Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

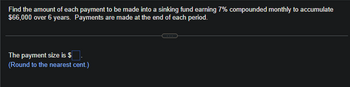

Transcribed Image Text:Find the amount of each payment to be made into a sinking fund earning 7% compounded monthly to accumulate

$66,000 over 6 years. Payments are made at the end of each period.

The payment size is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A sum of 50,000 deposited in a fund which will earn 12% compound semiannualy for the first 5 years and 8% interest compounded quarterly for the next 7 years. How much will be the amount after 12 years.arrow_forwardFind the interest rate needed for the sinking fund to reach the required amount. Assume that the compounding period is the same as the payment period. $21,563 to be accumulated in 5 years; quarterly payments of $900 The interest rate needed is approximately%. (Type an integer or decimal rounded to two decimal places as needed.)arrow_forwardCreate a complete sinking fund schedule and calculate the total payments and interest earned needed for a fund of $9,000 one year from now. The fund will receive deposits made at the end of every three months and earns 5% compounded quarterly. Payment Number 1 2 3 4 Total Payment Amout at End ($) (PMT) Number Number Number Number Total PMT = Number Interest Earned or Accrued ($) (INT) Number Number Number Number Total INT Number Principal Balance Accumulated at End of Payment Interval ($) (BAL) Number Number Number Numberarrow_forward

- Solve by using the sinking fund or amortization formula. (Round your answer to the nearest cent.) Sinking fund payment (in $) Sinking FundPayment PaymentFrequency TimePeriod (years) NominalRate (%) InterestCompounded Future Value(Objective) $ every 3 months 4 6.0 quarterly $7,000arrow_forwardK Find the amount of each payment into a sinking fund if $14,000 must be accumulated Payments are made at the end of each quarter for 3 years, with interest of 6% compounded quarterly Round to the nearest cent Click here to view part 1 of the Sinking Fund table. Click here to view part 2 of the Sinking Fund table. OA. $829.92 OB. $4,597 32 OC. $1,180.06 OD. $1,073.52arrow_forwardFind the periodic payment for each sinking fund that is needed to accumulate the given sum under the given conditions. (Round your answer to the nearest cent.) FV = $1,900,000, r = 9%, compounded monthly for 25 yearsarrow_forward

- Find the amount of each payment to be made into a sinking fund which earns 8% compounded quarterly and produces $49,000 at the end of 4.5 years. Payments are made at the end of each period. The payment size is $ . (Round to the nearest cent.)arrow_forwardBright Inc. will be receiving $5,500 at the end of every month for the next 2 years. If these payments were directly invested into a fund earning 6.00% compounded semi-annually, what would be the future value of the fund at the end of 2 years? Round to the nearest centarrow_forwardCalculate the future value of end-of-month payments of $4,000 made for 7 years into an investment fund that earns 5.50% compounded quarterly.arrow_forward

- Find the interest rate needed for the sinking fund to reach the required amount. Assume that the compounding period is the same as the payment period. $29,488 to be accumulated in 5 years; quarterly payments of $1275. %- The interest rate needed is approximately (Type an integer or decimal rounded to two decimal places as needed.)arrow_forward8. Deposits of 1000 are placed into a fund at the end of each year for the next 25 years for the subsequent purchase of a perpetuity. Five years after the last deposit, annual payments commence and continue forever. If i = .09 then find the amount of each payment.arrow_forwardUse the sinking fund formula shown to the right to determine the monthly payment needed to accumulate $400,000 with 7% interest are compounded monthly for 29 years. The monthly invested payment is $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education