FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

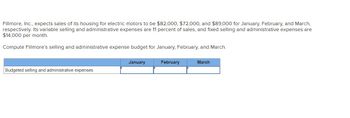

Transcribed Image Text:Fillmore, Inc., expects sales of its housing for electric motors to be $82,000, $72,000, and $89,000 for January, February, and March, respectively. Its variable selling and administrative expenses are 11 percent of sales, and fixed selling and administrative expenses are $14,000 per month.

Compute Fillmore’s selling and administrative expense budget for January, February, and March.

### Budget Table

| | January | February | March |

|----------------------------------|---------|----------|-------|

| Budgeted selling and administrative expenses | | | |

The table above includes columns for each month, with calculated budget values to be filled in for the selling and administrative expenses. The expenses will combine both variable and fixed costs for each period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zilly Company budgets sales of $146,000 for June. Zilly pays a sales manager a monthly salary of $6,700 and a commission of 8% of that month's sales dollars. Prepare a selling expense budget for June, ZILLY CO. Selling Expense Budget June Budgeted sales Salary for sales manager Total selling expensesarrow_forwardABC Company's actual unit sales in the current year for January, February, and March were 16,500, 13,500, and 19,500 units, respectively. Current year selling price is $20. An analysis of general economic trends and specific initiatives at ABC forecasts increases for the coming budget year: sales volume by 10% and sales price by 5%. Required: Prepare ABC Company's budgeted unit sales and total sales volume for the first quarter of the coming year. Current sales (units) Budgeted volume increase Budgeted sales (units) Budgeted selling price Budgeted total sales January $ 0 % February $ 0 % $ March 0 % $ Total 0 %arrow_forwardPreparing a Selling and Administrative Expenses Budget Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of $19,800,000. There is a 4% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following: Salaries $ 960,000 Utilities 365,000 Office space 230,000 Advertising 1,200,000 Required: Prepare a selling and administrative expenses budget for Fazel Company for the coming year. Fazel Company Selling and Administrative Expenses Budget For the Coming Year Variable selling expenses Fixed expenses: Salaries Utilities Office spacе Advertising Total fixed expenses Total selling and administrative expensesarrow_forward

- Preparing a Selling and Administrative Expenses Budget Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of $20,000,000. There is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following: Salaries $ 960,000 Utilities 365,000 Office space 230,000 Advertising 1,200,000 Required: Prepare a selling and administrative expenses budget for Fazel Company for the coming year. Fazel Company Selling and Administrative Expenses Budget For the Coming Year Variable selling expenses $fill in the blank 1 Fixed expenses: Salaries $fill in the blank 2 Utilities fill in the blank 3 Office space fill in the blank 4 Advertising fill in the blank 5 Total fixed expenses fill in the blank 6 Total selling and administrative expenses $fill in the blank 7arrow_forwardHow do I prepare the selling and administrative expense budget for the quarter ended March 31, 20X1?arrow_forwardBudget Preparation Collins Company is preparing its master budget for April. Use the given estimates to determine the amounts necessary for each of the following requirements. (Estimates may be related to more than one requirement.) a. What should total sales revenue be if territories A and B estimate sales of 10,000 and 13,000 units, respectively, and the unit selling price is $43? $ b. If the beginning finished goods inventory is an estimated 2,000 units and the desired ending inventory is 3,000 units, how many units should be produced? c. What dollar amount of material should be purchased at $4 per pound if each unit of product requires 3 pounds and beginning and ending materials inventories should be 5,000 and 4,000 pounds, respectively? $ d. How much direct labor cost should be incurred if each unit produced requires 1.5 hours at an hourly rate of $14? e. How much manufacturing overhead should be incurred if fixed manufacturing overhead is $52,000 and variable manufacturing…arrow_forward

- Zira Company reports the following production budget for the next four months. Each finished unit requires six pounds of direct materials, and the company wants to end each month with direct materials inventory equal to 40% of next month's production needs. Beginning direct materials inventory for April was 1,541 pounds. Direct materials cost $5 per pound. Prepare a direct materials budget for April, May, and June. (Round your answers to the nearest whole number.) April May June 642 670 676 Units to produce Check my work July 656arrow_forwardEcho Amplifiers prepared the following sales budget for the first quarter of 2018: Jan. Feb. Mar. Units BOD Sales price $100 $100 Budgeted sales $80,000 $130,000 $100,000 It also has this additional information related to its expenses: Direct material per unit Direct labor per unit Variable manufacturing overhead per hour Fixed manufacturing overhead per month Sales commissions per unit Sales salaries per month Delivery expense per unit Factory utilities per month Administrative salaries per month Marketing expenses per month Insurance expense per month Depreciation expense per month Budgeted Sales in Units Variable Expenses Sales Commissions 1,300 Delivery Total Variable Expenses Fixed Expenses Sales Salaris $100 Administrative Salaries Marketing Expenses Insurance Expense Depreciation Expense 1,500 Total Fixed Expenses Total Selling and Administrative Expenses $1.50 2 Prepare a sales and administrative expense budget for each month in the quarter ending March 31, 2018. Enter all…arrow_forwardJSS Company’s sales budget projects unit sales of part X of 15,000 units in January, 16,000 units in February, and 17,000 units in March. Each unit of part X requires 1.5 pounds of materials, which cost $2.5 per pound. JSS Company desires its ending raw materials inventory to equal 35% of the next month’s production requirements, and its ending finished goods inventory to equal 20% of the next month’s expected unit sales. These goals were met at December 31, 2020. Instructions (a) Prepare a production budget for January and February 2021. (b) Prepare a direct materials budget for January 2021arrow_forward

- Osprey Cycles, Inc. projected sales of 60,589 bicycles for the year. The estimated January 1 inventory is 6,049 units, and the desired December 31 inventory is 7,919 units. What is the budgeted production (in units) for the year?__________________arrow_forwardZilly Company budgets sales of $156,000 for June. Zilly pays a sales manager a monthly salary of $5,300 and a commission of 8% of that month's sales dollars. Prepare a selling expense budget for June. Budgeted sales ZILLY COMPANY Selling Expense Budget Junearrow_forwardOsprey Cycles, Inc. projected sales of 64,237 bicycles for the year. The estimated January 1 inventory is 3,510 units, and the desired December 31 inventory is 6,177 units. What is the budgeted production (in units) for the year?______________________arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education