FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

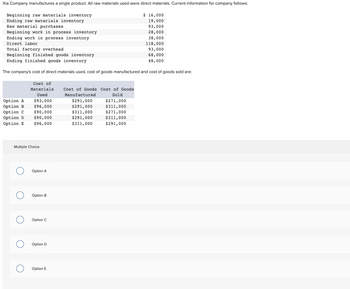

Transcribed Image Text:Xia Company manufactures a single product. All raw materials used were direct materials. Current information for company follows:

Beginning raw materials inventory

Ending raw materials inventory

Raw material purchases

Beginning work in process inventory

Ending work in process inventory

Direct labor

Total factory overhead

Beginning finished goods inventory

Ending finished goods inventory

The company's cost of direct materials used, cost of goods manufactured and cost of goods sold are:

Option A

Option B

Option C

Cost of

Materials

Used

$93,000

$96,000

$90,000

$90,000

Option D

Option E $96,000

Multiple Choice

O Option A

O Option B

O Option C

O Option D

O Option E

Cost of Goods Cost of Goods

Manufactured

Sold

$291,000

$291,000

$311,000

$291,000

$311,000

$ 16,000

19,000

93,000

28,000

38,000

118,000

93,000

68,000

48,000

$271,000

$311,000

$271,000

$311,000

$291,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data was prepared by the Sandhill Company. Total Variable Fixed $ 24/unit Sales price $ 78, 750 Direct materials used Direct labor $91,000 $ 110, 750 $ 13,850 $ 96.900 Manufacturing overhead $ 22,000 $ 12,600 $9,400 Selling and administrative expense 25,500 units Units manufactured 20, 800 units Beginning Finished Goods Inventory 9,000 units Ending Finished Goods Inventory Under variable costing, what is the unit product cost?arrow_forwardProduct Cost Flows Complete the following T-accounts: Materials Inventory 1,120 Answer Answer 18,120 250 Wages Payable 9,000 1,050 Finished Goods Inventory 1,500 Answer Answer 1,200 Manufactured Overhead 175 Answer Answer 18,000 4,500 0 Work in Process Inventory 3,500 Answer Answer 9,000 Answer 500 Cost of Goods Sold Answer Save AnswersNextarrow_forwardYouTube O Maps Estimated Income Statements, using Absorption and Variable Costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: Sales (27,200 x $96) $2,611,200 Manufacturing costs (27,200 units): Direct materials 1,572,160 Direct labor 372,640 Variable factory overhead 174,080 Fixed factory overhead 206,720 Fixed selling and administrative expenses 56,200 Variable selling and administrative expenses 68,000 The company is evaluating a proposal to manufacture 30,400 units instead of 27,200 units, thus creating an ending inventory of 3,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated income statement, comparing operating results if 27,200 and 30,400 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it…arrow_forward

- kk. Subject:- Accountingarrow_forwardBruce Corporation makes four products in a single facility. These products have the following unit product costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead. Unit product cost Additional data concerning these products are listed below. Multiple Choice Product C Product B Product D Product A Products A B C D $17.20 $ 21.10 $ 14.10 $ 16.80 19.20 22.60 17.00 11.00 6.00 7.20 29.10 16.00 $71.50 A 2.25 $ 86.70 $ 2.95 4,600 9.70 16.10 $66.90 $ 56.90 Products Grinding minutes per unit Selling price per unit Variable selling cost per unit Monthly demand in units. The grinding machines are potentially the constraint in the production facility. A total of 10,500 minutes are available per month on these machines. Direct labor is a variable cost in this company. Which product makes the MOST profitable use of the grinding machines? Note: Round your intermediate calculations to 2 decimal places. B 1.30 $ 79.10 $ 3.65 3,600 C 0.85 $ 75.90 $4.40 3,600arrow_forwardDivision X of Bella Corporation sells Part A to other companies for $87.20 per unit. According to the company's accounting system, the costs to Division X to make a unit of Part A are: O $87.20 per unit O $62.60 per unit O $58.10 per unit O $79.95 per unit O None of the above Direct materials Direct labor $5.80 Variable Division Y of Bella Corporation uses a part much like Part A in one of its products. Division Y can buy this part from an outside supplier for $79.95 per unit. However, Division Y could use Part A instead of the part it purchases from the outside supplier. What is the most Division Y would be willing to pay the Division X for Part A? Question 21 $42.70 manufacturing $9.60 overhead Fixed manufacturing $4.50 overheadarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education