods manufactured

Selling expenses

Administrative expenses

Sales

Finished goods inventory, January 1

Finished goods inventory, January 31

$4,490,000

530,000

340,000

6,600,000

880,000

775,000

(a) For the month ended January 31, determine Bandera's cost of goods sold.

Bandera Manufacturing Company

Cost of Goods Sold

January 31

Finished goods inventory, January 1

Cost of goods manufactured

Cost of finished goods available for sale

Less finished goods inventory, January 31

Cost of goods sold

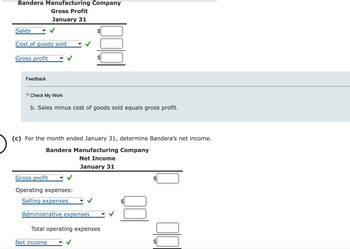

Transcribed Image Text:Bandera Manufacturing Company

Gross Profit

January 31

Sales

Cost of goods sold

Gross profit

Feedback

Check My Work

b. Sales minus cost of goods sold equals gross profit.

(c) For the month ended January 31, determine Bandera's net income.

Bandera Manufacturing Company

Net Income

January 31

Gross profit

Operating expenses:

Selling expenses

Administrative expenses

Total operating expenses

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare its schedule of cost of goods manufactured for the year ended December 31.arrow_forwardRequired information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. . Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses. Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,200,000 52,000 68,000 88,000 239,000 287,000 43,000 34,000 68,000 109,000 174,000 62,000 82,000 106,000arrow_forwardManufacturing costs: Direct materials: Direct materials inventory Work-in-process inventory Finished goods inventory Direct materials used during the year amount to $1,096,000 and the cost of goods sold for the year was $1,278,000. Required: Prepare a cost of goods sold statement. Note: Enter your answers in thousands of dollars (I.e., 234,000 should be entered as 234). Materials available Direct materials used Total manufacturing costs Total costs of work-in-process Cost of goods manufactured Finished goods available for sale January 1 (Beginning) ($000) $ 712 Cost of goods sold December 31 (Ending) ($000) $784 1,330 264 1,154 139 BIRWOOD FURNITURE Cost of Goods Sold Statement For the Year Ended December 31 ($000)arrow_forward

- Need help for this questionarrow_forwardLakeshore Manufacturing provided the following information for the month ended March 31: Sales Revenue $31,000 Beginning Finished Goods Inventory 7,000 Ending Finished Goods Inventory 8,500 Cost of Goods Manufactured 11,600 Compute gross profit. OA. $19,400 OB. $17,900 OC. $10,900 O D. $20,900 ***arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education