FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

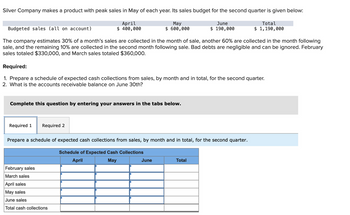

Transcribed Image Text:Silver Company makes a product with peak sales in May of each year. Its sales budget for the second quarter is given below:

Budgeted sales (all on account)

April

$ 400,000

May

$ 600,000

June

$ 190,000

Total

$ 1,190,000

The company estimates 30% of a month's sales are collected in the month of sale, another 60% are collected in the month following

sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February

sales totaled $330,000, and March sales totaled $360,000.

Required:

1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter.

2. What is the accounts receivable balance on June 30th?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter.

Schedule of Expected Cash Collections

February sales

March sales

April sales

May sales

June sales

Total cash collections

April

May

June

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Silver Company makes a product that is very popular as a Mother’s Day gift. Thus, peak sales occur in May of each year, as shown in the company’s sales budget for the second quarter given below: April May June Total Budgeted sales (all on account) $410,000 $610,000 $210,000 $1,230,000 From past experience, the company has learned that 25% of a month’s sales are collected in the month of sale, another 60% are collected in the month following sale, and the remaining 15% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $340,000, and March sales totaled $370,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th?arrow_forwardCypress Inc. has the following budgeted sales for the next quarter.Month: 1 2 3Units: 10,000 11,000 12,000Inventory of finished goods on hand at the beginning of the quarter is 7,000 units. The company desires to maintain ending inventory equal to beginning inventory plus 5,000 units every month.Calculate the total quantity to be produced during the quarter.arrow_forwardBloom Corp. produces one product that sells at $20 per unit and sells best on Valentine's Day and Mother’s Day. As a result peak sales occur in February and May of each year. Budgeted sales in units for the first six months of the coming year are: Month Units January 12,000 February 32,000 March 18,000 April 34,000 May 30,000 June 15,000 25% of all sales are cash sales and the rest are on account. Past experience shows that the company collects 25% of a month’s credit sales in the month of sale. Another 65% of credit sales are collected in the month following the sale, and the remaining 10% of credit sales are collected in the second month following the sale. Bad debts are negligible and can be ignored. To ensure that sales volumes can be met, the company requires that ending inventory for a particular month reflect 15% of next month's sales. Ending inventory on June 30th will be 1,500…arrow_forward

- Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur in May of each year, as shown in the company's sales budget for the second quarter given below: Budgeted sales (all on account) April May June Total $ 360,000 $ 560,000 $ 220,000 $ 1,140,000 From past experience, the company has learned that 30% of a month's sales are collected in the month of sale, another 60% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $290,000, and March sales totaled $320,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th? > Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of expected cash collections from sales, by month…arrow_forwardApollo Corporation produces and sells a single product, sewing machines, for $100 per unit. Budgeted sales for the next three months are given below: Unit Sales June 76,000 July 80,000 August 85,000 All sales are on credit and are collected in the following pattern: 30% in the month of sales and the remaining 70% in the month following the sale. 1. What is the amount of sales revenue reported on the company’s budgeted income statement for July? multiple choice 1 a)$8,000,000 b)$7,600,000 c)$8,500,000 d)$7,720,000 2. Past experience has shown that end-of-month inventory levels must equal 20% of the following month’s unit sales. How many units are required to be produced in July? multiple choice 2 a)82,400 units b)81,000 units c)86,400 units d)80,000 units 3. In July, how much cash the company can collect from sales? multiple choice 3 a)$7,600,000 b)$8,000,000 c)$8,680,000 d)$7,720,000 4. In the company’s balance sheet dated…arrow_forwardSanjayarrow_forward

- Vishnuarrow_forwardSilver Company makes a product that is very popular as a Mother’s Day gift. Thus, peak sales occur in May of each year, as shown in the company’s sales budget for the second quarter given below: April May June Total Budgeted sales (all on account) $300,000 $500,000 $200,000 $1,000,000 From past experience, the company has learned that 20% of a month’s sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $230,000, and March sales totaled $260,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th?arrow_forwardMajan company has budgeted sales in units for the next five months as follows: June 5,400 units July 6,500 units August 7,000 units September 8,200 units October 4,800 units Past experience has shown that the ending inventory for each month should be equal to 10% of the next month's sales in units. The inventory on May 31 is 400 units. The company needs to prepare a Production Budget for the next five months. The total number of units to be produced in August is a. 7,120 units b. 7,420 units c. 7,170 units d. 8,520 units W Parrow_forward

- Sherman has budgeted sales for the upcoming quarter as follows: April: 1, 600 units May: 1,900 units June: 1,750 units The desired ending finished goods inventory for each month is one - half of next month's budgeted sales. Three pounds of direct material are required for each unit produced. If direct material costs $5 per pound, and must be paid for in the month of purchase, the budgeted direct materials purchases (in dollars) for May are: Group of answer choices $1,975 $9, 875 $27, 750 $13, 875arrow_forwardWalker Company prepares monthly budgets. Company policy is to end each month with merchandise inventory equal to 15% of budgeted unit sales for the following month. Budgeted sales and merchandise purchases for the next three months follow. Beginning inventory on July 1 is 27,000 units. The company budgets sales of 200,000 units in October. The merchandise cost per unit is $2. Budgeted sales units. Units to purchase July 180,000 200,250 August 315,000 308,250 September 270,000 259,500 Prepare the merchandise purchases budgets for the months of July, August, and September. WALKER COMPANY Merchandise Purchases Budget July August September Next period budgeted sales units Ratio of inventory to future sales 0 0 0 Total required units Units to purchase Cost per unit Cost of merchandise purchasesarrow_forwardOur company provides the following sales forecast for the next three months: Sales units The company wants to end each month with ending finished goods inventory equal to 10% of the next month's sales. Finished goods inventory on December 31 is 300 units. The budgeted production units for January are: O 3,000 units. O 3,420 units. O 3,720 units. O 3,120 units. January February March 3,000 4,200 5,000 O2,880 units. please answer do not image .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education