Economics Today and Tomorrow, Student Edition

1st Edition

ISBN: 9780078747663

Author: McGraw-Hill

Publisher: Glencoe/McGraw-Hill School Pub Co

expand_more

expand_more

format_list_bulleted

Question

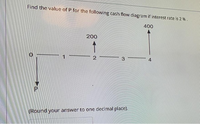

Transcribed Image Text:Find the value of P for the following cash flow diagram if interest rate is 2 % .

400

200

3

4

(Round your answer to one decimal place).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Find an expression for the present value of an annuity on which payments are 1 at the end of each 4-month period for 12 years assuming a rate of interest per 3-month period.arrow_forwardTrevor's starting salary at his new job is $40,000. His company gives a performance raise of 5% each year. If Trevor continues in the same position and always receives the performance raise, in how many years will he double his salary?arrow_forwardCalculate the annual payouts C to be given for 15 years with an interest rate of 8% on an annuity with a present of value of $150,000. Round your answer to the nearest cent. Do not include the dollar sign in your answer.arrow_forward

- If $18,000 is invested at 9% for 15 years, find the future value if the interest is compounded semi-annually. Please round the answer to the nearest cent. (two decimal places)arrow_forwardWhat is the interest rate that would make $10,000 received in the first year equivalent to $3,500 received each year for 4 years?arrow_forwardPlease solve this using the formula, thank youarrow_forward

- FIN301 Copyright © 2020 Singapore University of Social Sciences (SUSS) Page 5 of 5Timed Online Assignment – July Semester 2020(a) Suppose Jack can get a 2% interest rate for a 6 month USD deposit, solve for the interest rate for a 6 month SGD deposit so that Jack will be indifferent to exchanging the USD now or in 6 months’ time. (Note: The 2% is not an annual rate but is applicable for the 6-month period.) (b) Suppose Jack decides not to use the forward market to hedge the exchange rate risk but use the futures market instead. Explain one (1) advantage and one (1) disadvantage of using each method.arrow_forwardIf you save $1,000 today and the annuel interest rate is 6%, what will that money be worth in 40 years?arrow_forwardQUESTION 1 A student has inherited $5,000. If it is placed in a savings account that earns 4% interest, how much is in the account in 30 years? Assume that the unit for your answer is in $. Only state the numeric value of your calculation.arrow_forward

- Calculate the simple interest due on a 58-day loan of $1300 if the interest rate is 5%. (Round your answer to the nearest cent.)$arrow_forwardIf a person wants to invest $5,000.00 now for the next 10 years plans to withdraw $7,500.00 after 10 years, what is the exact interest rate he should ask for his investment?arrow_forwardCalculate the total interest earned, if you save $68 each month, Starting today, for 11 more years, if the annual interest rate is 9.6 and interest is compounded on a monthly basis?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co