Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

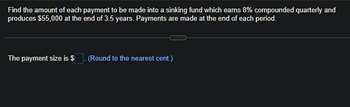

Transcribed Image Text:Find the amount of each payment to be made into a sinking fund which earns 8% compounded quarterly and

produces $55,000 at the end of 3.5 years. Payments are made at the end of each period.

The payment size is $ . (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You owe $2,500 in 5 months and $4,750 in 15 months. Your creditor has agreed to let you make one interest rate and a Focal Point Now. What single cash payment will make? single cash payment NOW using a 4% simple Round Each calculation to the nearest penny (even if zero), USE dollar signs, USE commas if and where needed Iarrow_forwardA bank makes a loan of $1,000,000 at a rate of 6% p.a. It also requires a compensating balance of 5%. What is the effective cost to the borrower?arrow_forwardFind the finance charge on an unpaid balance of $1219.27 in a revolving charge account if the monthly interest rate is 1.5%. The finance charge is $ (Round to the nearest cent.) ...arrow_forward

- The collection of a 1200 account after the 2 percent discount period will result in aarrow_forwarda. If the present value of $153 is $139, what is the discount factor? (Round your answer to 4 decimal places.) Discount Factor 0.9084 b. If that $153 is received in year 5, what is the interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Interest rate %arrow_forwardThe amount of simple interest on a deposit varies jointly with the principal and the time in days. If $17.85 is earned on a deposit of $3500 for 12 days, how much interest would be earned on a deposit of $3700 for 20 days? ... The deposit would earn S in interest. (Simplify your answer. Round to the nearest cent as needed.)arrow_forward

- how about the cash discount 5% ?arrow_forwardNote: Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $) for the following installment loan. Total Purchase Down Amount Monthly Payment Number of Finance Deferred (Cash) Price Payment Financed Payments Charge Payment Price $3,200 20% 2$ $236.00 12 $ $arrow_forwardGive your answer as a rate, accurate to five decimal places.What discount would exactly offset a 10% surcharge?arrow_forward

- So.2arrow_forwardThe Pharoah Acres Inn is trying to determine its break-even point during its off-peak season. The inn has 50 rooms that it rents at $65 a night. Operating costs are as follows: Salaries $5,200 per month $1,200 per month Depreciation $1,300 per month Maintenance $3,324 per month $13 per room $26 per room Utilities Maid service Other costs Determine the inn's break-even point in number of rented rooms per month. Break-even point Textbook and Media rooms SIarrow_forwardWhat does "2/10" mean, with respect to "credit terms of 2/10, n/30"? A. A discount of 2 percent will be allowed if the invoice is paid within 10 days of the invoice date. B. Interest of 2 percent will be charged if the invoice is paid after 10 days from the date on the invoice. C. A discount of 10 percent will be allowed if the invoice is paid within two days of the invoice date. D. Interest of 10 percent will be charged if invoice is paid after two days.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education