FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

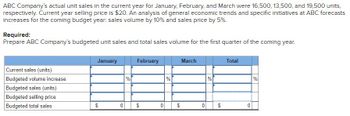

Transcribed Image Text:ABC Company's actual unit sales in the current year for January, February, and March were 16,500, 13,500, and 19,500 units,

respectively. Current year selling price is $20. An analysis of general economic trends and specific initiatives at ABC forecasts

increases for the coming budget year: sales volume by 10% and sales price by 5%.

Required:

Prepare ABC Company's budgeted unit sales and total sales volume for the first quarter of the coming year.

Current sales (units)

Budgeted volume increase

Budgeted sales (units)

Budgeted selling price

Budgeted total sales

January

$

0

%

February

$

0

%

$

March

0

%

$

Total

0

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company is formulating its marketing expense budget for the last quarter of the year. Sales in unitsfor the third quarter amounted to 4,000; sales volume for the fourth quarter is expected to increaseby 10%. Variable marketing expense per unit sold amount to approximately $0.05, paid in cash inmonth of sale. Fixed marketing expense per month amount to $10,000 of salaries, $5,000 of depreciation (delivery trucks), and $2,000 of insurance (paid monthly). What is the total budgeted marketing expense for the fourth quarter of the year? What is the estimated cash payment for marketingexpense for the fourth quarter?arrow_forwardThe budgeted units for sales in January, February and March are 25,000, 55,000 and 35,000 andselling price is $ 12, 15 and 20 per unit respectively. Please determine the total budgeted sales in unitsand dollars for the quarter ended March 31, 2021.arrow_forwardWaterway Company estimates that unit sales will be 10, 100 in quarter 1;12,500 in quarter 2:14,200 in quarter 3; and 17,700 in quarter 4. Management wants to have an ending finished goods inventory equal to 21% of the next quarter's expected unit sales. Prepare a production budget by quarters for the first six months of 2022arrow_forward

- Also include the total of the six monthsarrow_forwardAtlanta Industries sales budget shows quarterly sales for the next year as follows: Quarter 1–10,000; Quarter 2–8,000; Quarter 3–12,000; Quarter 4–14,000. Company policy is to have a target finished-goods inventory at the end of each quarter equal to 20% of the next quarter’s sales. Budgeted production for the second quarter of next year would be:arrow_forwardA company's sales for the nine months to 30 September are $2.5m. The sales forecast for the next three months is $500,000 in total. The company's budgeted sales for the year are $3.4m The company's CEO has a meeting with the sales manager to discuss plans to close the gap between the forecast and the original budgeted sales for the next quarter. What is this process an example of? Feedback control An activity-based budget A rolling budget Feed-forward controlarrow_forward

- Champ, Inc., predicts the following sales in units for the coming two months. Each month’s ending inventory of finished units should be 70% of the next month’s sales. The April 30 finished goods inventory is 133 units. May June Sales in units 190 220 Compute budgeted production (in units) for May.arrow_forwardWaterways Corporation is preparing its budget for the coming year, 2020. The first step is to plan for the first quarter of that coming year. The company has gathered information from its managers in preparation of the budgeting process. Sales Unit sales for November 2019 111,000 Unit sales for December 2019 101,000 Expected unit sales for January 2020 113,000 Expected unit sales for February 2020 113,000 Expected unit sales for March 2020 118,000 Expected unit sales for April 2020 124,000 Expected unit sales for May 2020 137,000 Unit selling price $12 Waterways likes to keep 10% of the next month’s unit sales in ending inventory. All sales are on account. 85% of the Accounts Receivable are collected in the month of sale, and 15% of the Accounts Receivable are collected in the month after sale. Accounts receivable on December 31, 2019, totaled $181,800.Direct MaterialsDirect materials cost 80 cents per pound. Two pounds of direct materials…arrow_forwardThe Northeast Regional Division of Bridgeport Corp. has been requested to prepare a quarterly budgeted income statement for 2022. The regional manager expects that sales in the first quarter of 2022 will increase by 10% over the same quarter of the preceding year and will then increase by 5% for each succeeding quarter in 2022. The corporate head office has requested that the regional manager maintain an inventory in dollars equal to 20% of the next quarter's sales. Quarterly purchases average 55% of quarterly sales. Budgeted ending inventory on December 31, 2021 is $177,000. Quarterly salaries are $21,900 plus 5% of sales. All salaries are classified as sales salaries. Other quarterly expenses are estimated to be as follows: Rent expense $24,500 Depreciation on office equipment $12,700 Utilities expense $4,500 Miscellaneous expenses 2% of sales The income statement for the first quarter of 2021 was as follows: Income StatementFor the Quarter…arrow_forward

- Preparing a Budgeted Income Statement Oliver Company provided the following information for the coming year: Units produced and sold 160,000 Cost of goods sold per unit $6.30 Selling price $12 Variable selling and administrative expenses per unit $1.10 Fixed selling and administrative expenses $423,000 Tax rate 28 % Required: Prepare a budgeted income statement for Oliver Company for the coming year. Round all income statement amounts to the nearest dollar. Oliver Company Budgeted Income Statement For the Coming Year Sales v Cost of goods sold v Gross margin Less: Variable selling and administrative expenses Less: Fixed selling and administrative expenses Operating income Less: Income taxes Net income v 24arrow_forwardOsprey Cycles, Inc. projected sales of 60,589 bicycles for the year. The estimated January 1 inventory is 6,049 units, and the desired December 31 inventory is 7,919 units. What is the budgeted production (in units) for the year?__________________arrow_forwardHeartland Company's budgeted sales and budgeted cost of goods sold for the coming year are $144,000,000 and $99,000,000, respectively. Short-term interest rates are expected to average 10%. If Heartland can increase inventory turnover from its present level of 9 times a year to a level of 12 times per year, compute its expected cost savings for the coming year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education