Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

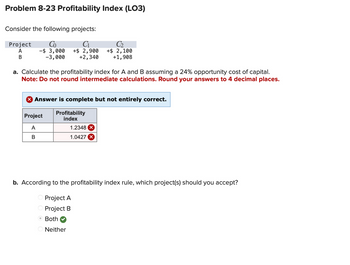

Transcribed Image Text:Problem 8-23 Profitability Index (LO3)

Consider the following projects:

Project

A

Co

-$ 3,000

B

-3,000

C₁

+$ 2,900

+2,340

C2

+$ 2,100

+1,908

a. Calculate the profitability index for A and B assuming a 24% opportunity cost of capital.

Note: Do not round intermediate calculations. Round your answers to 4 decimal places.

Answer is complete but not entirely correct.

Profitability

index

Project

A

1.2348 X

B

1.0427 X

b. According to the profitability index rule, which project(s) should you accept?

Project A

Project B

O Both ☑

Neither

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Problem 8-6 Profitability Index (LO3) The following are the cash flows of two projects: Year Project A Project B $ (270) $ (270) 1 150 170 2 150 170 3 150 170 4 150 If the opportunity cost of capital is 12%, what is the profitability Index for each project? Note: Do not round Intermediate calculations. Round your answers to 4 decimal places. Project A B Profitability Indexarrow_forwardNonearrow_forwardCompute the NPV for Project M if the appropriate cost of capital is 7 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project M Time: Cash flow: 2 4 -$1,100 $370 $500 $540 $620 $120 NPV Should the project be accepted or rejected? O accepted O rejected MacBook Alrarrow_forward

- Based on the information below which projects will we choose based on weighted average profitabiltity Index if we only have OMR500,000 to invest? Project NPV Investment PI A 130,000 200,000 B 241,250 225,000 C 294,250 275,000 D 262,000 250,000 Select one: a. WAPI AD b. WAPI AB c. WAPI BD d. WAPI BCarrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward8. NPV profiles An NPV profile plots a project's NPV at various costs of capital. An example NPV profile is shown below: Identify the range of costs of capital that a firm would use to accept and reject this project, and answer the questions that follow. NPV (Dollars) 600 500 400 300 200 100 0 ← -100 -200 -300 A 2 4 6 8 10 12 14 16 DISCOUNT (REQUIRED) RATE (Percent) The project represented by triangle A should be B 18 20 This NPV profile demonstrates that as the cost of capital increases, the project's NPV ?arrow_forward

- The Company has three potential projects from which to choose. Selected information on each of the three projects follows: Project A Project B Project C Investment required $44,400 $55,700 $53,100 Net present value of project $49,100 $74,100 $69,100 Using the profitability index, rank the projects from most profitable to least profitable. A, B, C B, A, C B, C, A C, B, Aarrow_forwardConsider the following information: Cash Flows ($) Project C0 C1 C2 C3 C4 A –5,300 1,300 1,300 2,700 0 B –700 0 600 2,300 3,300 C –5,200 3,400 1,700 800 300 a. What is the payback period on each of the above projects? (Round your answers to 2 decimal places.)arrow_forwardQUESTION 3 If the cash flows for Project M are CO= -2,000; C1 = +400; C2 = +1,400; and C3= +1,300, calculate the IRR for the project. Please input the percentage format for your answer. And there is no need to put the percentage sign (%).arrow_forward

- Consider the following projects: Project Co C₁ Cash Flows ($) C2 C3 CA C5 A -1,300 1,300 0 0 0 0 B -2,600 1,300 1,300 4,300 1,300 1,300 C -3,250 1,300 1,100 0 1,300 1,300 a. If the opportunity cost of capital is 9%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? Complete this question by entering your answers in the tabs below. Required A Required B Required C If the opportunity cost of capital is 9%, which project(s) have a positive NPV? Note: Do not round intermediate calculations. Positive NPV project(s) Projects B and C Required A Required Barrow_forwardNonearrow_forwardThe profitability analysis of three projects is provided below: Project A Project B Project C NPV $10,000 $5,000 - $1,000 IRR 10% 15% 15% WACC 8% 12% 16% If these projects were independent, which project(s) would be accepted? Why? If these projects were mutually exclusive, which project(s) would be accepted? Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education