Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

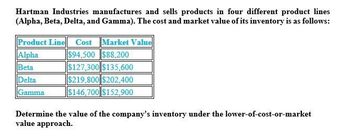

Transcribed Image Text:Hartman Industries manufactures and sells products in four different product lines

(Alpha, Beta, Delta, and Gamma). The cost and market value of its inventory is as follows:

Product Line Cost Market Value

Alpha

Beta

Delta

Gamma

$94,500 $88,200

$127,300 $135,600

$219,800 $202,400

$146,700 $152,900

Determine the value of the company's inventory under the lower-of-cost-or-market

value approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Novak Corp. sells three different categories of tools (small, medium, and large). The cost and net realizable value of its inventory of tools are as follows. Net Realizable Cost Value Small $ 64,000 $61,100 Medium 290,000 260,800 Large 152,700 170,700 Determine the value of the company's inventory under the lower-of-cost-or-net realizable value approach. Total inventory value $arrow_forwardSubject - General Account..arrow_forwardDetermine of the companys inventoryarrow_forward

- GENERAL ACCOUNT Moberg Company sells three different categories of tools (small, medium, and large). The cost and market value of its inventory of tools are as follows. Cost Market Value Small $ 63,000 $ 74,000 Medium 2,80,000 2,70,000 1,81,000 Large 1,62,000 Determine the value of the company's inventory under the lower-of-cost or market value approach.arrow_forwardDetermine the value of the company's inventoryarrow_forwardCody Company sells three different categories of tools (small, medium, and large). The cost and market value of its inventory of tools are as follows: Cost Market Small Medium $ 64,000 $ 73,000 2,90,000 2,60,000 Large 1,52,000 1,71,000 Determine the value of the company's inventory under the lower-of-cost-or-market approach. Note: general account question answer it short and simplearrow_forward

- Note: general accountarrow_forwardByron Company has five products in its inventory and uses the FIFO cost flow assumption. Specific data for each product are as follows: Estimated Cost of Disposal Product A B C D E Cost $90,000 110,000 60,000 100,000 105,000 B Selling Price $150,000 120,000 70,000 115,000 110,000 Required: 1. What is the correct inventory value, assu ing the LCNRV rule is applied to each item of inventory? Product Inventory Value A C D $20,000 15,000 5,000 5,000 8,000 E Total 2. What is the correct inventory value, assuming the LCNRV rule is applied to the total of inventory? losses relative to applying the rule to 3. Next Level Comment on any differences that result from applying the LCNRV nule to individual items compared to the total of inventory Applying the LCNRV rule to the total of inventory will result in The result occurs because the application of the LCNRV rule to groups of inventory allows price inventory valuations and the unitsarrow_forwardaccarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning