Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

please answer within the format by providing formula the detailed working

Please provide answer in text (Without image)

Please provide answer in text (Without image)

Please provide answer in text (Without image)

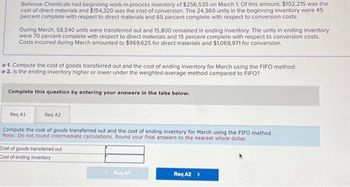

Transcribed Image Text:Bellevue Chemicals had beginning work-in-process inventory of $256,535 on March 1. Of this amount, $102,215 was the

cost of direct materials and $154,320 was the cost of conversion. The 24,360 units in the beginning inventory were 45

percent complete with respect to direct materials and 65 percent complete with respect to conversion costs.

During March, 58,540 units were transferred out and 15,800 remained in ending inventory. The units in ending inventory

were 70 percent complete with respect to direct materials and 15 percent complete with respect to conversion costs.

Costs incurred during March amounted to $969,625 for direct materials and $1,069,971 for conversion.

a-1. Compute the cost of goods transferred out and the cost of ending inventory for March using the FIFO method.

a-2. Is the ending inventory higher or lower under the weighted-average method compared to FIFO?

Complete this question by entering your answers in the tabs below.

Req A1

Reg A2

Compute the cost of goods transferred out and the cost of ending inventory for March using the FIFO method.

Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar.

Cost of goods transferred out

Cost of ending inventory

Reg A1

Req A2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Narwhal Swimwear has a beginning work in process inventory of 13,500 units and transferred in 130,000 units before ending the month with 14,000 units that were 100% complete with regard to materials and 30% complete with regard to conversion costs. The cost per unit of material is $5.80 and the cost per unit for conversion is $8.20 per unit. Using the weighted-average method, what is the amount of material and conversion costs assigned to the department for the month?arrow_forwardThe packaging department began the month with 750 units that were 100% complete with regard to material and 25% complete with regard to conversion. It received 9,500 units from the processing department and ended the month with 500 units that were 100% complete with regard to materials and 75% complete with regard to conversion. With a $7 per unit material cost and a $4 per unit cost for conversion, what is the cost of the units transferred out and remaining in ending inventory?arrow_forwardNorwood Co. had 200 units in work in process at the beginning of the month. During the month, 7,500 units were started in production, 6,800 of which, along with the beginning work in process, were completed by the end of the month. The uncompleted units were in ending inventory, one-half complete. What were the equivalent units of production for the month?arrow_forward

- The packaging department began the month with 500 units that were 100% complete with regard to material and 85% complete with regard to conversion. It received 9,500 units from the processing department and ended the month with 750 units that were 100% complete with regard to materials and 30% complete with regard to conversion. With a $5 per unit cost for conversion and a $5 per unit cost for materials, what is the cost of the units transferred out and remaining in ending inventory?arrow_forwardArdt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

- In October, the cost of materials transferred into the Rolling Department from the Casting Department of Kraus Steel Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600 (275,000 factory overhead applied and 187,600 direct labor). The total cost transferred to Finished Goods for the period was 3,392,400. The Rolling Department had a beginning inventory of 163,800. a. Journalize for the Rolling Department (1) the cost of transferred-in materials, (2) the conversion costs, and (3) the costs transferred out to Finished Goods. b. Determine the balance of Work in ProcessRolling at the end of the period.arrow_forwardA company started the month with 4,519 units in work in process inventory. It started 15,295 units and had an ending inventory of 4,936. The units were 100% complete to materials and 30% complete with conversion. How many units were transferred out during the period?arrow_forwardLoanstar had 100 units in beginning inventory before starting 950 units and completing 800 units. The beginning work in process inventory consisted of $2,000 in materials and $500O in conversion costs before $8.500 of materials and $11,200 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forward

- During March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forwardRexar had 1,000 units in beginning inventory before starting 9.500 units and completing 8,000 units. The beginning work in process inventory consisted of $5,000 in materials and $8,500 in conversion costs before $16,000 of materials and $18,500 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forwardA company started the month with 8,329 units in work in process inventory. It started 23,142 unit and had an ending inventory of 9,321. The units were 100% complete to materials and 67% complete with conversion. How many units were transferred out during the period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning