ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

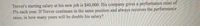

Transcribed Image Text:Trevor's starting salary at his new job is $40,000. His company gives a performance raise of

5% each year. If Trevor continues in the same position and always receives the performance

raise, in how many years will he double his salary?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What type of interest is the capital invested in a transaction is principal and at any time after the investment of the principal, the sum of the principal and the interest due is future amount?arrow_forwardDraw the cash flow diagram with your solution.In a certain department store, the monthly salary of a saleslady is partly constant and partly varies with her sales for the month. When the value of her sales for the month is P10,000, her salary for the month is P900. When her salary for the month goes up to P12,000, her monthly salary becomes P1,000. What must be the value of her sales for the month so that her salary for the month will be P2,000?arrow_forwardplease answerarrow_forward

- James has been working as a Mechanical Engineer ever since he graduated five years ago. Two years ago, he bought and financed a new $25,000 Jeep Compass and still owes $15,750 on his car loan. He has never been late with a car payment. James has one major credit card, with a $1,000 limit. He has had it since his senior year of college and was two months late with a payment one time during that first year. He is currently carrying a balance of $600 on this card. In the last year, James applied for six store credit cards at places that he shops a lot so that he can earn points and get discounts. He carries no balances Part 1: Calculate James’ credit score. Recalculate his credit score if he had not opened the six store credit cards. Part 2: James is tired of paying rent and would like to purchase a condo so that he can start building equity in his home. He is looking for a 30-year mortgage to purchase a $240,000 condo. What interest rate does James qualify for on a mortgage with his…arrow_forwardInterest inflation and purchasing powerarrow_forwardIt is likely that airplane tickets will increase 5% in each of the next 4 years. The cost of a plane ticket at the end of the first year will be $10571. How much money would need to be placed in a savings account now to have money to pay for a trip at the end of each year for the next 4 years? Assume the savings account pays 2% annual interest. Round your answer to 2 decimal places. Add your answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education