Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN: 9781305635937

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help

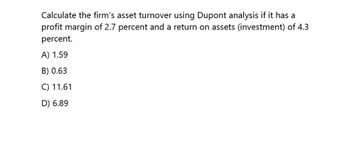

Transcribed Image Text:Calculate the firm's asset turnover using Dupont analysis if it has a

profit margin of 2.7 percent and a return on assets (investment) of 4.3

percent.

A) 1.59

B) 0.63

C) 11.61

D) 6.89

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need answer ✅arrow_forwardQuestion No. 16 - Calculate the firm's asset turnover using Dupont analysis if it has a profit margin of 2.7 percent and a return on assets (investment) of 4.3 percent. (Financial Accounting)arrow_forwardManufacturer A has a profit margin of 2.0%, an asset turnover of 1.7, and an equity multiplier of 4.9. Manufacturer B has a profit margin of 2.3%, an asset turnover of 1.1, and an equity multiplier of 4.7. How much asset turnover should manufacturer B have to match manufacturer A's ROE?arrow_forward

- From the Google Finance site, use the DuPont analysis to determine the total assets turnover ratio for each of the peer companies. (Hint ROA = Profit margin Total assets turnover.) Once youve calculated each peers total assets turnover ratio, then you can use the DuPont analysis to calculate each peers equity multiplier.arrow_forwardCaspian Textiles has a profit margin of 3.5 percent and a return on assets (investment) of 5.6 percent. Calculate the firm's asset turnover using DuPont analysis. A) 1.49 B) 0.63 C) 6.25 D) 1.60arrow_forwardNeed helparrow_forward

- I want the correct answer with accounting questionarrow_forwardCalculate the ROE for smith manufacturing if they havearrow_forwardAssume the following ratios areconstant: Total asset turnover 2.8Profit margin 6.8 % Equitymultiplier 2 Payout ratio 30 %What is the sustainable growthrate? (Do not round intermediate Training calcarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning