FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

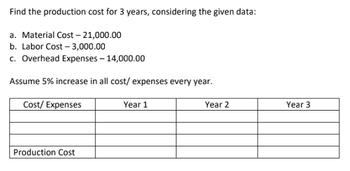

Transcribed Image Text:Find the production cost for 3 years, considering the given data:

a. Material Cost -21,000.00

b. Labor Cost - 3,000.00

c. Overhead Expenses - 14,000.00

Assume 5% increase in all cost/ expenses every year.

Cost/ Expenses

Year 1

Year 2

Production Cost

Year 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: June $201,000 Manufacturing costs" Insurance expense** April May $157,200 $197,600 970 970 2,200 420 2,200 420 970 Depreciation expense Property tax expense*** "Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $970 a month; however, the insurance is paid four times yearly in the first month of the quarter, (.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of May are O&$187.500 b. $39,300 Oe5148,200 Od $226,800 2,200 420arrow_forwardShalom Company's Peace Department had the following information last year Minimum required rate of return 18% Average operating assets Traceable fixed expenses Variable expenses Sales 2,000,000 90,000 310,000 1,000,000 What was Peace Department's return on investment?arrow_forwardOperating Capacity in hours per year = 2,000 hours Hourly rate for crane with operator = $203.00 Downtime = 10.0% Operating Expense = 53.0% Calculate each with the provided numbers above: Gross Potential Income Effective Gross Income Net Operating Income.arrow_forward

- Question 1: Estimation of WC The management of ABC Company Limited has called for a statement showing the WC needed to finance a level of activity of 3,00,000 units of output per year. The cost statement of the company's product, for the above-mentioned activity level, is given below: Cost per unit TK 20 Direct material Direct labor Overhead Total cost Target profit Target selling price 5 TK 15 40 10 TK 50 1. Past records show that raw materials are held in stock, on an average, for two (2) months; 2. Work in process (WIP) will approximate to 15 days production; 3. Finished goods remain in warehouse on average for 1 month; 4. Suppliers for materials extend one month's credit; 5. Two months credit is normally allowed to customers (assume all sales are on credit) 6. A minimum cash balance of TK 5,00,000 is expected to be maintained; 7. The production pattern is assumed to be even during the year. Prepare a Statement of Working Capital Requirementsarrow_forwardpre.3arrow_forwardPlease provide correct solutionarrow_forward

- Assuming a mark-up of 13.54% and that your payment will be received 60 days after the start of the project, what is the cumulative total at the 5th month? Month 1 2 13 14 5 16 7 18 Total Planned Monthly Costs $13,110.84 $14,261.79 $36,314.98 $57.441.75 $27.141.85 $21,763.22 SO $O Planned Monthly Revenue $ Cumulative Costs Cumulative Revenue Cumulative Totalarrow_forwardProduct Q has a sales of 80,000 units per annum and other details as follows: Material=4,80,000 Labor=1,60,000 Variable Overheads=3,20,000 Fixed Overhead=5,00,000 Fixed portion of the capital employed is 12 Lakhs. Its varying portion will be 50% of sales turnover. Find the selling price per unit to earn 12% net on capital employed, net of tax @40%arrow_forwardKyle Corporation provides the following information for the Product Division and Service Division for the year. Product Division Service Division 420,000 $ 650,000 195,000 245,000 640,000 610,000 14.0% 14.0% Net sales Operating income Average total assets Target rate of return $ Requirement 1. Calculate the return on investment for each division. (Enter answers as a percent rounded to the nearest hundredth percent, X.XX%) The return on investment for the Product Division is The return on investment for the Service Division is Requirement 2. Which division has the highest ROI? % % Requirement 3. Calculate the residual income for each division. (Round answers to the nearest whole dollar.) The residual income for the Product Division is The residual income for the Service Division is Requirement 4. Which division has the highest residual income?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education