FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

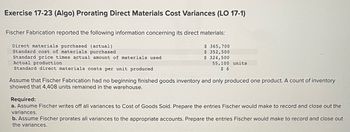

Transcribed Image Text:Exercise 17-23 (Algo) Prorating Direct Materials Cost Variances (LO 17-1)

Fischer Fabrication reported the following information concerning its direct materials:

Direct materials purchased (actual)

Standard cost of materials purchased

Standard price times actual amount of materials used.

Actual production

Standard direct materials costs per unit produced

$365,700

$ 352,500

$ 324,500

55,100 units

$ 6

Assume that Fischer Fabrication had no beginning finished goods inventory and only produced one product. A count of inventory

showed that 4,408 units remained in the warehouse.

Required:

a. Assume Fischer writes off all variances to Cost of Goods Sold. Prepare the entries Fischer would make to record and close out the

variances.

b. Assume Fischer prorates all variances to the appropriate accounts. Prepare the entries Fischer would make to record and close out

the variances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Proctor Cleaning Products manufactures a product using a process that allows for substitution between two materials, X-1 and Y-7. The company has the following direct materials data for its product: Standard costs for one unit of output 68 units of input at $1.00 12 units of input at $4.60 The following results were reported for January: X-1 Y-7 Units of output produced Materials purchased X-1 Y-7 Proctor has a policy of holding no inventories of any kind. Required: a. Compute materials price and efficiency variances. b. Compute materials mix and yield variances. Required A Required B 18,200 units Complete this question by entering your answers in the tabs below. 1,204,000 units at $1.02 224,000 units at $4.551 Materials price variance Materials efficiency variance Compute materials price and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select…arrow_forwardBlossom Company purchases $50,300 of direct raw materials and it incurs $65,400 of direct factory labor costs. Supporting records show that (a) the Assembly Department used $25,800 of direct raw materials and $38,000 of direct factory labor, and (b) the Finishing Department used the remainder. Record the assignment of the costs to the processing departments using the following format. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Direct materials used Assign direct factory labor Raw Materials Inventory $ $ Manufacturing Costs Factory Labor Manufacturing Overhead $ $ Assembly Work in Process $ Finishingarrow_forwardPlease do not give solution in image format thankuarrow_forward

- TaskMaster Enterprises employs a standard cost system in which direct materials inventory is carried at standard cost. TaskMaster has established the following standards for the prime costs of one unit of product. Standard Quantity Standard Price Standard Cost Direct Materials 8 pounds $ 1.90 per pound $ 15.20 Direct Labor 0.25 hour $ 8.20 per hour 2.05 $ 17.25 During November, TaskMaster purchased 160,500 pounds of direct materials at a total cost of $288,900. The total factory wages for November were $43,000, 90% of which were for direct labor. TaskMaster manufactured 19,000 units of product during November using 142,500 pounds of direct materials and 5,010 direct labor-hours. What is the direct labor rate variance for November?arrow_forwardRecord the amount in each account affected by the transactions/adjustments below. Note: These are not complete journal entries not all rows will have more than one entry and they will not balance like previous transactions. Beginning Inventory Purchased $10,000 of raw materials Transferred $13,000 direct materials to factory for production. Production required $7,200 of direct labor. Applied overhead at $2 per each dollar of direct Completed work on production costing $32,120. Sold products that cost $17,530 to produce for $35,000 in sales. Actual overhead totaled $16,000. Ending Balances Raw Materials $12,500 Work In Process $3,600 Finished Goods Cost of Goods Sold $5,980 Sales $0 $0 $12,500 $3,600 $5,980 $0 $0arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Fortune Company had beginning raw materials inventory of $9,900. During the period, the company purchased $55,500 of raw materials on account. If the ending balance in raw materials was $6,900, the amount of raw materials transferred to work in process is: Multiple Choice $52,500. $58,500. $55,500. $62,400.arrow_forwardThe following information is taken from the accounting records of four different companies. Provide the missing amounts. Assume there are no indirect materials used in the company's finished product. Direct Materials Inventory, beginning Purchases of direct materials Company 1 Company 2 $15,000 $ 92,200 Company 3 $5,000 50,600 Company 4 $130,500 221,800 Total direct materials available for use 391,000 101,300 Direct Materials Inventory, ending 25,000 34,600 Direct materials used in production 71,200 Direct labor 212,000 25,000 324,400 Total manufacturing overhead 254,400 97,500 64,300 Total manufacturing cost Work in Process Inventory, Beginning 194,000 138,300 913,200 148,500 38,000 Work in Process Inventory, Ending 50,000 43,700 47,500 Cost of goods manufactured 814,400 103,450 920,300 Finished Goods Inventory, beginning 35,000 36,000 Cost of goods available for sale 393,000 140,050 Finished Goods Inventory, ending Cost of Goods Sold $796,400 $ 12,600 $109,400 $ 42,300arrow_forwardSheridan Company accumulates the following data concerning raw materials in making one gallon of finished product. (1) Price-net purchase price $3.00, freight-in $0.50, and receiving and handling $0.20. (2) Quantity-required materials 3.50 pounds, allowance for waste and spoilage 0.80 pounds. Compute the following. (Round answers to 2 decimal places, e.g. 1.25.) (a) (b) (c) Standard direct materials price per gallon. Standard direct materials quantity per gallon. Total standard materials cost per gallon. ta poundsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education