FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

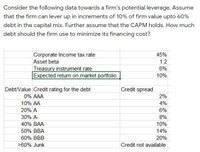

Transcribed Image Text:Consider the following data towards a firm's potential leverage. Assume

that the firm can lever up in increments of 10% of firm value upto 60%

debt in the capital mix. Further assume that the CAPM holds. How much

debt should the firm use to minimize its financing cost?

Corporate Income tax rate

Asset beta

45%

1.2

Treasury instrument rate

Expected return on market portfolio

6%

10%

Debt/Value Credit rating for the debt

Credit spread

0% AAA

2%

10% AA

4%

20% A

6%

30% A-

8%

40% BAA

10%

50% BBA

14%

60% BBB

20%

>60% Junk

Credit not available

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- URGENT PLEASE d. Calculate the firm's weighted average cost of capital using the capital structure weights shown in the following table . (Round answer to the nearest 0.01%)arrow_forwardPremium for Financial Risk Ethier Enterprise has an unlevered beta of 1.0. Ethier is financed with 25% debt and has a levered beta of 1.2. If the risk free rate is 4.5% and the market risk premium is 6%, how much is the additional premium that Ethier's shareholders require to be compensated for financial risk? Round your answer to one decimal place. %arrow_forwardA firm's unlevered beta is 0.5 and tax rate is 30%. If it is with 20% debt. What is the firm's levered beta? 0.9012 1.2533 0.5875 0.6235arrow_forward

- Corporate Finance Consider a company where the market value of debt and equity are 25% and 75%,respectively of total Enterprise Value. The company’s debt yields 200bps over the risk free interest rate of 5.25%. The company’s tax rate is 21%. The beta of the company’s stock is 1.2. Assuming the equity risk premium is 4.5%, what is the company’s after-tax WACC?arrow_forward↑ Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.50%, the company's credit risk premium is 4.50%, the domestic beta is estimated at 1.06, the international beta is estimated at 0.75, and the company's capital structure is now 25% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.30% and the company's effective tax rate is 35% Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates 8.10% b. 7.00% 6.5.00% d. 3.90% ++ a. Using the domestic CAPM, what is Ganado's weighted average cost of capital of the fom's equity risk premium is 10% (Round to two decimal places) tude 1.1.... oline mearrow_forwardA company is considering its optimal capital structure. The firm currently has 1 million shares outstanding at $ 20 per share (tax rate = 40%) and a debt balance of $5 million. Currently, its (levered) beta is 1.5 and its ERP is 5.5%. The current risk-free rate is 5%. Your research indicate the following ratings and pre-tax cost of debt across the different debt ratios: D/(D+E) Rating Pre-tax cost of debt 0% AAA 10% 10% AA 10.5% 20% A 11% 30% BBB 12% 40% BB 13% 50% B 14% 60% CCC 16% 70% CC 18% 80% C 20% 90% D 25% a. Using the optimal WACC approach, what is the firm's optimal debt ratio? b. Calculate the company's unlevered value, assuming that the probability of default is 5% and the company loses 30% of its value in the event of a default.arrow_forward

- Financial leverage A firm issues long-term debt with an effective interest rate of 10%, and the proceeds of this debt issue can be invested to earn an ROI of 12%. What effect will this financial leverage have on the firm's ROE relative to having the same amount of funds invested by the owners/stockholders?arrow_forwardReview this situation: Universal Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc. has gathered the following financial information to help with the analysis. Debt Ratio 30% 40% 50% 60% 70% Equity Ratio 70% 60% 50% 40% 30% Id 7.00% 7.20% 7.70% 11.40% 8.90% 12.20% 10.30% 13.50% Is WACC 10.50% 8.61% 10.80% 8.21% 8.01% 8.08% 8.38% Which capital structure shown in the preceding table is Universal Exports Inc.'s optimal capital structure? Debt ratio = 70%; equity ratio = 30% Debt ratio 50%; equity ratio = 50% Debt ratio = 30%; equity ratio = 70% Debt ratio = 40%; equity ratio = 60% Debt ratio= 60%; equity ratio = 40%arrow_forwardYour firm has a Return on Assets of 8.00 % , the firm can issue debt at 3.50% regardless of the leverage, and the firm's marginal tax rate is 25% . If the firm'sdebt - to - asset ratio is 24 % , what is the Cost of Equity Capital within the 1963 Miller & Modigliani framework? Group of answer choices9.35% 9.78% 6.77% 9.07% 8.81%arrow_forward

- Assume the company has weight of debt WD = 70%, cost of debt RD = 13%, for un-leveraged firm: Bu =1; the company has Tax Rate = 30%, risk-free rate Rf = 3%, Market Return = 10%, free cash flow FCF0 = 200 million, growth rate g = 4%. Use the following formula for beta of leveraged company: B = Bu [1+ (1-T) × (WD /WS)], What is the WACC and what is the value of the firm?arrow_forwardWhat is the company's cost of debt? a. 9.21%b. 10.31%c. 11.5%d. 7.73% What is the company's cost of equity using the Capital Asset Pricing Model? a. 9.21%b. 10.31%c. 11.5%d. 7.73%arrow_forwardSuppose Alcatel-Lucent has an equity cost of capital of 10.3%, market capitalization of $9.36 billion, and an enterprise value of $13 billion. Assume that Alcatel-Lucent's debt cost of capital is 7.3%, its marginal tax rate is 34%, the WACC is 8.7650%, and it maintains a constant debt-equity ratio. The firm has a project with average risk. The expected free cash flow, levered value, and debt capacity are as follows: Thus, the NPV of the project calculated using the WACC method is $182.73 million - $100 million = $82.73 million. a. What is Alcatel-Lucent's unlevered cost of capital? b. What is the unlevered value of the project? c. What are the interest tax shields from the project? What is their present value? d. Show that the APV of Alcatel-Lucent's project matches the value computed using the WACC method. a. What is Alcatel-Lucent's unlevered cost of capital? Alcatel-Lucent's unlevered cost of capital is%. (Round to four decimal places.) Data table (Click on the following icon in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education