FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

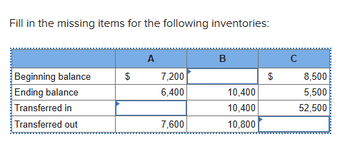

Transcribed Image Text:Fill in the missing items for the following inventories:

Beginning balance

Ending balance

Transferred in

Transferred out

$

A

7,200

6,400

7,600

B

10,400

10,400

10,800

$

с

8,500

5,500

52,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare journal entries to record the following transactions, assuming perpetual inventory updating and first-in, first-out (FIFO) cost allocation. Assume no beginning inventory. Number of Units Purchased Sold Purchased Sold Purchased 35 If an amount box does not require an entry, leave it blank. 0 00 00 J 10 10 10 Unit Cost Sales $23 175 120 220 180 200 29 $38 41arrow_forwardSolve for the missing information designated by "?" in the following table. (Use 365 days in a year. Round the inventory turnover ratio to one decimal place before computing days to sell. Round days to sell to one decimal place.) Case a. b. C. $ $ Beginning Inventory Purchases 112 $ 224 SA Cost of Goods Sold 1,120 $ $ $ 8.0 Days to Sell 36.5arrow_forwardinventory as your base numper and adjust the couss amount to the required amount to make the Total Goods Available for Sale to the total of the Value of the ending inventory and the COGS total. Negative value should be indicated with minus sign. Round your intermediate and final answers to 2 decimal places.) \table[[Date,, \table [[Purchases/Transportation - In /], [(PurchaseReturns/Discounts)]], \table [[Cost of Goods Sold/(Returns to], [Inventory)]], Balance in Inventory], [Units, Cost/Unit, Total $, Units, Cost/Unit, Total $, Units, \table[[Avg], [ Cost/Unit]], Total $], [Mar., Brought Forward,,r, 61, $, 93.00, $, 5, 673.00 Telamark Company uses the moving weighted average method for inventory costing. Required: The following incomplete inventory sheet regarding Product W506 is available for the month of March 2023. Complete the inventory sheet. (Use the value of the ending inventory as your base number and adjust the COGS $ amount to the required amount to make the Total Goods…arrow_forward

- Please Solve in 15mins I will Thumbs up promisearrow_forwardPresented below are the components in determining cost of goods sold.Determine the missing amounts. BeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofGoods Sold (a) $78,100 $101,600 ? ? $121,000 (b) $54,700 ? $120,000 $33,800 ? (c) ? $110,000 $151,000 $28,800 ?arrow_forwardCash receipt journalarrow_forward

- Determine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $8,710. Line Item Description Amount Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $973,000 for the year. Line Item Description Amount Amount added $fill in the blank 3 Ending balance $fill in the blank 4arrow_forwardSolve for the missing information designated by "?" in the following table. (Use 365 days in a year. Round the inventory turnover ratio to one decimal place before computing days to sell. Round days to sell to one decimal place.) Case Beginning Inventory Purchases Cost of Goods Sold Ending Inventory Inventory Turnover Ratio Days to Sell a. $ 130 $ 730 $ 690 b $ 230 $ 1,320 C $ 1,120 $ 135 6.6 32.6arrow_forwardConsider the following information: Units Cost per unit Total costs Goods in inventory at start of year 1,600 $1.92 $3,072 Purchases, quarter 1 800 $1.40 $1,120 Purchases, quarter 2 1,000 $1.60 $1,600 Purchases, quarter 3 1,200 $1.80 $2,160 Purchases, quarter 4 800 $2.00 $1,600 5,400 $9,552 Goods sold during the year: 3000 units Using the weighted-average-cost method, the value of ending inventory is:arrow_forward

- Subject: acountingarrow_forwardPresented below are the components in determining cost of goods sold.Determine the missing amounts. BeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofGoods Sold (a) $79,400 $102,500 $111,000 (b) $47,400 $111,000 $35,300 (c) $120,000 $159,000 $29,000arrow_forwardWorkings required for the image attcahed.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education