Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

URGENT PLEASE

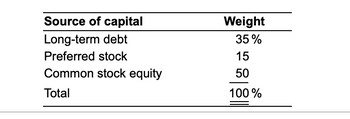

d. Calculate the firm's weighted average cost of capital using the capital structure weights shown in the following table

.

(Round answer to the nearest 0.01%)

Transcribed Image Text:Source of capital

Long-term debt

Preferred stock

Common stock equity

Total

Weight

35%

15

50

100%

Transcribed Image Text:Calculation of individual costs and WACC Lang Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is in the 26% tax bracket.

Debt The firm can raise debt by selling $1,000-par-value, 8% coupon interest rate, 20-year bonds on which annual interest payments will be made. To sell the issue, an average discount of $25 per bond would have to be given. The firm also

must pay flotation costs of $25 per bond.

Preferred stock The firm can sell 7.5% preferred stock at its $100-per-share par value. The cost of issuing and selling the preferred stock is expected to be $7 per share. Preferred stock can be sold under these terms.

Common stock The firm's common stock is currently selling for $90 per share. The firm expects to pay cash dividends of $8 per share next year. The firm's dividends have been growing at an annual rate of 5%, and this growth is expected to

continue into the future. The stock must be underpriced by $7 per share, and flotation costs are expected to amount to $6 per share. The firm can sell new common stock under these terms.

Retained earnings When measuring this cost, the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available $130,000 of retained earnings in the coming year; once these retained earnings are

exhausted, the firm will use new common stock as the form of common stock equity financing.

a. Calculate the after-tax cost of debt.

b. Calculate the cost of preferred stock.

c. Calculate the cost of common stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the weighted average cost of capital (WACC)? The cost of all of the capital for a project or company The cost of all of the equity for a project or company The cost of all of the debt for a project or company The cost of all of the venture capital for a project or companyarrow_forwardWhile the Weighted Average Cost of Capital reflects the risk perceived by in investors the “real risk” is ____________arrow_forwardshortly explain all the capital structure theories and compare them with your own words (no copy paste from somewhere. Use your own book as reference.) Then randomly choose three companies enlisted in Borsa İstanbul and analyze their balance sheet. Write your comments about their capital structure and analyze with regard to risk and profitability. FINANCIAL MANAGEMENT II COURSE QUESTİONarrow_forward

- Use the following information to answer the following question(s). a) What is the percentage of common stock in Sumitomo's weighted average cost of capital? b) What is the percentage of debt in Sumitomo's weighted average cost of capital? c) What is the percentage of preferred stock in Sumitomo's weighted average cost of capital? d) What is the total capital that should be used in computing the weights for Sumitomo's WACC?arrow_forward3. Explain the relationship between the weighted average cost of capital (WACC), the maximization of firm value, and financial decision making.arrow_forwardThe financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 8 % 10 4 8 20 4 8 30 5 9 40 6 10 50 8 12 60 10 14 70 12 16 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of…arrow_forward

- You have the following information about Burgundy Basins, a sink manufacturer. Equity shares outstanding Stock price per share Yield to maturity on debt Book value of interest-bearing debt Coupon interest rate on debt Market value of debt Book value of equity Cost of equity capital Tax rate a. What is the internal rate of return on the investment? Note: Round your answer to 2 decimal places. Internal rate of return I Weighted-average cost Burgundy is contemplating what for the company is an average-risk investment costing $38 million and promising an annual ATCF of $4.9 million in perpetuity. % b. What is Burgundy's weighted-average cost of capital? Note: Round your answer to 2 decimal places. 20 million % $39 7.5% $350 million 4.4% $ 245 million $ 410 million 11.8% 35%arrow_forwardBIE The Cost of Capital: Weighted Averige cost of capital The firm's target capital structure is the mix of debt, presured stack, and common equity the firm plans to mise funds for future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these I components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common study then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will I have to issue new common stock, the cost of new common stock should be used in the firm's WALC calculation. Barton Industines expects that its target capital Structure for finds in the future for its raising capital budget will consist of 40% debt, 5% prefence stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd is 10.0%, the firm's cost of preferred stock, rp is 9.2.%. and the firm's cost of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education