FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need answer accounting

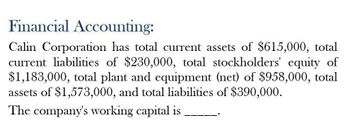

Transcribed Image Text:Financial Accounting:

Calin Corporation has total current assets of $615,000, total

current liabilities of $230,000, total stockholders' equity of

$1,183,000, total plant and equipment (net) of $958,000, total

assets of $1,573,000, and total liabilities of $390,000.

The company's working capital is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide Answer for Blankarrow_forwardThe balance sheet for Stevenson Corporation reported the following: noncurrent assets, $220,000; total assets, $410,000; noncurrent liabilities, $210,000; total stockholders’ equity, $100,000. Compute Stevenson’s working capital.arrow_forwardA firm has the following balance sheet for year 2020 (millions of dollars): Cash $ 12 Accounts payable $ 108 Short-term investment 30 Accruals 72 Accounts receivable 180 Notes payable 67 Inventory 180 Long-term debt 150 Net Fixed assets 300 Common stock 50 Retained earnings 255 Total liabilities Total assets $702 and equity $702 In 2020, a firm has Sales 500 million, Cost of good solds 300 million, Operating profit (EBIT) of $150 million, NI of 60 million and tax rate is 40%. In year 2019, a fırm has $460 million of total operating capital (i.e., Net operating working capital + net fixed assets). What is the free cash flow for year 2020? O $150 million $492 million $460 million $58 million $300 millionarrow_forward

- Jones Corp. reported current assets of $191,000 and current liabilities of $136,000 on its most recent balance sheet. The working capital is:arrow_forwardWorking capital: Winston Electronics reported the following information at its annual meetings. The company had cash and marketable securities worth $1,236,761, accounts payables worth $4,159,857, inventory of $7,122,108, accounts receivables of $3,488,872, notes payable worth $1,152,718, and other current assets of $121,748. What is the company’s net working capital?arrow_forwardKing Industries has net working capital of $17,700, current assets of $39,800, equity of $55,400, and long-term debt of $11,800. What is the amount of the net fixed assets?arrow_forward

- Scare Train, Inc. has the following balance sheet statement items: current liabilities of $779,470; net fixed and other assets of $1,329,896; total assets of $3,237,746; and long-term debt of $621,991. What is the amount of the firm's net working capital?arrow_forwardThe balance sheet for Yakima Corporation reported the following: noncurrent assets, $230,000; total assets, $470,000; noncurrent liabilities, $210,000; total stockholders’ equity, $83,000. Compute Stevenson’s working capital.arrow_forwardThe Balance Sheet for Consolidated Industrial shows the following balances: retained earnings = $1,050,000; cash = $280,000; patents and copyrights = $560,000; inventory = $840,000; accounts payable = $350,000; accounts receivable = $525,000; property plant and equipment = $3,010,000; notes payable = $540,000; long-term debt = $2,800,000. What must the value for Common Stock be?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education