Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give me answer

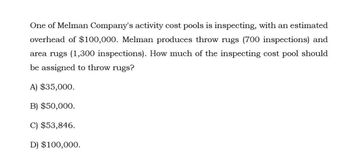

Transcribed Image Text:One of Melman Company's activity cost pools is inspecting, with an estimated

overhead of $100,000. Melman produces throw rugs (700 inspections) and

area rugs (1,300 inspections). How much of the inspecting cost pool should

be assigned to throw rugs?

A) $35,000.

B) $50,000.

C) $53,846.

D) $100,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- The following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardOne of anfa company's activity cost pools is inspecting, with an estimated overhead (OH) of $100,000.arrow_forwardOne of Swifty companies activity cost pools is inspection, which has estimated overhead cost of $220,000. Swifty produces throw rugs, 700 inspections in area rugs, 1300 inspections. What amount of the inspecting activity cost pool should be assigned to throw rugs?arrow_forward

- One of Astro Company's activity cost pools is machine setups, with estimated overhead of $150,000. Astro produces sparklers (400 setups) and lighters (600 setups). How much of the machine setup cost pool should be assigned to sparklers?arrow_forwardUnderwood Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of manufacturing overhead that should be assigned to each of the two product lines from the information given below. Total units produced Total number of material moves Direct labor hours per unit Budgeted material-handling costs are $50,000. The material handling cost per wall mirror under activity-based costing is: Multiple Choice O O $0. $250. Wall Mirrors 50 10 165 $770. Specialty Windows 50 30 165.arrow_forwardTo make a batch of 1,000 units of a certain item, it is estimated that 120 direct labor hours are required at a cost of $10/hour. Direct material costs are estimated at $1,500 per batch. The overhead costs are calculated based on an overhead rate of $7.50 per direct labor hour. The item can be readily purchased from a local vendor for $4 per unit. a. Should the item be made or purchased? b. Over what range of overhead rate is your answer in part a valid?arrow_forward

- The Household Company has established standard costs for the cabinet department, in which one size of MX cabinet is made. The standard costs of producing one of these MX cabinets are shown below: Direct material: lumber 50 board feet at P4 200 Direct labor: 8 hours at P10 80 Overhead costs: Variable – 8 hours at P5 40 Fixed – 8 hours at P3 24 Total standard unit cost 344 During June 2019, 500 of these cabinets were produced. The cost of operations during the month is shown below. Direct material purchased: 30,000 board feet at P4.10 123000 Direct materials used: 24,000 board feet Direct labor: 4,200 hours at P9.50 39,900 Overhead costs: Variable costs – P22,000 Fixed costs – P11,000 The budgeted overhead for the cabinet department…arrow_forwardXYZ Co.produces two different products (Product Y and Product Z) using two different activities : Machining , which uses machine hours as an activity driver , and Inspection , which uses number of batches as an activity driver . The cost of Machining is $ 500,000 , while the cost of Inspection is $30,000. Product Yuses 20% of total ?machine hours and 75 % of total batches . What is the total Machining cost assigned to Product Z a. $ 7,500 b. $ 375,000 c. None of the given answer is correct d. $ $400,000arrow_forwardMuspest Supplies is currently evaluating the cost of manufacturing some of the components utilised in their products. Currently the company expects to need 6 000 parts each month. A supplier of the part has been identified and the total cost of purchasing the parts on a monthly basis would be $97 000. In analysing the part costs, the direct labour and materials cost would be $64 000 and the variable overheads would be $22 000.Based only on the relevant cost per unit, which would be the preferred option of Muspest Supplies?HD EDUCATIONA. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case, the best option would be to commence purchasing the part.B. Unit costs to produce the part would be $10.67 with the unit cost to purchase of $ 16.17. In this case, the best option would be to continue to make the part.C. None of the other answers D. Unit costs to produce the part would be $14.33 with the unit cost to purchase of $ 16.17. In this case,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College