EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

4 POINTS

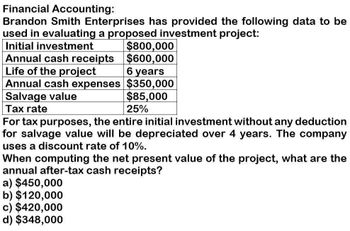

Transcribed Image Text:Financial Accounting:

Brandon Smith Enterprises has provided the following data to be

used in evaluating a proposed investment project:

Initial investment

$800,000

Annual cash receipts $600,000

Life of the project

6 years

Annual cash expenses $350,000

Salvage value

Tax rate

$85,000

25%

For tax purposes, the entire initial investment without any deduction

for salvage value will be depreciated over 4 years. The company

uses a discount rate of 10%.

When computing the net present value of the project, what are the

annual after-tax cash receipts?

a) $450,000

b) $120,000

c) $420,000

d) $348,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Garnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the following cash flows over the next five years: $99,000, $88,000, $92,000. $87,000, and $72,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel. see Appendix C.arrow_forwardGallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forwardThe Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning